In early 2026, whereas the altcoin market capitalization (TOTAL3) rebounded from $825 billion to over $880 billion, marking a achieve of greater than 7%, Pi Community (PI) remained stagnant across the $0.2 degree. Alternate information has not proven any clear indicators of a return to demand.

In the meantime, the Pi Community group has reported rising losses amongst traders who pursued expectations tied to the GCV worth.

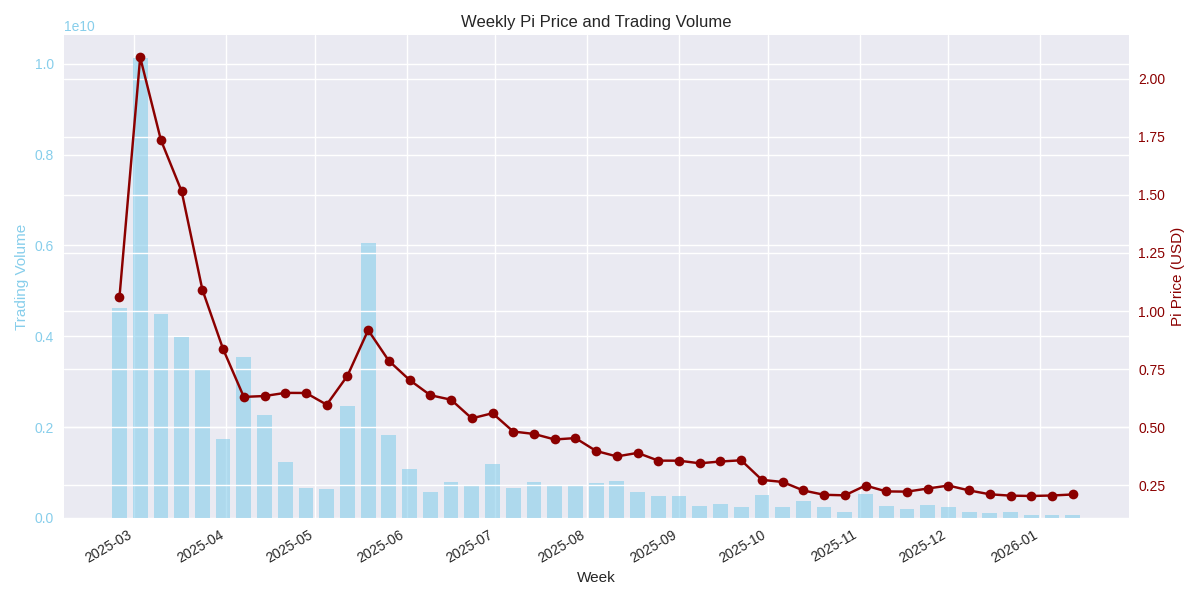

Pi Community’s Weekly Buying and selling Quantity Hits Document Lows

Knowledge from CoinGecko reveals that Pi’s buying and selling quantity has fallen to report lows. The weekly quantity dropped sharply beneath $100 million, with day by day averages of round $10 million.

By comparability, in March final 12 months, Pi recorded greater than $10 billion in weekly buying and selling quantity. The present figures signify a decline of over 99%.

Weekly Pi Value and Buying and selling Quantity. Supply: CoinGecko.

The collapse in buying and selling quantity displays weakening demand for Pi on exchanges. Skinny liquidity will increase the danger of enormous worth swings, even with comparatively small shopping for or promoting stress.

If costs rise underneath such low liquidity situations, the transfer is unlikely to be sustainable. If costs fall, the identical situations make Pi susceptible to sharp sell-offs.

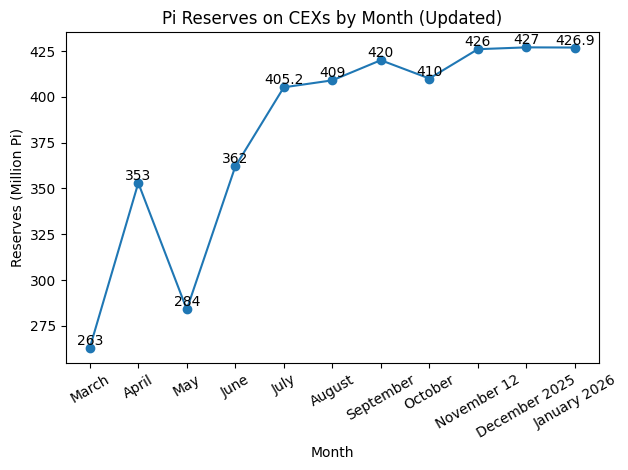

Moreover, Piscan information point out that Pi reserves on centralized exchanges (CEXs) haven’t declined. As a substitute, they continue to be elevated.

Pi Reserves on CEXs by Month. Supply: Piscan

On January 9, greater than 1.3 million Pi tokens had been transferred to exchanges, pushing whole change reserves to 427 million Pi. Larger change balances enhance promoting stress. Mixed with skinny liquidity, this dynamic considerably raises the danger of additional worth declines.

Pioneers Endure Losses After Trusting the GCV Concept

One among Pi Community’s most distinctive options is its two-value system. Holders acknowledge each the market worth on exchanges and the GCV (World Consensus Worth), a theoretical valuation.

Supporters promote GCV as a hard and fast worth of $314,159 per Pi, derived from the mathematical fixed Pi (π). They encourage customers and retailers to just accept Pi at this valuation.

Nevertheless, current group experiences point out that a number of traders have suffered extreme losses by following the GCV narrative, whereas Pi’s market worth has fallen greater than 90% from its peak.

The Pi-focused information account r/PiNetwork highlighted not less than two such instances.

One instance includes Taufan Kurniawan, who invested 50 million Indonesian rupiah (roughly $3,200) to open a store serving Pi customers. He accepted funds based mostly on the GCV worth and anticipated substantial income. When the market worth collapsed, the enterprise failed, leaving him with heavy losses.

“Retailers utilizing GCV will probably be bankrupted by their incapacity to get better funds within the ecosystem. It’s already taking place,” r/PiNetwork commented.

Pi’s extended worth decline and weak liquidity are forcing Pioneers to make a tough alternative: proceed holding and pursuing Pi’s long-term imaginative and prescient, or abandon the undertaking altogether.

The publish Pi’s Liquidity Disaster Deepens Whereas GCV Believers Face Heavy Losses appeared first on BeInCrypto.