Jupiter, the biggest decentralized alternate (DEX) aggregator on the Solana blockchain with over $2.5 billion in complete worth locked (TVL), is routing almost half of its buying and selling quantity by means of proprietary automated market makers (AMMs), in keeping with Delphi Digital analyst 0x_Arcana.

In an X put up on July 31, the analyst revealed that proprietary AMMs, akin to SolFi, ZeroFi, and Obric, have quickly gained market share prior to now six months regardless of being closed-source, elevating questions on rising centralization within the Solana ecosystem.

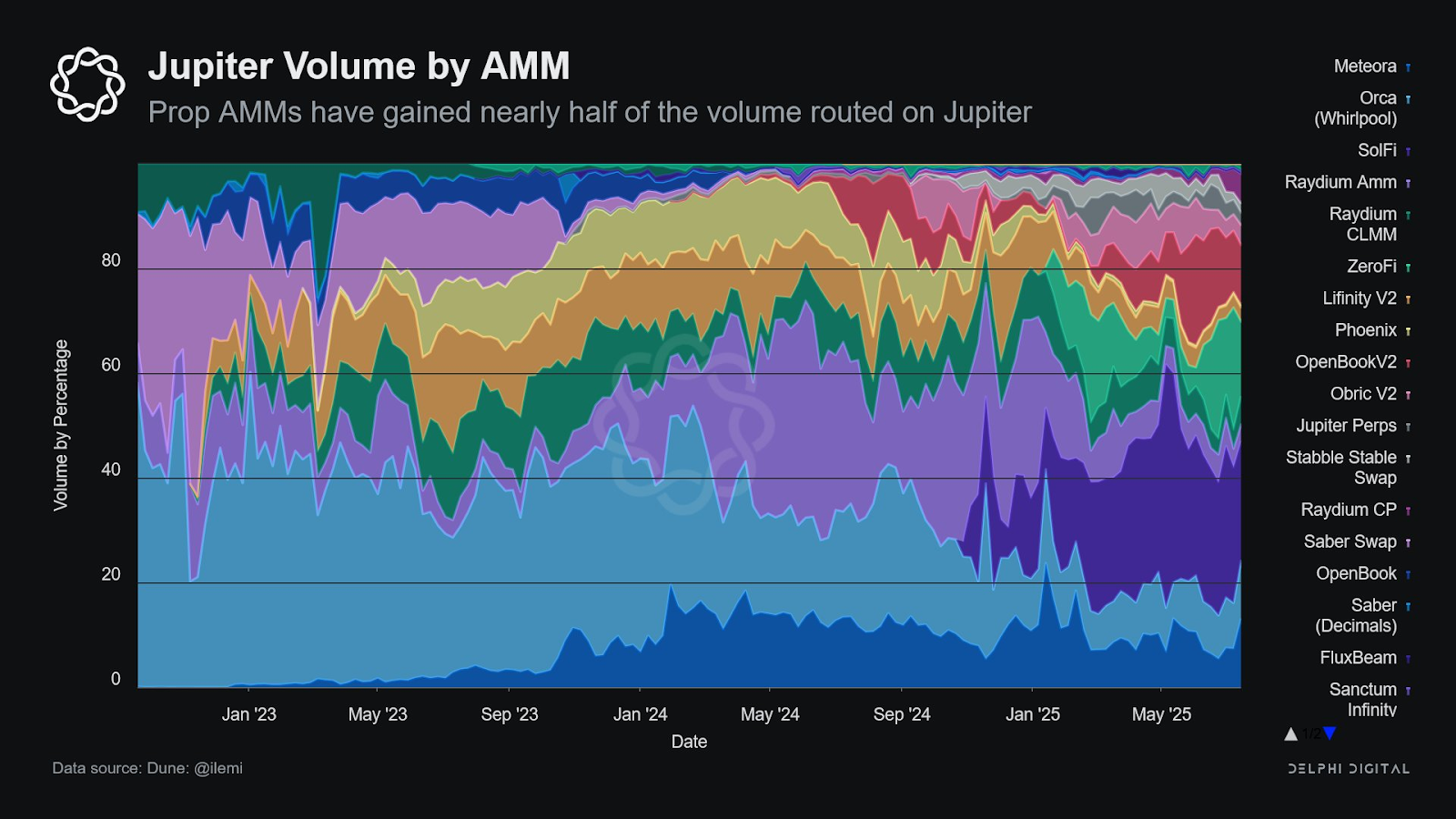

“Over 40% of all buying and selling quantity on Jupiter at present is routed by means of prop AMMs like SolFi, ZeroFi, and Obric,” 0x_Arcana wrote.

Information from Dune Analytics reveals SolFi handles 1 / 4 of all Jupiter buying and selling quantity. ZeroFi follows intently with 22%, whereas Meteora accounts for round 10%.

Jupiter Quantity by AMM

Improved Market Effectivity

Not like conventional AMMs — that are absolutely open and clear on-chain — proprietary AMMs like SolFi mix personal, off-chain worth quotes with on-chain commerce execution. They quote costs privately, depend on vault-based liquidity, and execute trades solely by means of aggregators with out public frontends.

0x_Arcana factors out that this shift could create a extra environment friendly market however strikes away from the clear, permissionless model of earlier AMMs. Merchants appear to care extra about higher costs and execution than platforms’ transparency, which helps proprietary AMMs achieve market share.

“We might see a bifurcated market construction – on one finish subtle venues dominating quantity on Jupiter, and on the opposite, V2 model swimming pools like Raydium capturing the tail-end of belongings,” 0x_Arcana wrote.

Centralization Dangers

Traditionally, AMMs supplied a democratic means for customers to produce liquidity however struggled with points like capital inefficiency. On the identical time, their public nature uncovered merchants and liquidity suppliers to dangers akin to frontrunning and maximal extractable worth, also called MEV.

Proprietary AMMs handle these issues by combining on-chain commerce execution with off-chain pricing and personal liquidity administration. And but, though this method can enhance market effectivity, it additionally raises centralization considerations, as liquidity and order movement turn into concentrated with a small variety of closed-source entities.

The Jupiter DAO additionally confronted governance challenges and paused all voting by means of the tip of 2025 after backlash over the crew’s outsized voting energy. Holding 20% of the ten billion JUP tokens, the crew’s affect raised considerations about equity and belief.

Governance is anticipated to renew in 2026 with a renewed deal with unity, accountability, and sustainable progress as Jupiter addresses centralization points each on-chain and in governance.