Crypto mining shares posted sharply divergent outcomes throughout day by day, weekly, and year-to-date intervals, with Bitmine rising because the sector’s standout performer.

Crypto Mining Inventory Performances Diverge Sharply

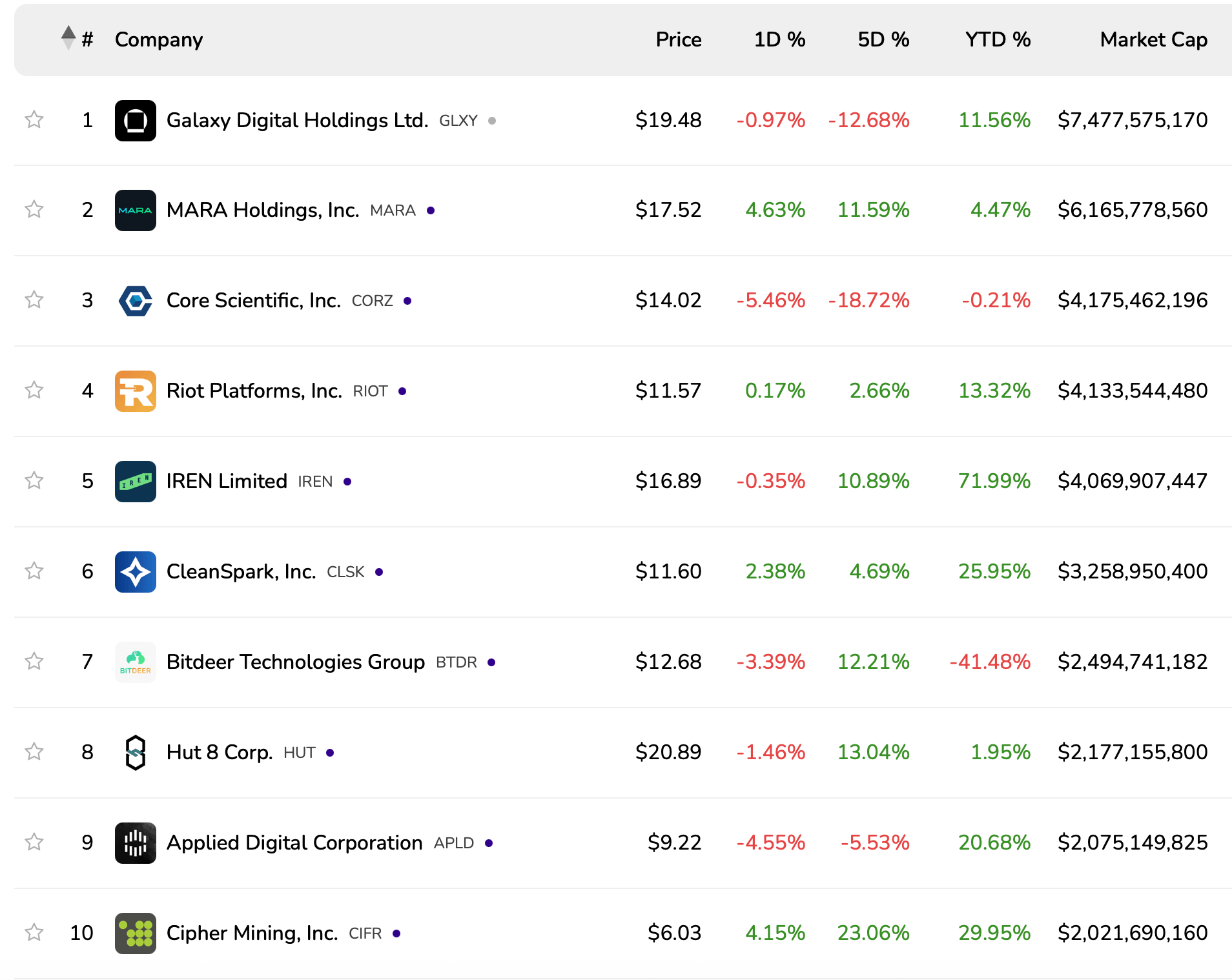

The crypto mining trade is something however boring in 2025. As of stats collected on July 8, 2025, Galaxy Digital Holdings Ltd. holds the biggest by market cap at $7.48 billion, regardless of a 0.97% day by day decline and a 12.68% drop over the previous 5 days. However, MARA Holdings noticed a 4.63% day by day achieve and an 11.59% weekly rise. Whereas Core Scientific, Inc. declined 5.46% day by day and 18.72% weekly.

The highest ten bitcoin miners by market cap, utilizing knowledge collected by bitcoinminingstock.io.

Heavyweights within the sector are feeling the warmth—some greater than others. Riot Platforms gained 0.17% on the day and a couple of.66% weekly. IREN Restricted posted a 71.99% year-to-date (YTD) achieve. Cleanspark, Inc. rose 25.95% YTD, whereas Bitdeer Applied sciences Group fell 41.48% YTD. Cipher Mining, Inc. superior 29.95% YTD, and Bit Digital, Inc. surged 61.90% over the week.

One firm, nevertheless, is mining extra than simply cash—it appears to be placing gold with traders. Bitmine Immersion Applied sciences led all miners with a 1,329.48% YTD improve. The U.S.-based agency, which trades on the NYSE American underneath the image BMNR, attributes its progress to the usage of immersion cooling know-how, inexperienced mining practices, and enlargement into low-cost power areas.

Moreover, its strategic pivot towards ethereum (ETH) and a $250 million capital increase contributed to a current surge in investor curiosity. The corporate operates websites in Texas, Kentucky, and Trinidad & Tobago, and in addition provides mining-as-a-service (MaaS). In contrast, Bitfufu, Bitfarms, and HIVE Digital all posted YTD declines.

Northern Knowledge AG fell 45.13%, and Canaan, Inc. declined 65.10%, the steepest drop among the many high 20. Neptune Digital Belongings Corp. closed the listing with a $129 million market cap and a 43.66% YTD achieve. On the mining entrance, bitcoin miners are having fun with a lift because of a better hashprice—the estimated earnings per petahash per second (PH/s)—which has climbed 11.67% in comparison with 30 days in the past.