- ProShares has up to date its XRP ETF submitting to a brand new efficient date of June 25, exhibiting continued efforts to realize SEC approval.

- The replace is boosting sentiment within the XRP market, accompanied by worth surge.

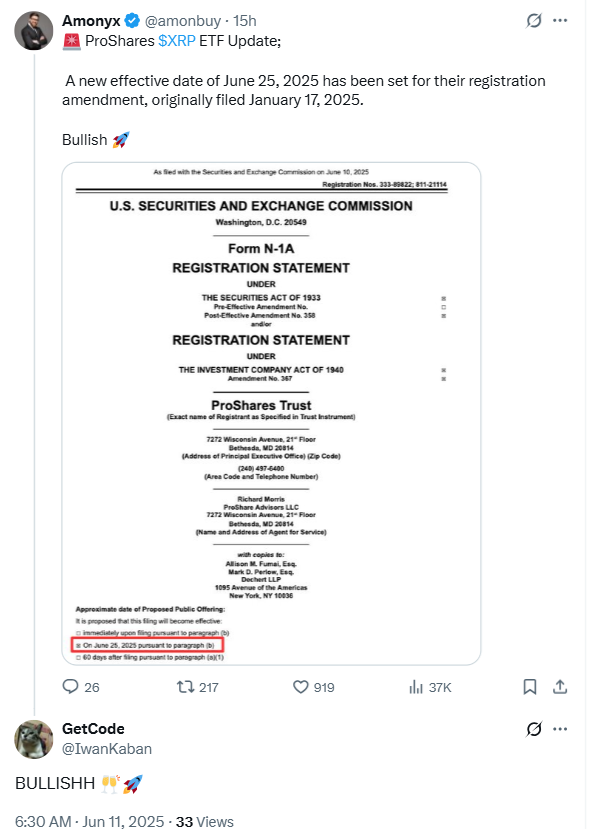

ProShares has up to date its XRP ETF submitting, an indication that the push for approval by america Securities and Change Fee (SEC) continues to be in movement. The revised date, now set for June 25, 2025, replaces an earlier timeline and displays persevering with steps in a regulatory journey that started in January.

XRP ETF Submitting Good points Consideration as New Date Emerges

As highlighted in our earlier information transient, the US SEC has permitted ProShares to launch the first-ever XRP Change-Traded Fund (ETF).

It’s value noting that the XRP ETF replace from ProShares, shared publicly on June 10, 2025, exhibits that the method has not stalled. As a substitute, the agency is engaged on a timeline greatest suited to the takeoff.

Initially submitted in January 2025, the submitting has been revised by means of Type N-1A. It is a commonplace doc required for open-end funds comparable to exchange-traded funds. This type outlines the operational particulars of the proposed fund and is topic to a full evaluate by the SEC.

After Amonyx posted the information on X, crypto observers on social media shortly picked up on the updates, sparking a mixture of reactions. Some customers welcomed the progress. One remark described the shift as bullish, suggesting optimism in regards to the potential launch.

Others, nevertheless, expressed concern in regards to the date change, noting earlier delays such because the missed April 30 expectation.

The brand new June 25 date presents a clearer level of focus because the group continues to observe developments. In the meantime, one other XRP ETF software, this one from Franklin Templeton, awaits a call.

As talked about in our earlier article, the anticipated ruling on Franklin Templeton’s proposed Spot XRP ETF is anticipated by June 17. The overlap of those filings has added strain on the SEC to reply on time.

SEC’s Position Stays Central to XRP’s Outlook

Based mostly on earlier outcomes from ETF filings for digital belongings, the attainable approval of an XRP ETF carries weight for buyers. It might enable folks to spend money on XRP with out instantly shopping for the cryptocurrency.

Likewise, ProShares, identified for its vary of ETF choices, seems assured in XRP’s potential, partly attributable to Ripple’s function in creating the XRP Ledger. The venture has been very profitable by way of rising adoption.

As famous earlier, crypto analysts SMQKE mentioned that Bitcoin and Ethereum are too sluggish and costly for world funds. Nonetheless, XRP can deal with extra transactions at a decrease value, making it higher for banks and cross-border use.

Though Bitcoin and Ethereum ETFs obtained the inexperienced mild in 2024, XRP faces a extra sophisticated path. Previous authorized battles involving Ripple have positioned the token underneath tighter scrutiny. Nonetheless, April 2025 information confirmed a 7% rise in XRP’s worth following Franklin Templeton’s submitting, suggesting sturdy investor curiosity. In the mean time, worth is up 1.26% to $2.318.

As June 17 and 25 strategy, market members proceed to attend for clear path. The SEC’s determination may set the tone for the way XRP suits into mainstream investing and whether or not it’ll be part of the rising record of crypto belongings obtainable by means of exchange-traded funds.