A carefully adopted crypto analyst says that Bitcoin (BTC) might instantly flip bullish based mostly on one key indicator.

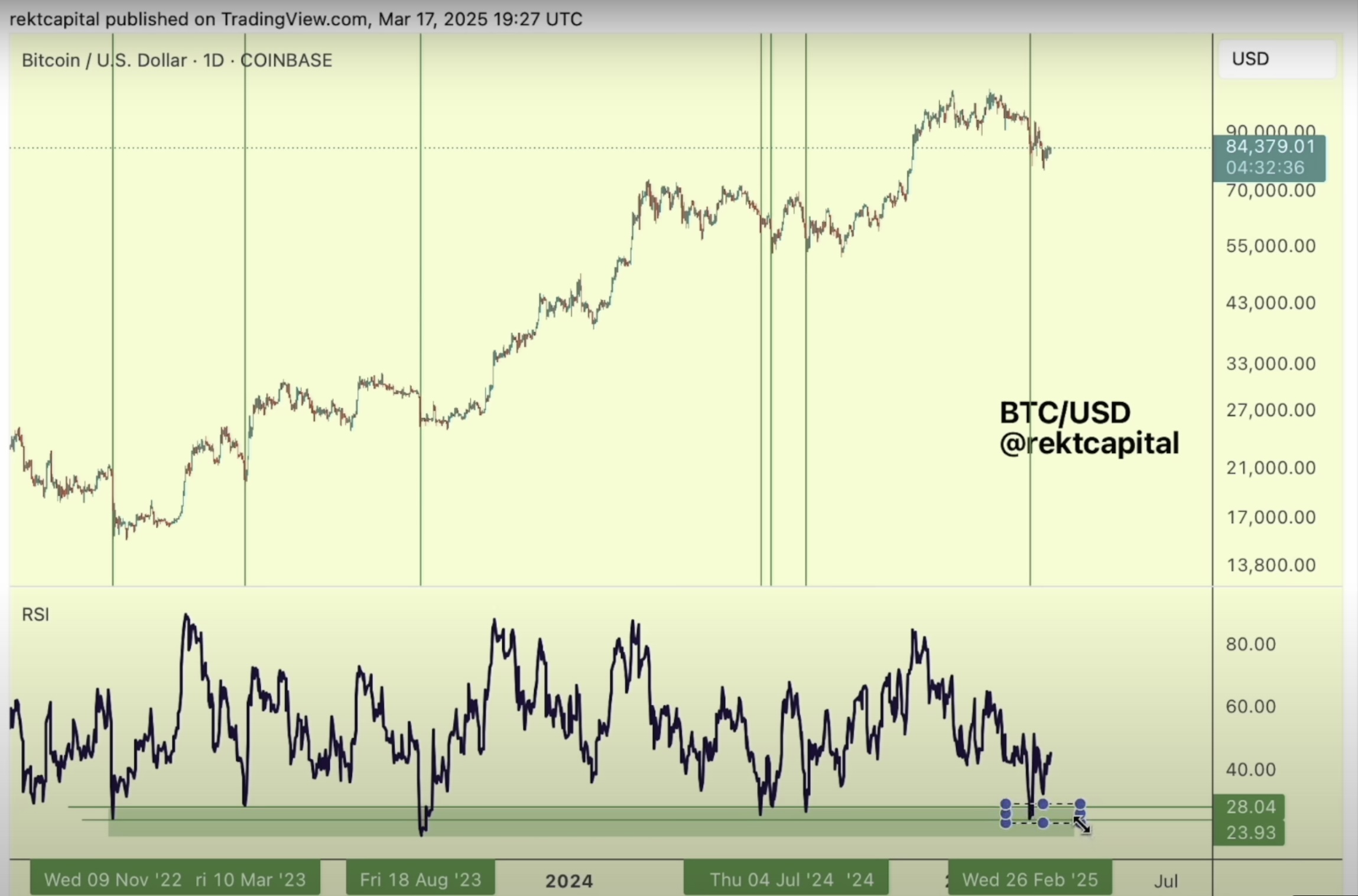

In a brand new publish, crypto dealer Rekt Capital tells his 542,500 followers on the social media platform X that the Relative Power Index (RSI) – a momentum indicator used to point overbought or oversold ranges – might quickly escape of a downtrend, signaling bullishness for Bitcoin.

“Going ahead, it will likely be price watching this every day RSI downtrend for a breakout sooner or later. This downtrend has been a resistance on the RSI since November 2024. An RSI downtrend break would probably precede a development reversal to the upside in worth.”

Supply: Rekt Capital/X

In a technique session, the analyst tells his 107,000 YouTube subscribers that the RSI has bounced off the oversold degree within the 20s vary, which traditionally has led to a worth reversal for Bitcoin.

“We’ve dropped right into a zone of overselling, so under the 30 RSI, that’s usually the place we see sellers get a little bit bit too enthusiastic. Persons are promoting an excessive amount of, and the sellers are slowly getting exhausted. They’re overselling, which signifies that it’s simpler for patrons to step into the market and begin shopping for up costs, they usually don’t even want to purchase up on excessive quantity.

And it’s already urgent costs up fairly properly in direction of the upside with out a lot effort. And that’s precisely what occurs when sellers are exhausted. And we’ve seen these oversold areas on fairly just a few events throughout this cycle. And every time we acquired right here on that first crash, we had been very near a backside, or we had been at a backside already, and we’d see worth reverse in direction of the upside.”

Supply: Rekt Capital/YouTube

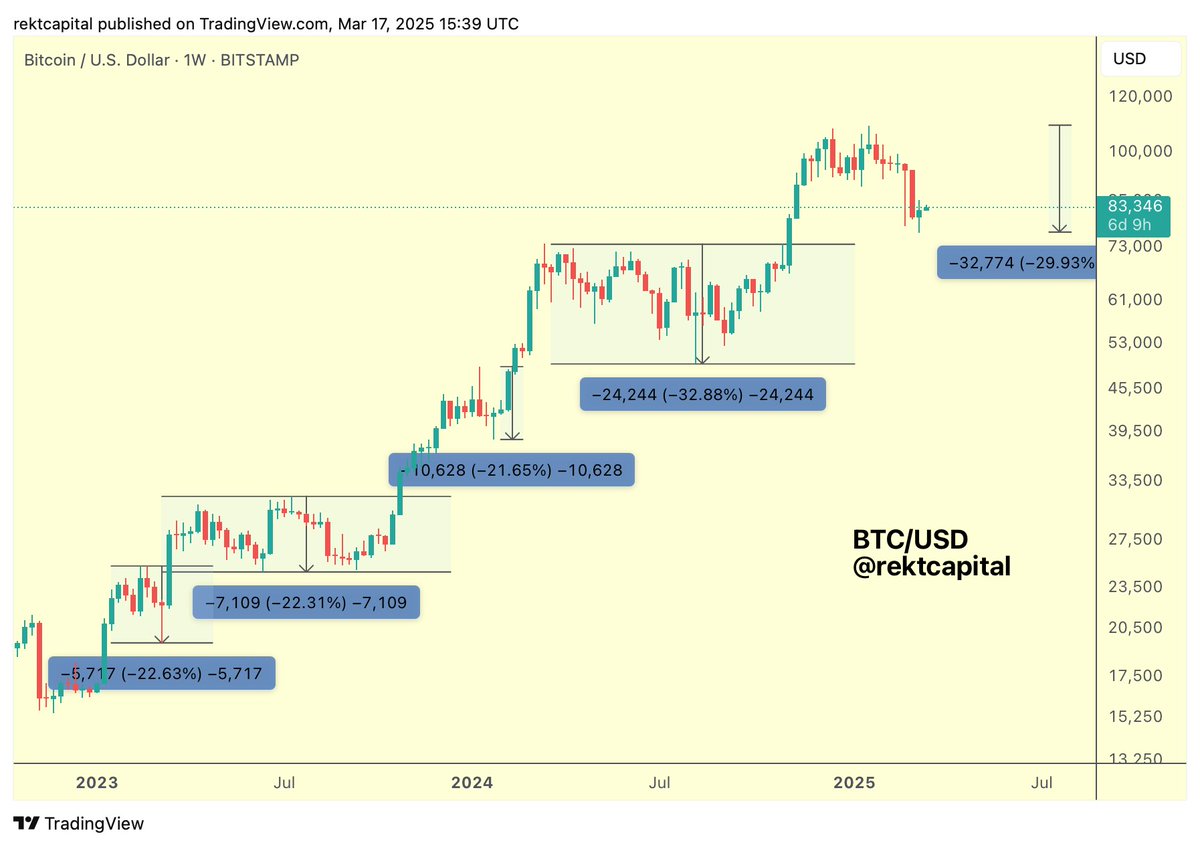

The analyst additionally says that Bitcoin’s retracement from the all-time excessive is just not out of the odd based mostly on historic priority.

“This present pullback (-29%) is likely one of the deeper retraces within the cycle nevertheless it’s not extraordinary. In spite of everything, we’ve seen a deeper retrace within the fast post-halving interval (-32%). Not solely that, however we’ve seen deeper pullbacks in earlier cycles.

Main 2021 corrections: -31%, -55%, -25%.

Main 2017 corrections: -34%, -34%, -38%, -40%, -29%.”

Supply: Rekt Capital/X

Bitcoin is buying and selling for $83,112 at time of writing, flat on the day.

Generated Picture: Midjourney