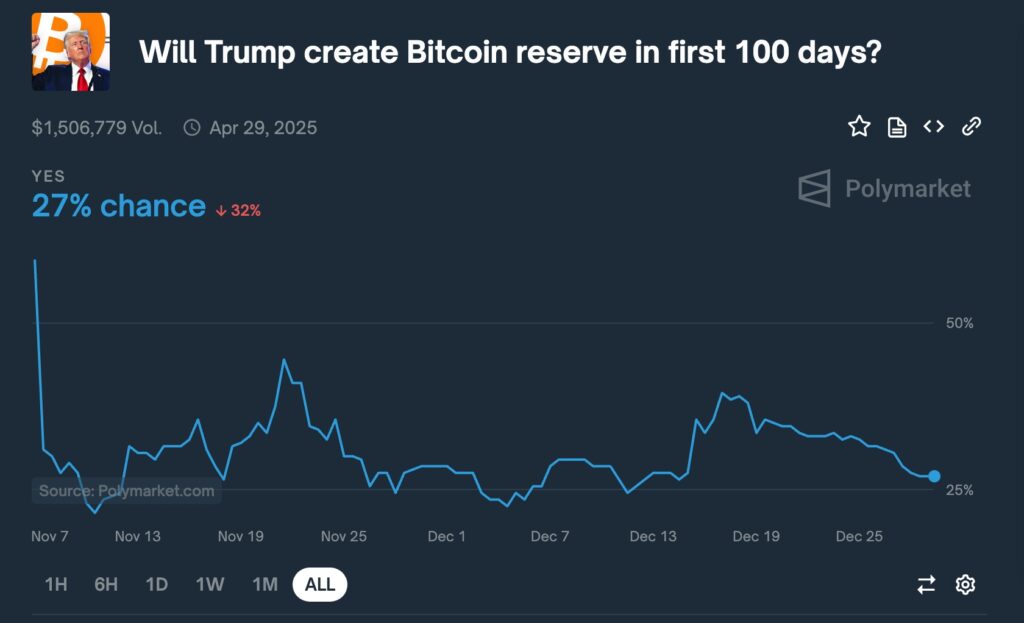

Polymarket customers predict that President-elect Donald Trump won’t approve a Strategic Bitcoin Reserve inside the first 100 days of his administration.

A ballot with over $1.5 million in funds places these odds at simply 27%, down from 60% after Trump’s election. It is a notable prediction since Polymarket has been extremely correct prior to now, together with its estimate on the final presidential election.

Odds of strategic Bitcoin reserves are falling | Supply: Polymarket

You may also like: US won’t approve strategic Bitcoin reserve: CryptoQuant CEO

Kalshi customers disagree

Different members within the prediction market anticipate Trump to finally settle for Bitcoin (BTC) as a strategic reserve, becoming a member of crude oil and gold. Kalshi, for instance, has positioned the percentages of a BTC reserve taking place by January 2026 at 61%, the very best level since Dec. 21.

Some conservative-leaning states like Texas, Ohio, and Pennsylvania have additionally began engaged on their strategic Bitcoin reserves. A invoice in Pennsylvania states that the federal government could make investments at the very least 10% of the State Basic Fund in Bitcoin to struggle inflation.

Nonetheless, Polymarket and Kalshi customers anticipate the Texas strategic Bitcoin reserve invoice to take time. A Polymarket ballot locations the percentages of Texas passing the invoice by March subsequent yr at 10%, whereas Kalshi has the percentages at 24%.

Proponents of the U.S. embracing Bitcoin as a strategic reserve, together with Senator Cynthia Lummis, argue that it makes monetary sense due to the demand and provide dynamics. Information reveals that Bitcoin demand is rising, with spot ETFs having over $128 billion in belongings.

Provide is falling, with the mining problem rising to a file excessive after the final Bitcoin halving occasion in April this yr. In accordance with CoinGlass, Bitcoin balances in exchanges have continued falling this yr.

Proponents additionally level to MicroStrategy’s success, which has helped it change into an $80 billion firm by changing into the largest Bitcoin holder. As such, some analysts predict that the U.S. might finally use its Bitcoin holdings to pay a few of its debt, which at the moment stands at over $36 trillion.

Opponents argue that Bitcoin’s volatility, restricted acceptance, market scale, regulatory constraints, and its implications for sovereignty and belief make it an impractical answer for paying off the U.S. nationwide debt.

Additionally, the Federal Reserve has already stated that it’s not allowed to carry Bitcoin, which means that it might want a congressional regulation to try this.

Trump has supported Bitcoin and steered that the federal government ought to convert its Bitcoin holdings into strategic reserves. Information by BitcoinTreasuries present that the federal government holds 198,000 cash valued at $18 billion.

Learn extra: VERUM surges 88%, PHALA jumps 44%, Bitcoin struggles at $94k