The 2025 crypto cycle has been outlined by extra than simply Bitcoin hitting new all-time highs, it has been a 12 months of structural evolution. As capital flows between on-chain venues and centralized exchanges (CEXs) reached fever pitch, the business’s focus shifted towards how platforms supply and worth new property.

A brand new complete audit by Gate Analysis, overlaying 447 spot listings all through 2025, reveals a transparent divergence in efficiency between fast-follow listings and first launches. The information means that Gate has carved out a big itemizing alpha, significantly inside its unique mission pipeline, the place short-term worth discovery was most intense, delivering a median achieve of almost 81% inside the first half-hour of buying and selling.

Notably, round 80% of those unique property opened with quick constructive momentum, signaling excessive demand from the beginning.

The Main Engine: 71% First-to-Market Provide

Gate’s 2025 technique was characterised by its function as an incubator for brand new provide. Of the 447 property analyzed, 318 (71%) have been major listings, that means Gate was the primary main venue to facilitate worth discovery for these tokens.

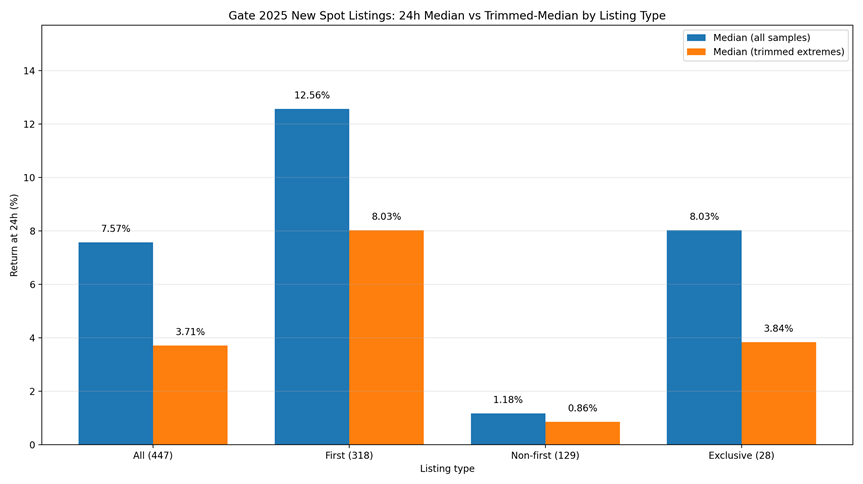

The information confirms that being early pays off. Within the first 24 hours:

- Main Listings posted a median return of 12.56%.

- Non-Main Listings (secondary listings of present tokens) lagged considerably with a median of simply 1.18%.

This hole highlights Gate’s potential to seize the preliminary warmth of a mission’s lifecycle, the place volatility and demand are at their peak. Whereas the typical 24-hour return for gainers reached a staggering 635%, the median throughout all the pattern (together with decliners) was a extra grounded 7.57%, suggesting that whereas the “long-tail” of winners is huge, the platform additionally gives a secure surroundings for broader asset pricing.

The Unique “30-Minute Dash”

Essentially the most aggressive alpha was discovered within the Gate-exclusive subset, a bunch of 28 high-conviction initiatives. These property didn’t simply carry out; they exploded out of the gate:

- Median Returns: The 30-minute median achieve for these exclusives sat at ~81%, marking a interval of intense and worthwhile worth discovery.

- Strike Fee: This efficiency was remarkably constant, with almost 80% (22/28) of unique initiatives buying and selling above their itemizing worth inside the first half-hour.

- Wealth Results: Over a 3rd of those unique listings delivered 100%+ beneficial properties in that very same half-hour window.

This means that Gate’s screening course of for exclusives is extremely synchronized with market urge for food, efficiently figuring out property that may convert quick consideration into buying and selling momentum.

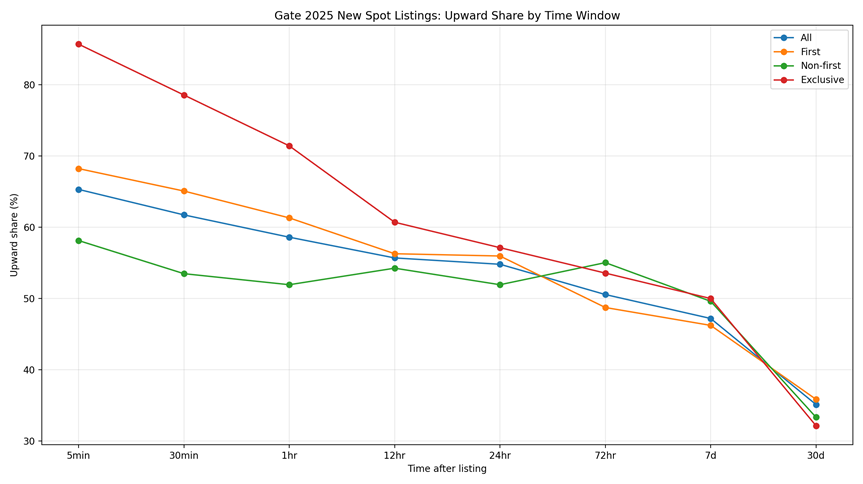

The “72-Hour Pivot”: A Dealer’s Roadmap

The report gives a granular take a look at the post-listing lifecycle, figuring out a vital inflection level for buyers.

By the 72-hour mark, the preliminary itemizing bounce usually fades, and the market shifts from momentum-driven buying and selling to a couple winners, many givebacks regime. The 30-day median return drops to -25%, reinforcing that probably the most actionable wealth results are concentrated within the first three days of an inventory.

From AI Infra to Group Tradition

Gate’s positioning in 2025 was much less about market timing and extra a couple of deliberate concentrate on particular narratives. The change’s trajectory was largely outlined by three themes:

The Visitors Gateways (e.g., Pi Community)

Initiatives like Pi Community (PI) demonstrated Gate’s potential to deal with large, community-driven site visitors property. After itemizing, PI surged almost 60x inside seven days, proving that Gate’s liquidity layers can soak up concentrated demand from hundreds of thousands of exterior customers with out breaking the value discovery mechanism.

AI Infrastructure & The x402 Narrative (e.g., Unibase)

As AI developed from easy wrapper apps to core infra, Gate stayed forward of the curve. Unibase (UB), a candidate within the x402 narrative, confirmed outstanding resilience. Regardless of broader market volatility in October, UB trended upward to an ATH of $0.086, a 500% achieve from its open, showcasing the longevity of technology-driven listings.

The Consideration Financial system (e.g., MUBARAK & USELESS)

Within the hyper-speed world of memes, timing is every part. Gate’s agility in itemizing Mubarak (MUBARAK) early in its hype cycle led to a single-day achieve of 120%. By transferring quick when cultural symbols gained traction, the platform allowed its customers to seize the growth part of group consensus.

Conclusion: A Platform for Actionable Listings

Information from the previous 12 months confirms Gate’s evolution right into a strategic launchpad for rising property. By specializing in unique listings, the platform has optimized its function within the early levels of the market cycle.

As we transfer into 2026, the sustainability of this high-volume itemizing technique might be vital for the change to stay aggressive in securing liquidity and person engagement.

The publish Main Listings Lead Value Discovery as 80% of Unique 2025 Tokens Hit Inexperienced appeared first on BeInCrypto.