GCash, the Philippines’ main digital cash app, introduced help for Circle’s USD Coin (USDC). Customers within the nation can now maintain and transact with the stablecoin.

This marks a serious step in integrating stablecoins with on a regular basis transactions within the nation.

Circle’s USDC Ventures Into the Philippines Market

Native media revealed the mixing, noting that GCash customers within the Philippines should buy, maintain, and ship USDC by GCrypto, the app’s cryptocurrency platform. GCash’s Group Head of Wealth Administration, Arjun Varma, says this integration presents a game-changer for monetary inclusion within the Philippines.

“By providing easy accessibility to digital {dollars}, we empower our customers with a secure and globally acknowledged monetary asset,” native media reported, citing Varma.

Not like risky cryptos like Bitcoin (BTC) and Ethereum (ETH), USDC is a stablecoin pegged to the US greenback. This makes it a extra dependable digital asset for funds and financial savings.

The transfer is predicted to assist thousands and thousands of Filipinos bypass conventional banking infrastructure, which is reportedly sluggish, costly, and inaccessible to many.

“Philippines funds are completely horrible. A number of the worst rails and ramps on this planet,” one consumer remarked.

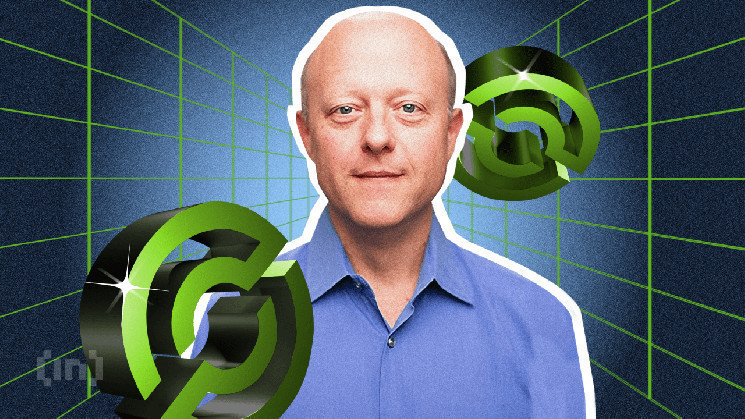

With USDC reserves held at regulated monetary establishments, they endure common third-party attestations to make sure transparency. Circle CEO Jeremy Allaire highlighted the dimensions of this enlargement, citing a chance for progress within the agency’s stablecoin community.

“The most important and most generally used digital cash app within the Philippines, GCash, simply introduced help for USDC of their cell pockets. One other ~100m customers being introduced into Circle’s stablecoin community,” he expressed.

In the meantime, this transfer indicators Circle’s outward enlargement as competitors within the stablecoin market intensifies. Main conventional finance establishments, together with the Financial institution of America (BoA), are actually eyeing stablecoin adoption.

This poses competitors for stablecoin issuers like Tether and Circle as established banks look to enter the area with their stablecoin choices. As monetary giants transfer in, fintech firms like GCash provide themselves as potential avenues for enlargement to stablecoin issuers.

“GCash’s USDC transfer places a world digital greenback in 100 million Filipino fingers. Stablecoins would possibly simply leapfrog banks in locations like this,” one other consumer added.

Regardless of the optimism, transparency stays a big concern for stablecoin adoption. Whereas the blockchain’s openness is nice for safety and belief, it’s not all the time very best for on a regular basis funds.

“Crypto funds failed for one small purpose that wants fixing: When sending USDC, let the recipient see the transaction however not your deal with. No person desires to disclose their pockets for a ten USDC beer fee,” DeFi researcher Ignas mentioned lately.

Whereas GCash’s USDC integration presents comfort, requires stablecoin transparency, like revealing pockets addresses for USDC transactions, might deter adoption even for Philippine customers.

Nonetheless, GCash’s transfer displays a broader pattern of digital wallets embracing blockchain-based finance.