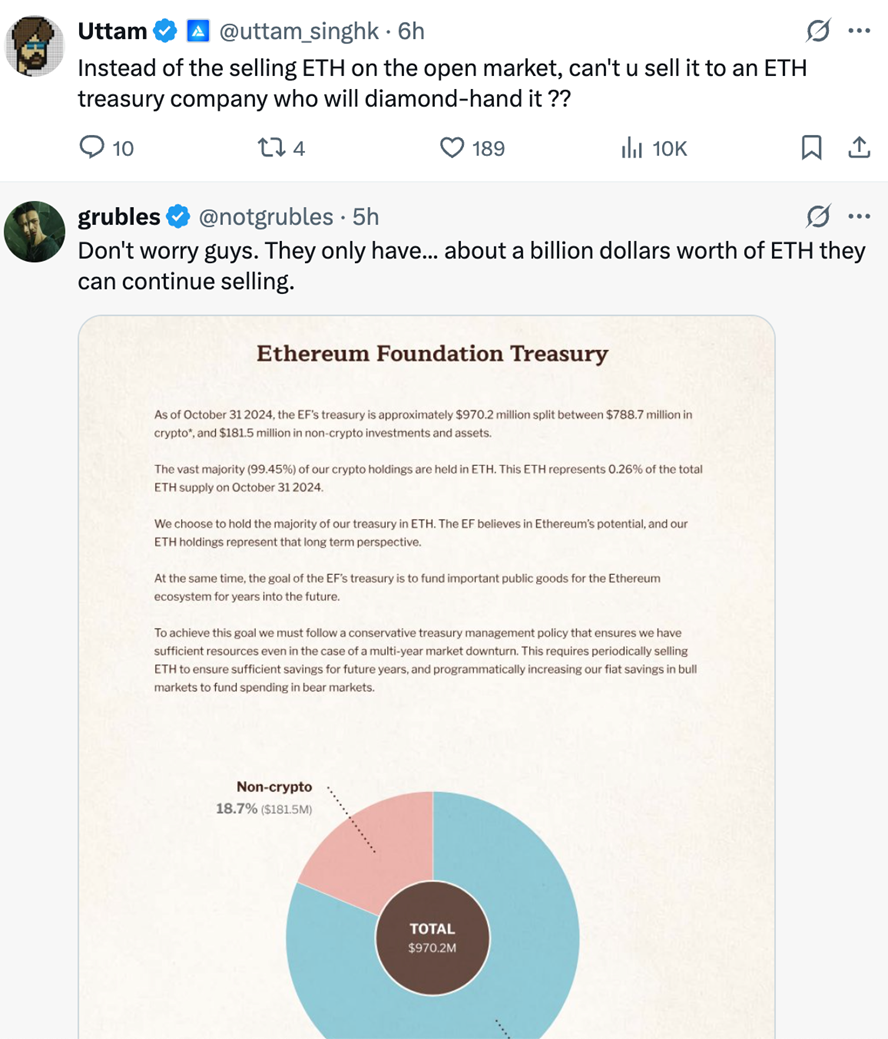

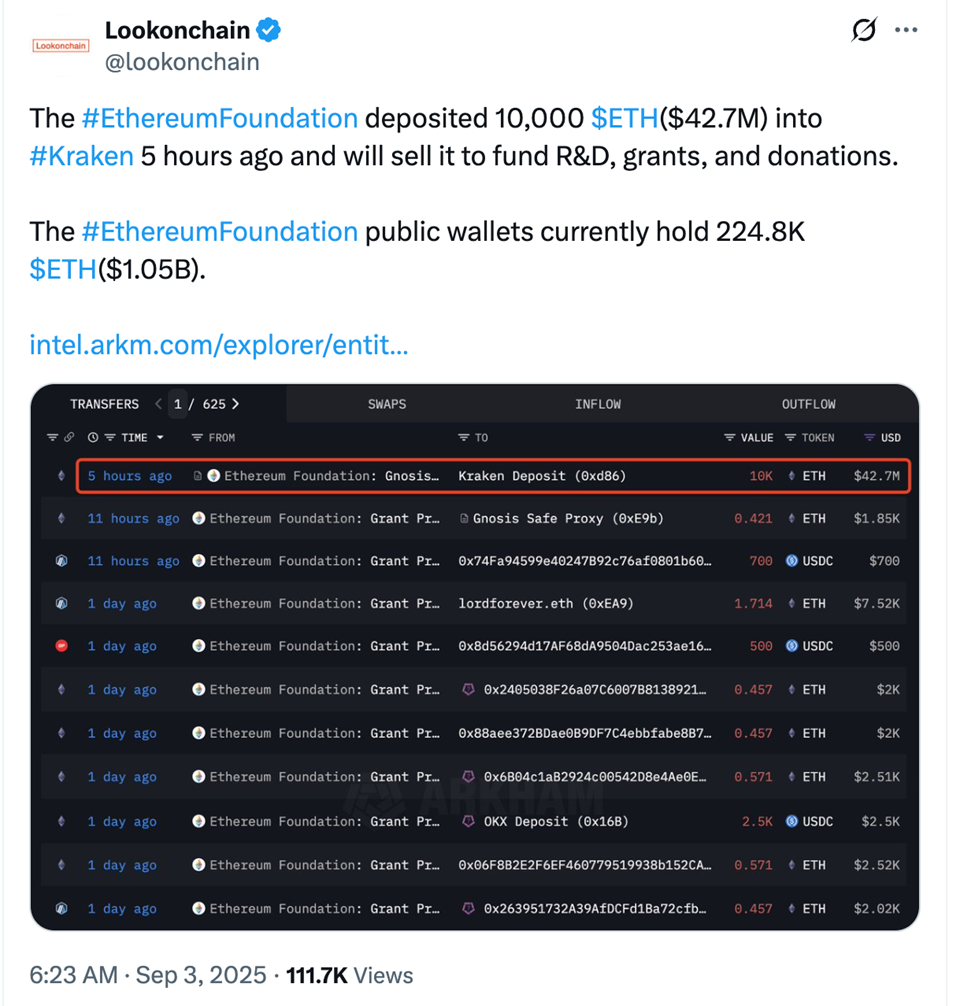

P2P.org has launched what it calls an “industry-first” fast-track ETH staking product designed to assist institutional purchasers bypass Ethereum’s rising validator entry queue. The transfer comes because the {industry} is carefully watching Kiln’s mass exit of all Ethereum validators, a precautionary measure following an infrastructure incident involving SwissBorg.

The Ethereum validator entry queue has ballooned to between 10 and 16 days, leaving stakers unable to earn rewards till activation is full. For establishments migrating giant validator units, that hole interprets into weeks of missed yield.

P2P’s new product gives pre-activated validators funded with the corporate’s personal ETH, permitting purchasers to start incomes rewards instantly whereas their stake waits within the common queue.

Supply: Validatorqueue.co

Supply: Validatorqueue.co

P2P declined to share full technical particulars of the setup, citing aggressive sensitivity, however mentioned the safety mannequin is similar to vanilla staking with no further danger publicity.

“We’ve already launched validators into the set which might be merely ready for activation,” the staff mentioned, including that rivals making an attempt to copy the method would face an extended activation delay, making their providing much less engaging to purchasers.

Ethereum’s validator exit queue (distinct from the entry queue) spiked sharply on Sept. 10, rising from underneath 1 million ETH to greater than 2.6 million ETH in a single day, and pushing the estimated exit wait time to its highest stage on file. The timing aligns with Kiln’s announcement that it was initiating the orderly exit of all of its Ethereum validators, suggesting {that a} vital share of the spike is attributable to Kiln’s precautionary withdrawal.

Supply: Validatorqueue.com

Supply: Validatorqueue.com

Kiln emphasised that rewards proceed to accrue through the exit interval and that shopper belongings stay safe.

“We took rapid motion as soon as we recognized a possible compromise in our infrastructure. Exiting validators is the accountable step to guard stakers,” the corporate wrote in a thread on X.

The choice follows an incident involving SwissBorg’s SOL earn program, during which about $41 million in SOL was misplaced.

An infrastructure compromise would usually confer with a suspected breach of validator key materials, nonetheless Kiln says it’s “not conscious of any additional buyer losses outdoors of Monday’s SwissBorg incident.” Blockworks contacted Kiln for particulars. A autopsy is anticipated following a evaluate, in keeping with the Kiln weblog.

A lot of that ETH will have to be restaked, re-entering the queue on the opposite facet.

Staking yield has steadily declined from a peak of 5.81% to the present 3% | Supply: Blockworks Analysis

Staking yield has steadily declined from a peak of 5.81% to the present 3% | Supply: Blockworks Analysis

P2P makes use of Distributed Key Era (DKG) to create validator keys that by no means exist in full type, then splits them into three shards with a 2-of-3 threshold distributed throughout three separate individuals in three areas.