Whereas the highlight has wandered from non-fungible tokens ( NFTs), Bitcoin-based NFT gross sales are closing in on the $6 billion threshold, with the community quietly claiming third place amongst blockchains by complete NFT gross sales and shifting previous Ronin. On the similar time, Ordinal inscriptions on the Bitcoin blockchain have crossed the 100 million milestone.

Bitcoin NFT Gross sales Close to $6 Billion

Simply over three years in the past, on Dec. 14, 2022, Bitcoin developer Casey Rodarmor launched the Ordinals protocol, and the primary Ordinal inscription (1) was minted on the Bitcoin blockchain two days later. Within the opening months of 2023, curiosity in Ordinal inscriptions accelerated quickly, drawing rising consideration throughout the crypto ecosystem.

In easy phrases, a Bitcoin Ordinal inscription locations arbitrary information—reminiscent of photos or textual content—immediately onto a person satoshi, Bitcoin’s smallest unit, by utilizing the witness discipline of a Taproot transaction. Ordinal idea assigns every satoshi a definite serial quantity primarily based on its mining order, permitting information to be affixed onchain with out modifying Bitcoin’s protocol and giving rise to what are generally known as digital artifacts.

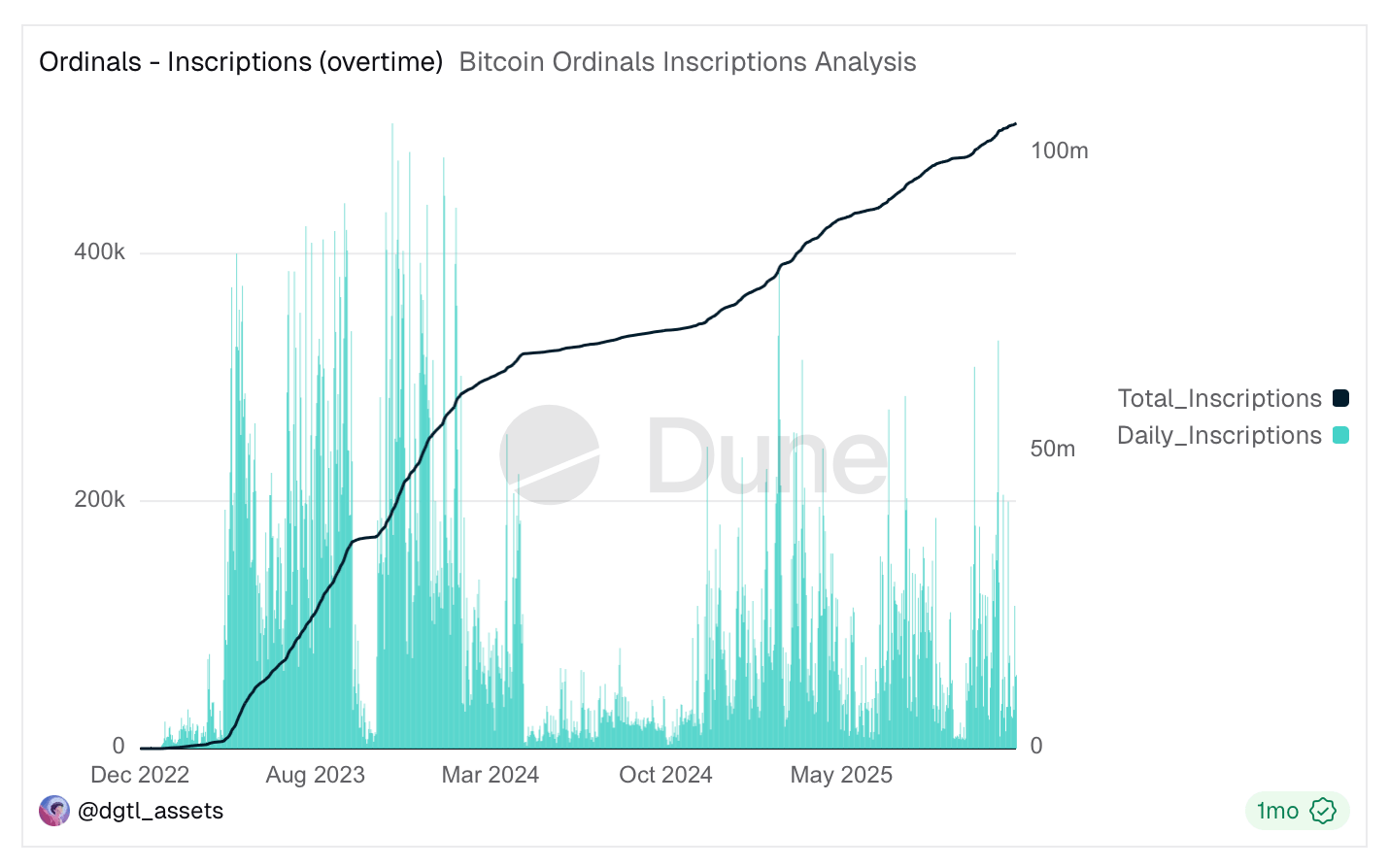

Arbitrary information can take many types, together with plain textual content, photos, code, and purposes. By September 2024, the chain accounted for 75 million inscriptions, and it later pushed previous the 100 million mark within the first week of November 2025. At press time, ordinals.com signifies there are greater than 117 million inscriptions as of the second week of January 2026. The quantity crossed tapped 117 million formally on Thursday, Jan. 15, 2026, based on ord.io and ordinals.com stats.

Dune stats from the person @dgtl_assets present greater than a ten% discrepancy between numbers from ordinals.com and ord.io.

Parsing information from Dune.com, which carries an estimated 10.3% undercount, suggests bitcoin miners have collected roughly $646 million in inscription charges, protecting that hole in thoughts. The majority of these charges, measured by the 7,092 bitcoin gathered from inscriptions, was generated across the fourth Bitcoin halving and within the interval main as much as it. Since then, miners have seen comparatively little income from inscribers in contrast with earlier durations.

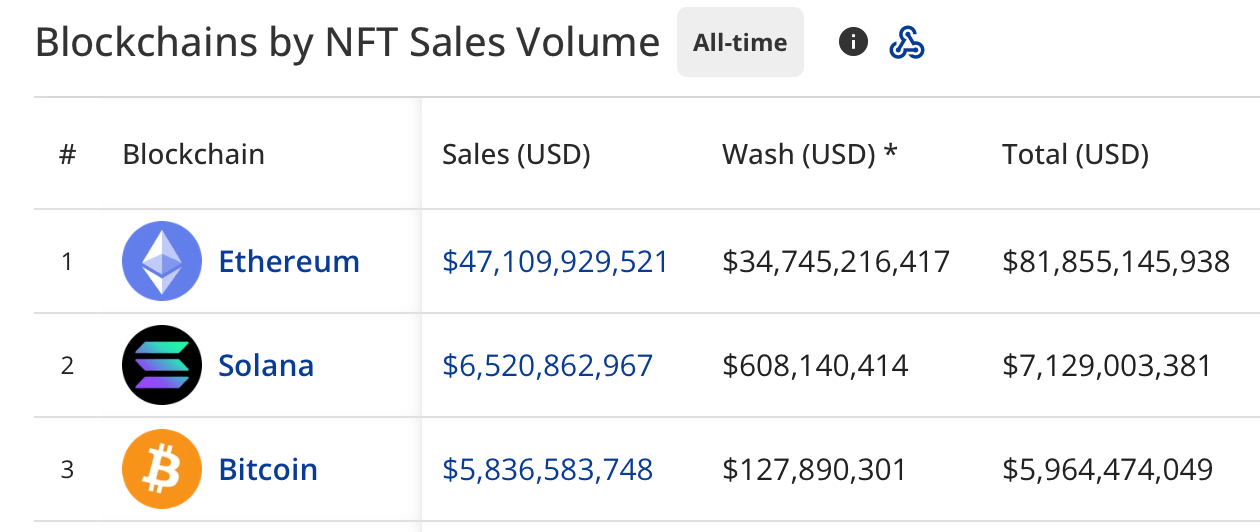

From a gross sales perspective, Bitcoin has climbed previous a number of blockchains that moved massive volumes of NFTs properly earlier than it, again when the NFT frenzy of 2020–2021 was at its peak. Bitcoin now sits in third place with $5.8 billion in complete gross sales, based on cryptoslam.io information. Solely Ethereum and Solana rank increased, and Bitcoin would wish roughly $688 billion extra in gross sales to overhaul Solana—assuming, after all, that Solana’s figures remained static.

NFT gross sales information from cryptoslam.io on Jan. 15, 2026.

Bitcoin sits comfortably forward of Ronin, the community behind Axie Infinity NFTs, which has recorded $4.3 billion in NFT gross sales. That determine additionally exceeds Polygon’s $2.2 billion in digital collectible gross sales and Movement’s $1.73 billion complete. Over the previous seven days, cryptoslam.io stats present Bitcoin ranked third by gross sales with $6.9 million, whereas on a month-to-month foundation it moved into second place with $62 million after posting an 88% month-over-month achieve.

Even so, it’s arduous to disregard how marginal NFTs have turn into within the broader crypto dialog. Outdoors of area of interest circles, digital collectibles are not a each day speaking level, and retail curiosity that when powered the 2020–2021 growth has largely drifted elsewhere. In opposition to that backdrop, Bitcoin’s NFT numbers learn much less like a cultural revival and extra like a quiet accounting milestone—proof that exercise persists at the same time as hype has light and a spotlight has shifted to different corners of the market.

Additionally learn: Ripple Locks RLUSD Into LMAX’s $8.2 Trillion Buying and selling Engine

That distinction could be the most telling takeaway. Bitcoin’s ascent into the higher tier of NFT gross sales has unfolded with out fanfare, superstar drops, or retail frenzy, pushed as a substitute by ordinals and a gradual, if narrower, base of customers. Whether or not that basis proves sturdy or stays a historic footnote will rely much less on gross sales tallies and extra on whether or not NFTs regain relevance past specialised communities—or stay a subdued sideshow whereas Bitcoin continues to dominate the crypto narrative for solely completely different causes.

FAQ ❓

-

What’s driving Bitcoin’s NFT progress over the previous couple of years?

Bitcoin’s NFT exercise is being fueled by Ordinal inscriptions, which embed information immediately onto satoshis with out altering Bitcoin’s core protocol. -

How a lot have Bitcoin NFTs generated in complete gross sales?

Bitcoin NFTs have recorded about $5.8 billion in cumulative gross sales, rating the community third behind Ethereum and Solana. -

What number of Ordinal inscriptions exist on Bitcoin at this time?

The Bitcoin blockchain hosts greater than 117 million Ordinal inscriptions as of mid-January 2026. -

Are Bitcoin NFTs nonetheless worthwhile for miners?

Inscription charges added significant income earlier than and across the fourth halving, however contributions have since tapered massively in contrast with earlier peaks.