Because the broader cryptocurrency market grapples with important downturns, Ethereum (ETH) and Solana (SOL) have emerged as a number of the hardest-hit property among the many prime ten digital currencies.

On prime of that, current allegations by market specialists on social media recommend potential market manipulation by main gamers within the house, elevating additional considerations for buyers.

Ethereum Falls Beneath $2,600: Potential Finish To Altseason

Over the previous few days, on-chain knowledge has surfaced, indicating large-scale promoting of Ethereum and Solana tokens primarily by Binance (BNB), the world’s largest cryptocurrency change.

Market professional Crypto Rover highlighted that these gross sales, which occurred over a span of simply 48 hours, have contributed to a staggering 7% drop in Ethereum and a 12% decline in Solana’s worth.

Ethereum has now breached its essential help degree of $2,600, some extent that analysts like Ali Martinez warning may sign the top of the altcoin season if confirmed on larger time frames.

Martinez notes that the subsequent important threshold for the Ethereum holders is ready at $2,300; falling under this degree may jeopardize the psychologically essential $2,000 mark.

For Solana, the state of affairs is equally dire. The asset has retraced under its main help degree at $150, settling round $140. This decline represents a substantial 51% hole from its all-time excessive of $293 reached in January.

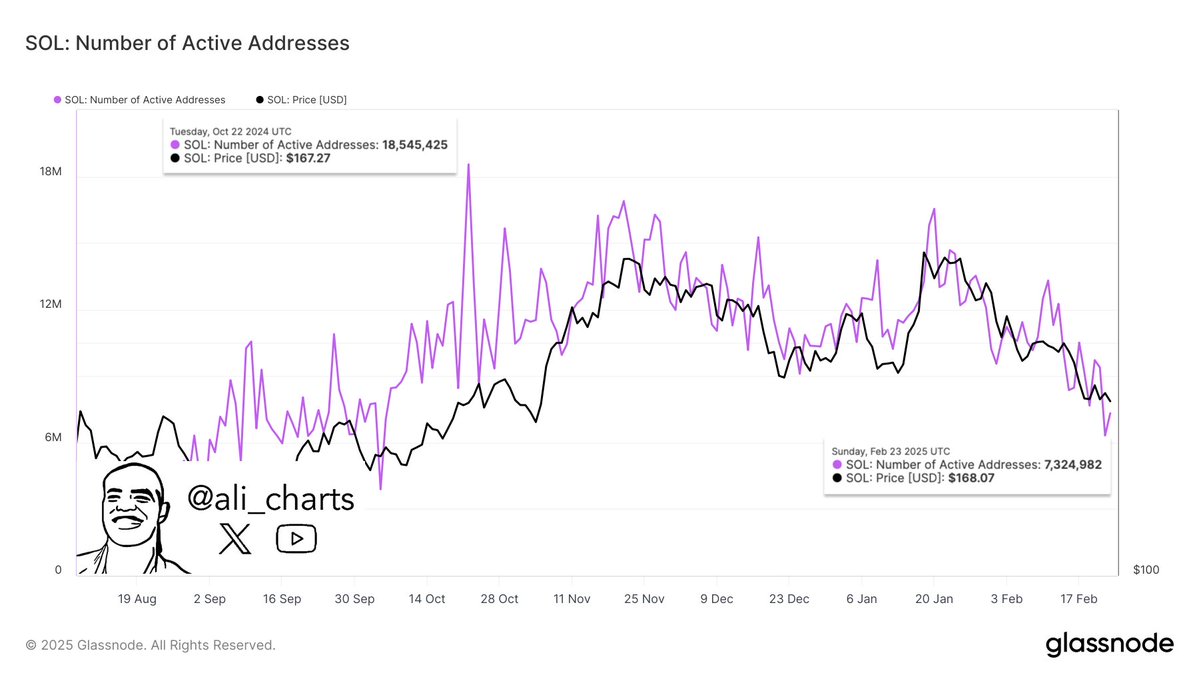

The bearish sentiment surrounding Solana is additional underscored by a stark drop in community exercise. Martinez identified that Solana’s lively addresses have plummeted by 60%, falling from a formidable all-time excessive of 18.5 million in October to simply 7.3 million.

Market Manipulation Allegations Come up

Amidst these troubling developments, voices throughout the crypto neighborhood are suggesting that the market turbulence is probably not coincidental.

Specialists like Marty Get together have expressed considerations in regards to the function of Binance, asserting that the change might have offloaded its holdings in Solana and Ethereum to cowl fines imposed by the Division of Justice (DOJ) whereas additionally cashing in on liquidating leveraged futures positions.

Such actions have been characterised as “manipulative,” with Marty noting the timing of those gross sales. Physician Revenue, one other market professional, additionally means that platforms like Bybit might have engaged in comparable practices to get better “misplaced Ethereum” after its current hack, fueling additional hypothesis in regards to the integrity of those exchanges.

Critics argue that these “market maneuvers” are indicative of a broader sample of manipulation, notably aimed toward triggering mass liquidations amongst lengthy positions.

Physician Revenue remarked on the obvious transparency of those manipulations, suggesting that market gamers are exploiting the naivety of common crypto buyers.

Given the present local weather, there’s a rising name throughout the crypto neighborhood to shift away from centralized exchanges and conventional monetary constructions.

Advocates like Physician Revenue are urging buyers to embrace decentralized finance (DeFi) and monolithic networks, emphasizing the significance of self-custody and minimizing reliance on establishments which may be vulnerable to manipulation.

For now, Ethereum has managed to stabilize at $2,390, which is almost 50% under the file excessive of $4,878 reached in the course of the 2021 bull market.

Featured picture from DALL-E, chart from TradingView.com