Ethereum, the second-biggest cryptocurrency, has lagged behind Bitcoin this yr amid sluggish development of its exchange-traded funds and competitors from different layer-1 and layer-2 blockchains.

Ethereum (ETH) has rallied by lower than 20% in 2024, whereas Bitcoin (BTC) has risen by over 50%.

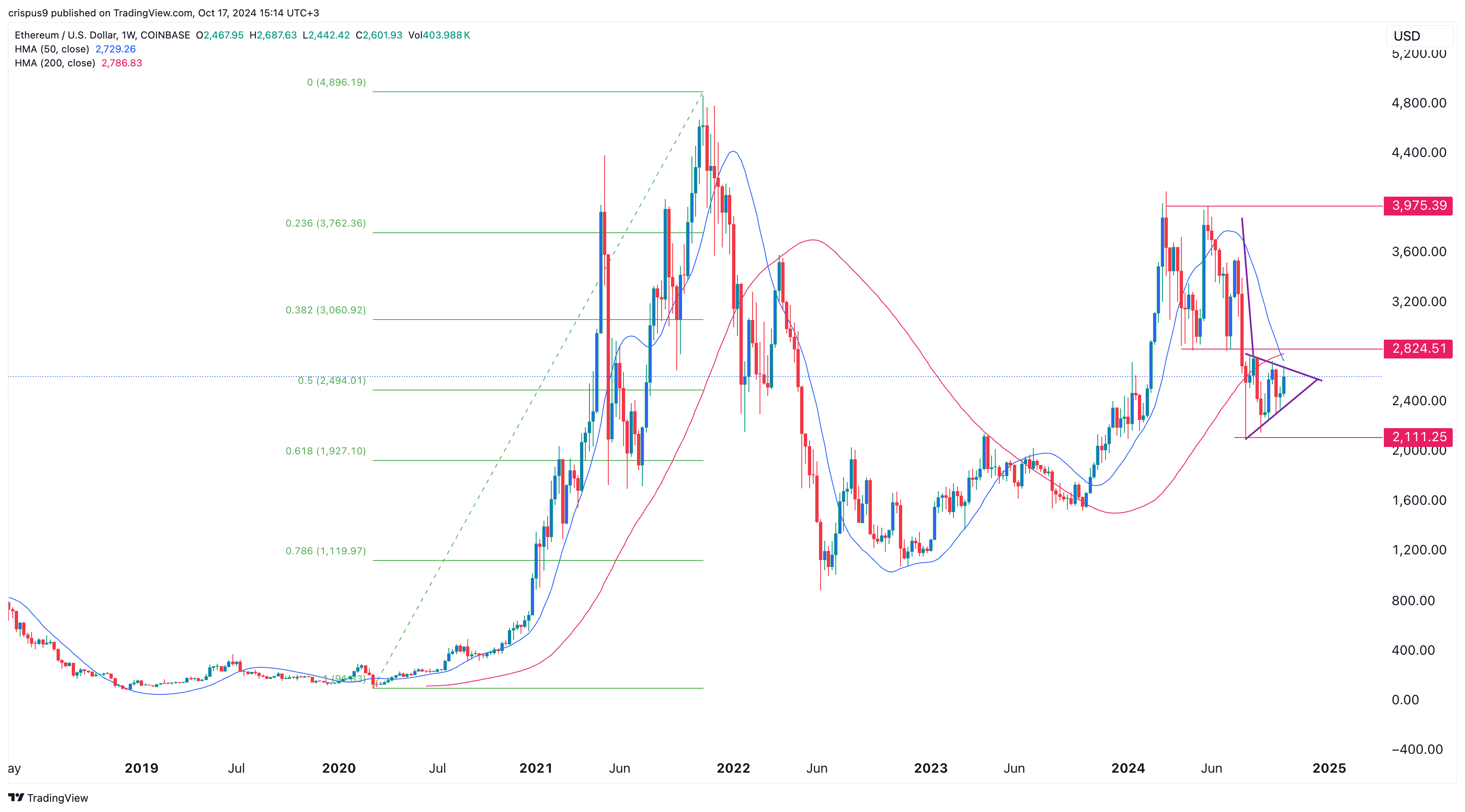

Technicals level to extra Ether weak spot within the coming months. On the weekly chart, the coin fashioned a double-top chart sample round $4,000. It dropped beneath the neckline of this sample at $2,824 in July, confirming the bearish breakout.

Ethereum has additionally fashioned a demise cross sample because the 200-day and 50-day Hull Shifting Averages made a bearish crossover. The HMA reduces lag through the use of weighted transferring averages to clean out value knowledge.

The final time Ethereum fashioned a demise cross on the weekly chart was in March 2022, and the coin dropped by over 70% after that.

Ether has additionally fashioned a bearish pennant chart sample, which is characterised by a protracted vertical line adopted by a symmetrical triangle. Usually, an asset experiences a bearish breakout when the 2 traces of the triangle converge.

Moreover, this consolidation is going on on the 50% Fibonacci Retracement degree. Due to this fact, there are rising probabilities that the coin may have a powerful bearish breakout within the close to time period, with the following goal to look at being $2,111, its lowest level on Aug. 5.

Ethereum value chart | Supply: TradingView

You may also like: Nansen integrates token and pockets monitoring instruments into Solana

Ethereum’s weak fundamentals

Along with weak technicals, Ethereum can be battling vital elementary challenges. First, Ether ETFs haven’t seen robust inflows a couple of months after launch.

Based on SoSoValue, these funds have had cumulative outflows of over $530 million, primarily because of the Grayscale Ethereum Fund. In distinction, Bitcoin ETFs have crossed the $20 billion influx degree, pointing to increased demand from institutional traders.

Ethereum can be seeing intense competitors in areas it used to dominate like DeFi and NFTs. Knowledge by DeFi Llama reveals that Solana has crossed Ethereum when it comes to DEX quantity within the final seven days. It dealt with $10.87 billion in comparison with Ethereum’s $9.69 billion.

If the development continues, Solana might surpass Ethereum this month. Solana has dealt with $23.9 billion to date, in comparison with Ethereum’s $24 billion.

This efficiency is essentially pushed by the recognition of Solana (SOL) meme cash like Dogwifhat, Bonk, and Popcat have grow to be in style amongst merchants. All Solana meme cash have gained over $10 billion in market cap.

Moreover, some high-profile Ethereum whales, together with Vitalik Buterin and the Ethereum Basis, have offered 1000’s of cash just lately.

A pockets associated to #DiscusFish(@bitfish1) deposited 2,044 $ETH($5.45M) and 155,720 $LINK($1.85M) to #Binance 2 hours in the past.

The pockets has deposited a complete of 12,347 $ETH($30.4M) to #Binance since Oct 2.https://t.co/niluIilTRi pic.twitter.com/ojHhveOtqq

— Lookonchain (@lookonchain) October 15, 2024

Due to this fact, a mixture of weak fundamentals and technicals may push Ether decrease within the coming weeks.

You may also like: Bitcoin kinds a golden cross, analysts predict parabolic strikes forward