Because the weekend launch of Official Trump (TRUMP) on Solana, Phantom has carried the majority of the visitors surge on the community. Phantom Pockets accomplished $1.25B in swaps, with customers noticing delays in transactions.

Document DEX exercise on Solana led to $1.25B in volumes swapped straight by the Phantom pockets. The push to purchase and commerce Official Trump (TRUMP) led to peak exercise, as Phantom dealt with 10M transactions in a 24-hour window.

Transactions are touchdown a lot smoother now and all techniques ought to be again to regular.

Regardless of all of the challenges, our customers swapped over $1.25B in quantity and made 10M transactions right now.

Large due to the @0xMert_/@heliuslabs and @ethanyish/@AlliumLabs groups for serving to us…

— Phantom (@phantom) January 20, 2025

The launch of the TRUMP token was a second of speedy mainstream curiosity in Solana. Searches on Google peaked at 100 factors on January 20, signaling most Solana companies would see unprecedented inflows of onboarding for brand new customers.

Traders turned to Phantom to commerce TRUMP

Phantom was essentially the most user-friendly pathway into Solana, rating at place 93 as the preferred finance app within the USA. The exercise on Solana was the equal of every week of transactions on Ethereum (ETH), the place exercise slowed down on account of excessive charges.

Phantom can also be among the many high finance apps in Eire, Russia, Mexico, and different crypto-friendly markets, reflecting the worldwide rush to purchase promising memecoins.

Solana noticed round 4.85M customers per day, inside its typical vary. Nevertheless, the massive variety of transactions and workload got here from DEX routing and token swaps. Customers are nonetheless reporting failed transactions and even misplaced funds after the surge. Among the transactions additionally despatched funds to centralized exchanges.

The latest buying and selling and transaction spree was a stay stress check for Phantom, although nicely inside Solana’s capabilities. The pockets acquired as much as 8M requests per minute from international customers, because it supplied limitless onboarding. Actual merchants made up round 60% of Solana exercise, with bots making round 40% of swaps.

Jito SOL block-building engine was additionally below unprecedented stress. The Jito Labs block engine API suffered service outages, inflicting a stay stress check. The Jito Labs workforce moved in to restore the harm whereas assembly unprecedented demand for buying and selling. Solana itself didn’t have issues with consensus and didn’t cease producing blocks.

Solana carried peak visitors as Orca took the lead

The speedy transaction quantity as soon as once more lifted Raydium to change into the largest charge producer for the previous day. Raydium had $32.48M in day by day charges, adopted by high Solana validator and MEV builder JitoSOL.

This time, Orca emerged as one of the vital extensively used exchanges, producing greater than $9.34M in day by day charges. The Solana predominant chain had $13.53M in 24-hour charges on account of elevated visitors.

The chain additionally elevated its transaction success fee to over 76%, as customers paid bribes and precedence charges. On typical days, Solana carries round 67% of profitable transactions, on account of decrease urgency.

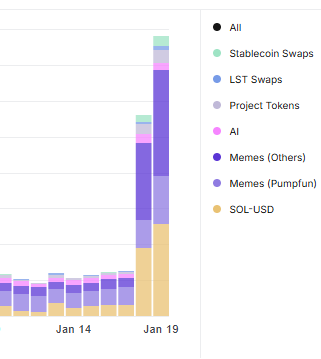

The visitors on Solana was extremely focused, concentrated between fiat and SOL swaps and memecoin trades. Probably the most lively class of trades was for memecoins exterior the Pump.enjoyable ecosystem, primarily because of the rush for the newly launched TRUMP token, in addition to rollovers to MELANIA, BARRON, and a sequence of latest property.

Solana swaps reached peak ranges over the weekend after the launch of TRUMP tokens. | Supply: Blockworks

Primarily based on Blockworks knowledge, Solana had the best degree of exercise for the previous three months, with day by day volumes rising as much as 800%. Solana’s meme token buying and selling was focused on Raydium, Orca, and Meteora, relying on the obtainable liquidity.

Jupiter DEX aggregator additionally went by a stay stress check

Jupiter DEX is the highest app on Solana, on account of demand for optimum charges and routing to exchanges. The buying and selling hub additionally went by an excessive overload with the occasional lack of companies.

The highest developer @weremeow apologized for the failures, stating that Jupiter resumed full service after the preliminary wave of patrons.

hey everybody, needed to apologize deeply for the system instability and scaling points.

over the previous couple of months, we have now been working tremendous exhausting to stabilize and scale up all these subsystems, however we clearly have a ton to do in instances of maximum market situations.

on account of… https://t.co/B9QY8mb456

— meow (🐱, 🐐) (@weremeow) January 20, 2025

Jupiter’s failure brought on delays and potential losses for particular person merchants, who missed out on sniping the tokens early. Some couldn’t purchase within the first minutes after cash launched, as they had been front-ran by bots and customers that paid increased charges.

Others misplaced SOL on excessive charges, that are charged from the pockets even for failed transactions.

From Zero to Web3 Professional: Your 90-Day Profession Launch Plan