Crypto-powered prediction market Polymarket is ready to make its long-awaited return to the USA, following a $112 million acquisition of a small however regulated derivatives change, QCX, and clearinghouse, QC Clearing.

Polymarket CEO Shayne Coplan took to X to share the feat at the moment, July 21, stating that the transfer “paves the best way for us to welcome American merchants once more. I’ve waited a very long time to say this: Polymarket is coming residence.”

The deal will see Polymarket thought of compliant below United States laws because it now owns an authorised derivatives clearing group (DCO) and designated contract market (DCM) within the type of holding firm QCEX, which was simply granted its approval to function by the Commodity Futures Buying and selling Fee (CFTC) on July 9, Bloomberg reported.

Entry to Polymarket restricted for U.S.-based customers following a 2022 settlement with the CFTC, although the agency remained headquartered in New York and Coplan, additionally the founder, is a U.S. citizen. Since then, the platform has been “read-only” for United States customers, which means U.S. residents can view the markets and their odds, however not take part in bets. The web site now reads “we’re working onerous to get the US platform prepared for launch”.

The information comes shortly after each the CFTC and the Division of Justice introduced they’d be dropping investigations into Polymarket and Coplan. The information additionally follows an announcement on Polymarket’s web site that will probably be “rolling out a brand new reward and oracle-resolution system later this 12 months,” after the Zelenskyy swimsuit market debacle earlier this month.

The platform additionally lately introduced its newest spherical of fundraising on the finish of June, the place it was reported that Peter Thiel’s Founders Fund was set to shut a $200 million increase, which might take Polymarket’s cumulative fundraising complete above the $1 billion mark.

Polymarket’s Progress

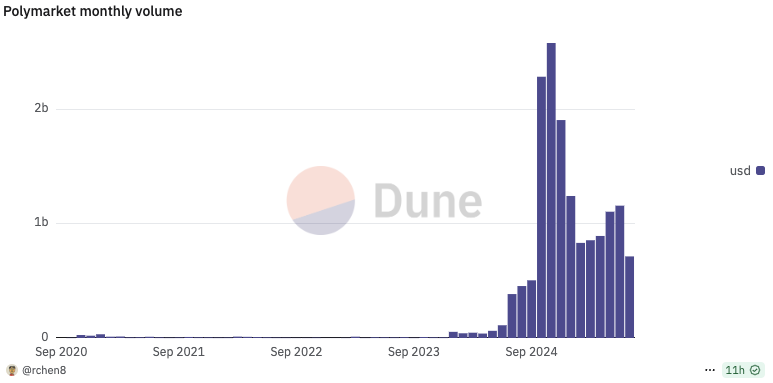

Polymarket, which exploded in 2024 in the course of the lead as much as the U.S. Presidential Election, has been considered one of this market cycle’s breakout crypto merchandise. The prediction market initially launched in 2020, however remained largely unnoticed by most crypto individuals apart from the prediction market diehards till final 12 months.

In 2025, the platform averages roughly $1 billion in quantity monthly, after averaging as little as $50 million monthly within the first half of 2024, and fewer than $10 million monthly in 2023.

Polymarket month-to-month quantity. Supply: Dune Analytics

Final month, X (previously Twitter) introduced that it might be integrating Polymarket because the social media large’s most popular prediction market platform

The rollout of bulletins additionally comes shortly after the U.S. Home of Representatives’ sweeping approval of a number of key crypto payments, with the stablecoin-focused GENIUS Act signed into legislation by President Trump on Friday, which despatched the “Made in USA” class of altcoins flying.