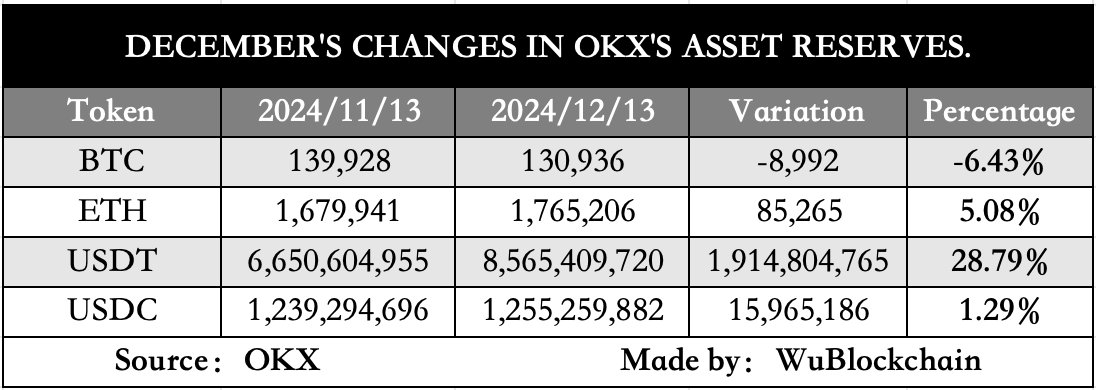

OKX’s twenty sixth proof of reserves report exhibits distinct modifications in person asset holdings as of December 13, 2024.

The trade reported 130,936 BTC in person property, an 8,992 BTC discount from November’s numbers. In distinction, Ethereum holdings grew by 85,265 to succeed in 1.765 million ETH. Nevertheless, USDT balances elevated by 1.91 billion to eight.56 billion, representing a 28.79% month-to-month achieve.

The most recent knowledge confirms full backing throughout all property, with the trade sustaining a 105% Bitcoin reserve ratio. This implies for each 100 BTC in person deposits, OKX holds 105 BTC in its wallets. The report gives an entire breakdown of property held instantly by the trade and people in third-party custody.

Bitcoin holdings drop whereas different property develop

The discount in Bitcoin holdings mirrors broader market tendencies in December. This alteration introduced OKX’s whole Bitcoin person property to 130,936 BTC. That is break up between 124,699 BTC held instantly by the trade and 12,312 BTC in third-party custody. The trade’s 105% reserve ratio means OKX maintains 137,011 BTC in whole pockets property, conserving an additional buffer above person deposits.

OKX crypto holdings as of December 2024. Supply: Wu Blockchain

Whereas Bitcoin holdings decreased, different main property on OKX noticed notable development. Ethereum property elevated by 85,265 ETH to succeed in 1.765 million ETH, with the trade sustaining a 102% reserve ratio. This implies OKX holds 1.807 million ETH in pockets property, divided between 1.630 million ETH on the trade and 176,527 ETH in third-party custody.

USDT holdings confirmed the most important proportion enhance, rising by 1.91 billion to succeed in 8.56 billion USDT, a 28.79% month-to-month achieve. The stablecoin maintains a 102% reserve ratio, with OKX holding 8.76 billion USDT in whole pockets property.

Reserve ration evaluation throughout property

OKX maintains totally different reserve ratios throughout its supported cryptocurrencies, with Bitcoin Money (BCH) displaying the very best protection at 113% of person deposits. For main cryptocurrencies, the reserve ratios paint a transparent image of the trade’s threat administration: Bitcoin at 105%, Ethereum at 102%, and Solana at 103%. These ratios imply that for each $100 value of person deposits, OKX holds between $102 and $113 in precise property.

Amongst different altcoins, XRP and EOS each preserve 107% reserve ratios, whereas Dogecoin sits at 101%. This consistency in over-collateralization extends to smaller market cap property, with most sustaining ratios between 100% and 105%.

The trade retains decrease reserve ratios for stablecoins in comparison with risky cryptocurrencies. USDC matches person deposits precisely at 100%, whereas USDT maintains a slight buffer at 102%.

For USDT, the 102% ratio represents over 8.76 billion USDT in pockets property towards 8.56 billion in person deposits. For ETH, it means holding an additional 42,213 ETH past person deposits.

Custody distribution and safety measures

OKX divides its property between direct trade custody and third-party custody providers, with most property held instantly on the trade. For Bitcoin, 124,699 BTC stay underneath direct trade management whereas 12,312 BTC sit with third-party custodians.

The custody sample varies by asset sort. Ethereum exhibits a bigger portion in third-party custody, with 176,527 ETH held externally, representing about 10% of whole holdings. USDT follows an identical mannequin, with 321 billion USDT, or roughly 3.7% of holdings, positioned in third-party custody. For tokens like APT, BCH, and LINK, OKX retains practically all property underneath direct trade management.

From Zero to Web3 Professional: Your 90-Day Profession Launch Plan