Peter Schiff got here out with one other gloom and doom prediction on Bitcoin, stating BTC did not change into an alternative choice to fiat. He spoke out in assist of gold once more, as BTC didn’t reside as much as an asset for the ‘debasement commerce’.

Monetary analyst Peter Schiff claimed BTC was not an sufficient asset for the lately rising ‘debasement commerce’. He claimed BTC did not reside as much as the usual as digital gold resulting from its inherent volatility.

It isn’t only a de-dollarization commerce however a de-bitcoinization commerce. Bitcoin has failed the take a look at as a viable various to the U.S. greenback or digital gold. HODLers are in denial and their refusal to just accept actuality will value them dearly.

— Peter Schiff (@PeterSchiff) October 16, 2025

Beforehand, many analysts bundled BTC and gold collectively into the ‘debasement commerce’, with some anticipating BTC to catch as much as gold’s current data. BTC has gained 60.8% within the 12 months thus far, virtually degree with gold’s 60.6% positive aspects.

Silver, which had a breakout rally, is up over 67% internet within the 12 months thus far, surpassing BTC because the primary progress asset. As of October 16, property within the debasement commerce baskets are outperforming different sectors by a large margin, regardless of the file inventory valuations.

Schiff spoke out as BTC had one other flash crash, sliding underneath the $108,000 vary. BTC additionally elevated its volatility to 1.8% in October, after a interval of extra subdued value strikes. BTC moved right down to $108,618 after a collection of downward strikes prior to now day.

Schiff has been recognized for his bearish stance on BTC, claiming the asset could collapse at any time. Nevertheless, BTC nonetheless has doubtlessly limitless upside, along with a 12 months of institutional assist.

BTC nonetheless offsets US greenback weak point

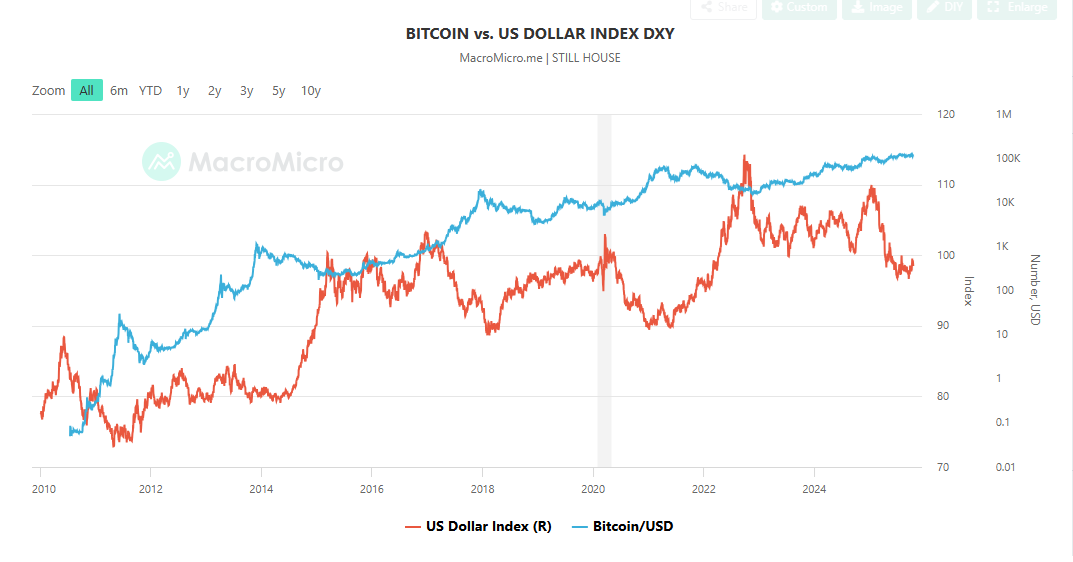

In 2025, BTC managed to offset a lot of the weak point within the US greenback, because the forex fell towards the euro and different fiat. The US greenback has been making an attempt a small restoration, however has proven weak point all through 2025, whereas BTC set a collection of value data.

BTC has proven it will possibly offset fluctuations within the greenback index, retaining its progress even during times of US greenback weak point. | Supply: MacroMicro

The BTC climb has offset a number of years of volatility within the US greenback index, even in the course of the current bear market. BTC has additionally been used as a retailer of worth for nations with hyperinflation and way more unstable currencies.

As for the underside falling out of BTC, the coin nonetheless has a ample variety of holders and has matured past panic-selling.

BTC nonetheless goes by speedy liquidation cycles

Within the quick time period, a few of the BTC flaws lie with the speedy unraveling of spinoff buying and selling.

BTC open curiosity declined once more to $33.32B, following one other spherical of speedy liquidations. Inside a four-hour window, BTC erased one other $155M from lengthy liquidations.

The BTC market may additionally bounce even after vital de-leveraging, although it could take months for liquidity to rebuild to earlier ranges. Regardless of this, BTC continues to be seen as a viable asset class for limitless progress. Moreover, BTC has proven a historic response to M2 liquidity progress, catching as much as the cash provide inside just a few months.

Need your mission in entrance of crypto’s high minds? Characteristic it in our subsequent trade report, the place knowledge meets influence.