New knowledge exhibits over 30% of South Korea’s rich traders choose crypto for long-term worth development, outpacing curiosity in gold or property.

South Korean traders — particularly the youthful crowd — are leaning tougher into crypto, and a brand new report from Hana Financial institution’s assume tank suggests this could possibly be greater than only a passing development.

In line with a latest report by Hana Financial institution, one among South Korea’s largest banks, digital property may mark a paradigm shift in funding patterns, particularly as conventional monetary techniques fall wanting youthful traders’ expectations. The assume tank famous that ought to these property acquire the perform of settlement and authorized standing as a monetary funding product, the chance of forming a brand new monetary order will increase. Whereas it’s not a prediction, it could possibly undoubtedly act as a flag.

It’s additionally a second of reckoning. Whereas the report didn’t declare crypto the way forward for finance, it nonetheless famous that the proportion of the rich investing greater than 10 million gained (round $7,000) in crypto “surpassed 70%, with the common funding quantity greater than twice” as a lot as different traders.

You may also like: South Korea’s Nationwide Pension Service to faucet into blockchain

Younger Koreans ignore shares

A few of that is already seen on the bottom. Younger Koreans are stepping away from the home inventory market. And quick. “I by no means put money into the Kospi [The Korea Composite Stock Price Index],” one workplace employee in his 20s informed Korea JoongAng Day by day in a mid-April interview. Others of their 30s echoed the sentiment, saying they’re shifting towards U.S. equities, and much more aggressively, into crypto.

The report, citing knowledge from the Korea Securities Depository, revealed that by 2023, solely 11% of traders within the Korean market have been of their 20s. That’s down from 14.9% in 2021. For traders of their 30s, it dropped from 20.9% to 19.4% over the identical interval.

And crypto? It’s booming among the many identical group. Almost 48% of crypto traders in South Korea have been of their 20s and 30s final 12 months, in line with the Monetary Providers Fee.

On simply 5 main exchanges — Upbit, Bithumb, Coinone, Korbit and Gopax — their buying and selling quantity totaled “2.52 quadrillion gained [or around $1.76 trillion],” the report reads. “It’s now frequent information within the trade that cryptocurrencies like Bitcoin are siphoning off retail funding funds from the inventory market,” mentioned one brokerage trade insider.

Crypto.information repeatedly reached out to each Upbit and Bithumb for remark, however neither responded by the point of publication.

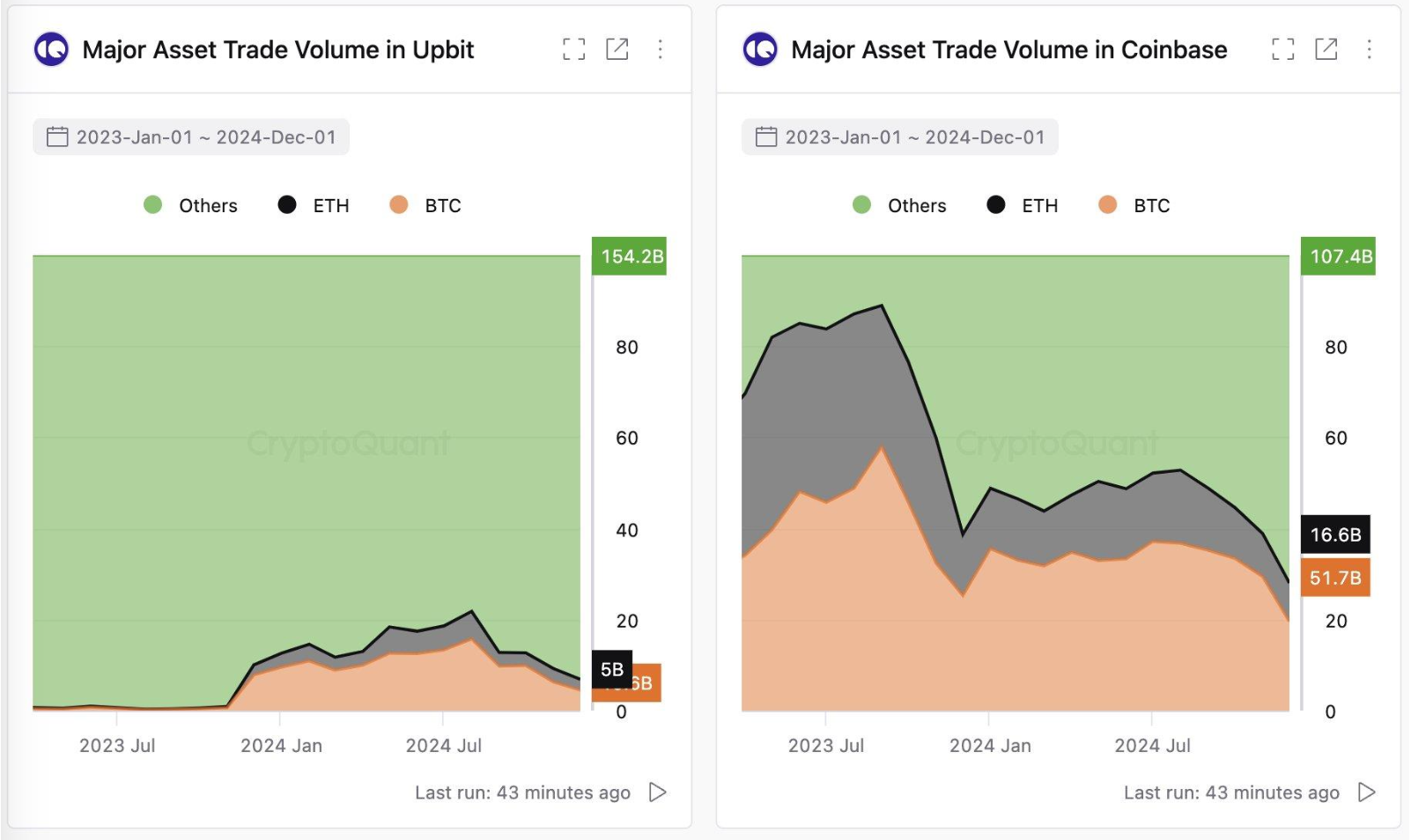

Buying and selling quantity on Upbit and Coinbase | Supply: CryptoQuant

CryptoQuant chief government Ki Younger Ju informed crypto.information the robust demand possible comes from Korean retail traders, who “have a a lot greater urge for food for threat property in comparison with these within the U.S.”

“Crypto buying and selling quantity in Korea has lengthy surpassed that of the native inventory market (Kosdaq), and on the subject of altcoins, Korea leads the world. By the tip of 2024, Coinbase’s month-to-month altcoin quantity was $107 billion —whereas Upbit’s hit almost $154 billion.”

Ki Younger Ju

Hana’s report doesn’t endorse any single crypto asset. However its researcher Yoon Seon-young famous that the rich group anticipating development potential in crypto “indicators the maturity of this discipline.”

“Nonetheless, the institutional security nets are nonetheless inadequate, and understanding of latest applied sciences is missing, resulting in a transparent division in opinions about digital property. Nonetheless, the rich have a tendency to check totally earlier than investing and like to put money into areas they perceive. I hope their curiosity and efforts to study new funding areas will proceed.”

Yoon Seon-young

Whereas that doesn’t imply crypto is protected, it does although imply it’s being taken extra significantly — even by legacy gamers.

Altering regulatory panorama

South Korea’s regulators are catching on as properly. The Monetary Providers Fee just lately mentioned it plans to launch complete funding tips for crypto by the third quarter of 2025.

It’s a part of a broader effort to convey crypto nearer to the formal monetary system. Universities and nonprofits could possibly be allowed to promote their crypto holdings quickly. Institutional guidelines are within the works. Even spot ETFs — as soon as banned — are being quietly reconsidered.

At a coverage assembly this month, FSC Vice Chairman Kim So-young mentioned Korea is shifting sooner to “foster its crypto market,” noting that the U.S. underneath Trump is accelerating world crypto adoption. The upcoming guidelines will give attention to “greatest practices,” with requirements round disclosure, reporting, and buying and selling.

Two-sided sword

It’s a tightrope. On one aspect, potential. On the opposite, volatility. South Korea — dwelling to one of many world’s most energetic crypto markets — is making an attempt to stroll that line.

Politicians are beginning to take discover, too. Presidential candidate Hong Joon-pyo has just lately mentioned he needs to roll again crypto rules, evaluating it to deregulatory strikes underneath the Trump administration. That type of discuss may resonate with youthful voters, a lot of whom already see crypto as a long-term play — or no less than a greater various than the Kospi.

This shift isn’t restricted to Korea. However it’s significantly sharp right here. Roughly 30% of the inhabitants trades crypto, in line with Korea Financial Day by day. That’s a staggering determine — and one regulators, banks, and political leaders can’t ignore.

Learn extra: Apple blocks KuCoin, MEXC, and 14 different crypto exchanges in South Korea