Optimism and OP Labs chief govt officer (CEO) Jing Wang introduced the launch of OP Enterprise at this time – a sequence deployment suite for enterprise shoppers seeking to construct native blockchains whereas retaining income.

The product goals to supply easy-to-work-with infrastructure for “firms that need to construct companies, not turn into blockchain specialists,” stated Wang on X.

Chains constructed through OP Enterprise will turn into a part of the OP Stack, which is residence to greater than $6 billion in complete worth locked (TVL) throughout greater than 50 blockchains, together with Base and Unichain.

Optimism’s weblog publish cites three totally different builder tiers out there through OP Enterprise with ultimate merchandise prepared in “8-12 weeks.” The tiers differentiate deployer involvement ranges, starting from launching on OP Mainnet and finally launching a local chain, to a local blockchain absolutely managed by OP Enterprise.

The transfer comes as regulatory readability within the U.S. and Europe makes it possible for conventional finance and fintech corporations to launch their very own chains. Over the subsequent 12 months, customers can anticipate native blockchains from the likes of Robinhood and Stripe, and OP Enterprise seems to be to supply a simple blockchain launch answer for potential rivals.

OP Enterprise might also not directly drive worth to the OP token, as Optimism tokenholders voted to approve a 12-month OP buyback program, which makes use of Superchain income to purchase and burn OP tokens.

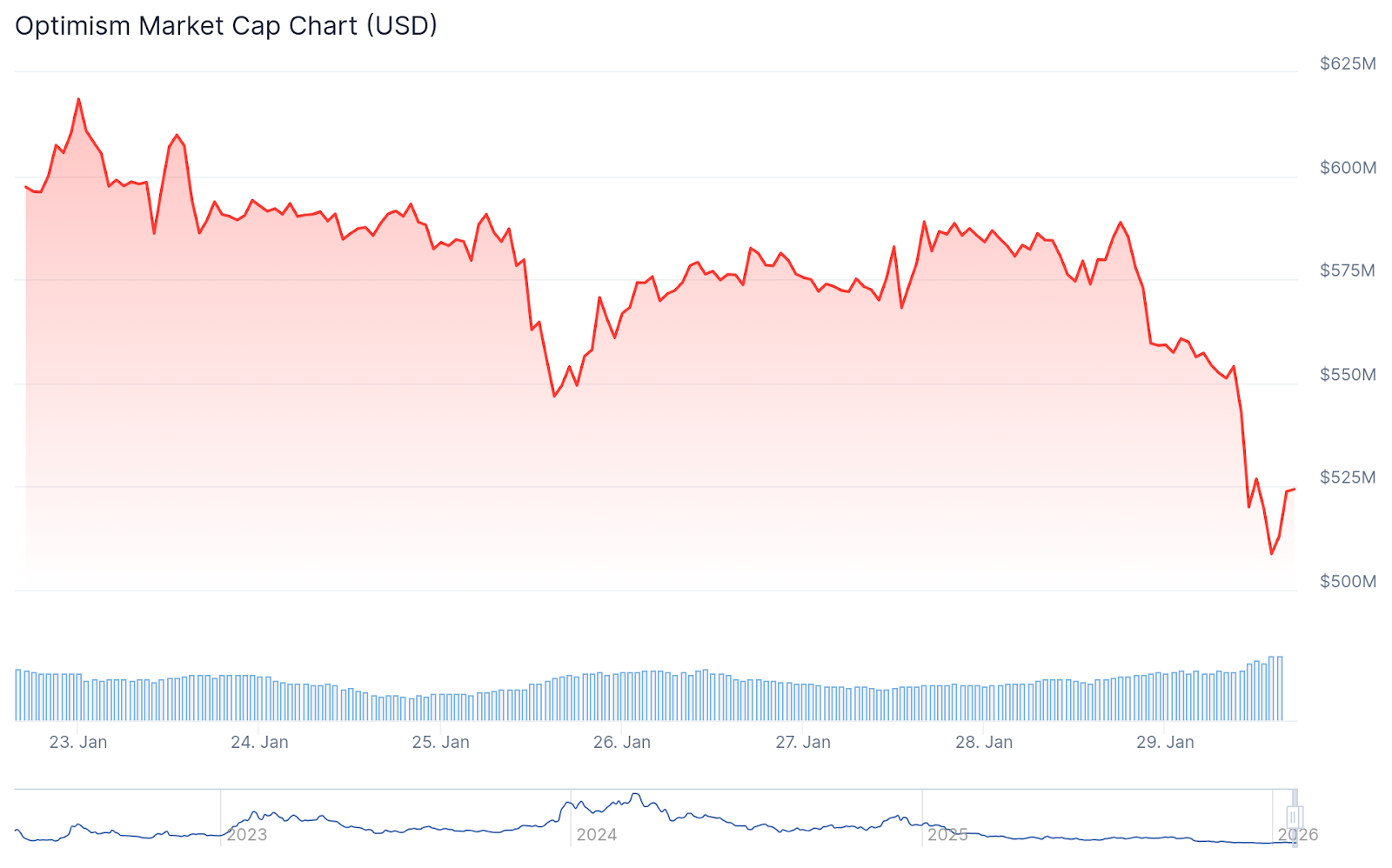

OP is down 10% at this time amid a broad market selloff, with BTC falling 5.5% and ETH slipping by 6.6%.

OP Chart – CoinGecko