This can be a phase from the Empire publication. To learn full editions, subscribe.

As we speak, we lined the brand new blockchain Converge, meant for merchandise and apps that may give institutional buyers methods of participating with tokenized belongings. Talking of tokenization, Blockworks Analysis analyst Carlos Gonzalez Campo has penned a brand new report on the topic.

“We anticipate the fast growth of purpose-built infrastructure,” Gonzalez Campo wrote.

And wouldn’t you understand it — we’re already seeing this sort of growth in Ondo Chain and Converge. Each are “designed to align with regulatory necessities whereas leveraging the efficiencies and transparency of open blockchain networks.”

“Within the coming months, we see the best alternatives within the tokenization of illiquid markets, significantly non-public fairness. Nevertheless, the profitable integration of offchain belongings into blockchain ecosystems depends closely on clear and constant regulatory frameworks,” he continued.

Gonzalez Campo makes the case that tokenizing non-public fairness makes extra sense than public shares as a result of excessive entry limitations and illiquidity that plagues non-public markets.

“In contrast to public shares, that are already simply traded on conventional brokerage platforms and apps like Robinhood, tokenized non-public fairness permits buyers to entry fractional possession in high-growth non-public corporations whereas including effectivity to valuation dislocations,” he wrote.

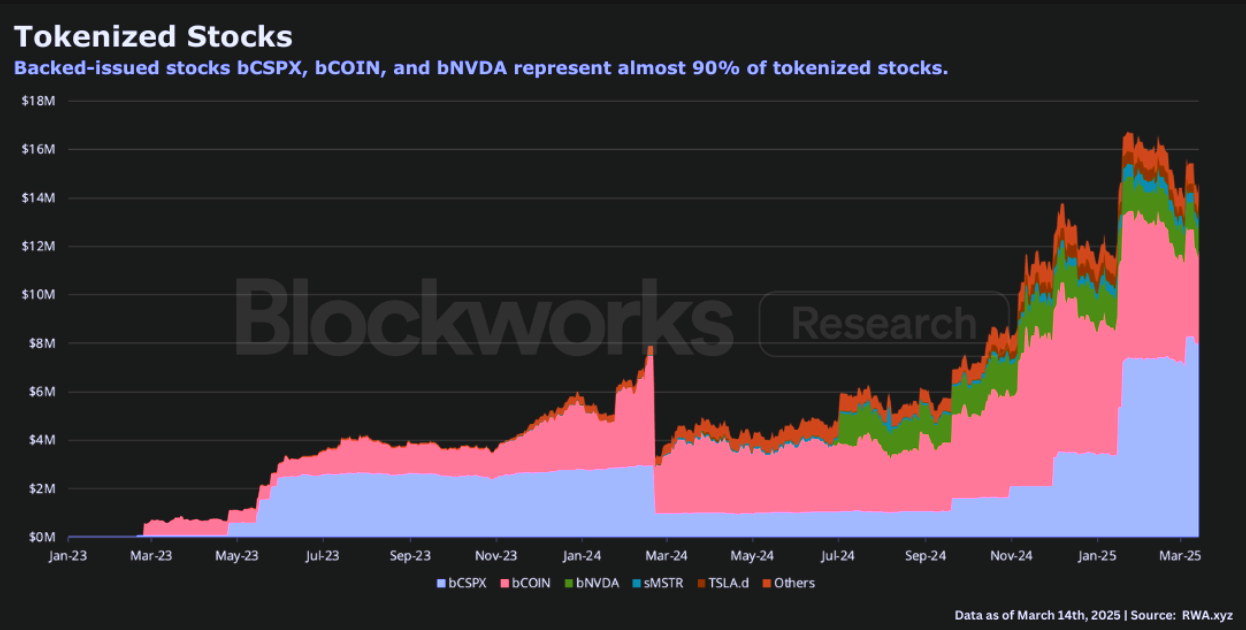

Tokenized shares, nonetheless, do have a little bit of curiosity, as seen within the chart beneath.

Supply: Blockworks Analysis

Proper now, tokenized variations of Coinbase, Nvidia, and the iShares Core S&P 500 UCITS ETF dominate the accessible tokenized public shares.

However, “with the correct regulatory steering within the US, we count on that shares of personal corporations like SpaceX and Open AI will probably be tokenized over the course of the subsequent 4 years,” the word mentioned.

All through my profession, the thought of creating these extremely unique non-public markets extra accessible to the general public has been teased however not likely actually acted on — not, a minimum of, in a approach the place people actually can get a bit of no matter non-public pie they need.

It’s actually taken longer than I believed it might after Robinhood modified the sport for inventory buying and selling years in the past. However it’s thrilling to see a possible timeline laid out.