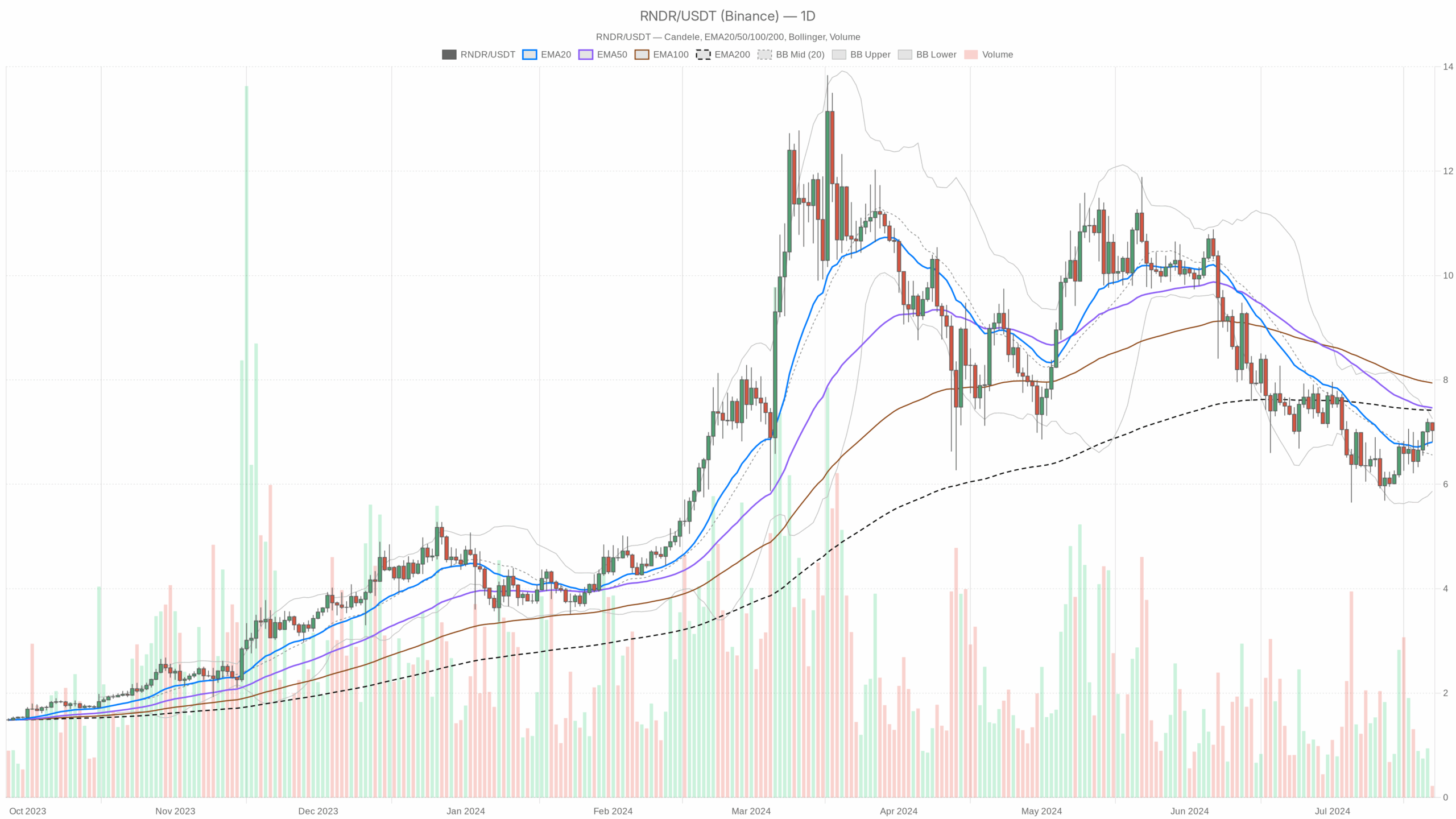

Market motion on Render crypto (RNDRUSDT) is coiling across the $7 zone, with value testing a key determination space that may outline whether or not that is only a pause or the top of the correction.

Day by day Chart (D1): Macro Bias – Slight Bullish Lean Inside a Impartial Regime

Pattern and EMAs

– Value: $7.03

– EMA20: $6.81

– EMA50: $7.46

– EMA200: $7.42

Value is now again above the 20-day EMA, however nonetheless beneath each the 50-day and 200-day. That places RNDR in a short-term rebound inside a medium-term corrective construction. The 50 and 200 EMAs are clustered above value, successfully making a provide zone between roughly $7.40–7.50. Till RNDR can break and maintain above that band, the larger development continues to be in restore, not absolutely bullish.

Interpretation: The each day development is trying to show up from a impartial or corrective state. Bulls have regained some management within the quick time period (above the 20-day), however the true check sits larger, close to the 50 and 200 EMAs. That’s the line between a bounce and a development resumption.

RSI (14) – Mid-Vary, No Extremes

– RSI14: 51.23

Day by day RSI is parked virtually precisely in the midst of the vary. There isn’t any overbought or oversold situation, and no apparent divergence from value within the numbers you could have offered.

Interpretation: Momentum is balanced. The market just isn’t stretched both method, which leaves room for a sizeable transfer in each instructions. Path shall be dictated extra by construction (breakouts or breakdowns) than by mean-reversion indicators from RSI proper now.

MACD – Bearish Section Shedding Steam

– MACD line: -0.17

– Sign line: -0.33

– Histogram: +0.16

The MACD continues to be beneath zero however the line has crossed above the sign, turning the histogram optimistic.

Interpretation: The prior bearish momentum wave is fading, and consumers are beginning to push again. It’s an early bullish momentum shift, however as a result of MACD continues to be unfavorable total, this seems to be extra like a counter-trend rally inside a broader corrective cycle than a confirmed new uptrend.

Bollinger Bands – Buying and selling within the Higher Half

– Mid-band (20-day foundation): $6.56

– Higher band: $7.26

– Decrease band: $5.87

– Value: $7.03

RNDR is buying and selling above the mid-band and beneath the higher band, within the higher half of the each day volatility envelope.

Interpretation: Value is leaning to the bullish aspect of its latest vary however has not triggered a volatility breakout. This matches the concept of a managed grind larger quite than an explosive transfer. Nonetheless, if value begins hugging or closing above the higher band with increasing vary, that’s when a development leg can develop.

ATR (14) – Room for $0.50+ Day by day Swings

– ATR14: $0.53

Day by day ATR above half a greenback is substantial relative to a $7 asset. You’re looking at a typical each day swing of round 7–8%.

Interpretation: Volatility is elevated sufficient that ordinary noise can simply hit close by ranges each above and beneath spot. Furthermore, place sizing and cease placement must respect that; tight stops inside a $0.50 band usually tend to be chopped out.

Day by day Pivot Ranges – Market Sitting Proper on the Steadiness Level

– Pivot level (PP): $7.01

– First resistance (R1): $7.21

– First help (S1): $6.83

Spot is nearly precisely on the each day pivot, with R1 simply above the higher Bollinger band mid-zone and S1 near the 20-day EMA.

Interpretation: The market is actually balanced at its reference stage. A push by $7.21 would sign intraday power aligning with the short-term bullish tone. A transfer again beneath $6.83 would present consumers dropping grip and re-opening a path again towards the mid-band and decrease help.

Day by day bias: Impartial regime with a slight bullish tilt, so long as value holds above the 20-day EMA and each day pivot. The larger development just isn’t absolutely repaired whereas RNDR trades beneath $7.40–7.50.

1-Hour Chart (H1): Quick-Time period Bulls in Management, However Momentum Is Pausing

Pattern and EMAs

– Value: $7.03

– EMA20: $7.00

– EMA50: $6.91

– EMA200: $6.65

– Regime (system): bullish

On the hourly, value is stacked cleanly above all three EMAs, and the quick averages (20 and 50) are above the 200.

Interpretation: Intraday construction is clearly bullish. Dips towards the 20-hour EMA round $7 and particularly the 50-hour close to $6.90 are being defended. This timeframe is supporting the each day try to show larger, not preventing it.

RSI (14) – Mildly Constructive

– RSI14: 52.48

Hourly RSI sits simply above impartial, barely favoring the purchase aspect however not overstretched within the slightest.

Interpretation: Quick-term momentum is modestly with the bulls. There may be room for continuation larger earlier than any overbought issues seem on this timeframe.

MACD – Flattening Out

– MACD line: 0.04

– Sign line: 0.05

– Histogram: -0.01

MACD on H1 is simply above zero, with the road primarily sitting on the sign.

Interpretation: The prior intraday impulse larger has cooled off. Momentum is pausing quite than reversing. This usually precedes both a consolidation earlier than one other leg up, or a gradual fade if consumers fail to step again in round help.

Bollinger Bands – Contained Throughout the Vary

– Mid-band: $6.97

– Higher band: $7.22

– Decrease band: $6.73

– Value: $7.03

Value is simply above the mid-band, nowhere close to the extremes.

Interpretation: Quick-term volatility is contained, and RNDR is buying and selling quietly inside its intraday vary. There isn’t any squeeze and no breakout, only a regular drift larger above development help.

ATR (14) – Intraday Swings Round $0.20

– ATR14: $0.19

Hourly ATR close to $0.19 means common hourly bars can swing roughly 2.5–3% at present costs.

Interpretation: For merchants on this timeframe, regular intraday noise can check each the pivot and close by EMAs inside a few hours. Due to this fact, entries too tight round $7 can get whipsawed simply.

Hourly Pivot Ranges

– Pivot level (PP): $6.99

– First resistance (R1): $7.14

– First help (S1): $6.88

Spot is buying and selling barely above the hourly pivot, with R1 in step with the higher Bollinger band space and S1 just below the 50-hour EMA.

Interpretation: So long as RNDR holds above $6.99 and particularly above $6.88, intraday bulls preserve the higher hand. A clear break over $7.14 would point out a recent push towards each day resistance zones.

15-Minute Chart (M15): Execution Context – Micro-Tight Vary

Pattern and EMAs

– Value: $7.03

– EMA20: $7.02

– EMA50: $7.02

– EMA200: $6.90

– Regime (system): bullish

The 15-minute EMAs are flat and overlapping round $7.02, with value pinned proper on them.

Interpretation: Very quick time period, RNDR is in a decent consolidation with a slight bullish bias (above the 200 EMA). This can be a basic compression zone that normally resolves with a directional push. Proper now, there isn’t a clear micro-timeframe benefit to both aspect.

RSI (14) – Lifeless Heart

– RSI14: 50.29

Interpretation: RSI is totally impartial on the 15-minute chart. There isn’t any edge from momentum right here; construction and ranges matter greater than indicators on this micro window.

MACD – Flatline

– MACD line: -0.02

– Sign line: -0.02

– Histogram: 0.00

Interpretation: Momentum is basically zero on this timeframe. RNDR is coiling, ready for a recent impulse.

Bollinger Bands and Pivots – Micro-Ranges

– Mid-band: $7.05

– Higher band: $7.28

– Decrease band: $6.83

– Pivot level (PP): $7.05

– R1: $7.08

– S1: $7.00

Value is slightly below the mid-band and the 15-minute pivot, with extraordinarily tight R1 and S1 ranges.

Interpretation: Quick-term scalpers are buying and selling a slim $7.00–7.08 vary. A break of both aspect is prone to feed into the 1-hour construction fairly rapidly. By itself, nevertheless, the 15-minute chart is simply noise round the important thing $7 space.

Cross-Timeframe Learn: The place Do the Alerts Agree, The place Do They Conflict?

– Day by day: Impartial regime with a slight bullish tilt; value above EMA20 however beneath EMA50 and EMA200.

– 1-hour: Clearly bullish; value above all key EMAs, wholesome construction.

– 15-minute: Micro-consolidation simply above help, no momentum edge.

The strain is easy: short-term timeframes are bullish, the upper timeframe continues to be undecided. Intraday merchants are urgent the lengthy aspect, however higher-timeframe gamers haven’t but validated a full development resumption above the $7.40–7.50 ceiling.

Overlay this on macro situations: whole crypto market cap is barely up, volumes are down sharply over 24 hours, BTC dominance is excessive, and the concern and greed index sits in Excessive Concern. That may be a backdrop the place altcoin breakouts usually fail on first makes an attempt. So whereas the microstructure of RNDR seems to be constructive, the broader atmosphere nonetheless encourages quick profit-taking quite than prolonged trend-chasing.

Important Situation for Render crypto (RNDRUSDT)

Based mostly on the each day chart, the main situation is impartial with a constructive, barely bullish bias. RNDR is making an attempt to base and push larger, but it surely has not but cleared the overhead provide that will mark a clear bullish development continuation.

Bullish Situation

Within the bullish path, the present consolidation above $7 acts as a launchpad.

Key steps:

1. Maintain above each day EMA20 and S1

So long as value holds above roughly $6.80–6.83 (each day S1 and close to EMA20), the short-term bullish construction stays intact. Any dip into that space that finds consumers would reinforce the view that RNDR is accumulating, not distributing.

2. Break and maintain above $7.21 then $7.40–7.50

– First set off: a decisive transfer and shut above $7.21 (each day R1 and native resistance) with rising hourly momentum.

– Affirmation: follow-through that pushes value by the $7.40–7.50 band the place the 50-day and 200-day EMAs sit.

On this bullish script, each day RSI grinds larger towards the 60s, MACD continues to rise and ultimately crosses again above zero, and value begins to lean on or above the higher Bollinger band as a substitute of oscillating within the center.

What invalidates the bullish case?

A clear break beneath $6.80 with each day closes beneath the 20-day EMA would undermine the concept of an early upturn and level to a deeper correction. If each day MACD rolls again down and widens negatively once more, that will affirm bulls have misplaced the momentum battle.

Bearish Situation

Within the bearish path, this bounce above the 20-day EMA is only a reduction rally inside a bigger distribution part.

Key steps:

1. Failure at $7.21–7.40

RNDR stalls between the each day R1 round $7.21 and the EMA cluster at $7.40–7.50. A number of failed intraday pushes into that zone, mixed with weakening hourly MACD and RSI, would trace that sellers are utilizing power to exit.

2. Break again beneath $6.83 and the 20-day EMA

A sustained transfer beneath $6.83 and the 20-day EMA flips the short-term construction again in favor of the bears. From there, the mid Bollinger band round $6.56 turns into the primary draw back magnet, with danger of a deeper transfer towards the decrease band close to $5.87 if macro sentiment deteriorates.

On this situation, each day RSI drifts again towards the 40s, MACD fails to reclaim zero and hooks decrease, and value shifts from buying and selling within the higher half of the bands to hugging the mid or decrease band.

What invalidates the bearish case?

A powerful breakout above $7.50 with increasing quantity, each day closes above the 50 and 200 EMAs, and MACD pushing towards or above zero would make the “only a bounce” narrative out of date. Bears lose the argument as soon as RNDR reveals it may well reside comfortably above that confluence of resistance.

Positioning, Threat, and Uncertainty

RNDR is in a basic determination zone: short-term charts lean bullish, the each day chart is making an attempt to show the nook, however the broader crypto market continues to be risk-averse. That blend normally favors vary buying and selling with quick response quite than sturdy directional conviction.

For directional publicity, the important thing questions are:

- Are you betting on a structural breakout above the each day EMA cluster ($7.40–7.50), or simply enjoying the vary between each day S1 and R1?

- Does your danger administration account for a each day ATR of about $0.53 and intraday ATR round $0.19?

These swings are massive sufficient that poorly positioned stops will be hit even when your broader directional thought is right. Furthermore, uncertainty stays excessive: macro information stream on regulation, ongoing political noise round crypto, and a fearful sentiment backdrop can all change the tape rapidly. RNDR’s setup is constructive, however it’s working in a market that’s nonetheless extra defensive than enthusiastic. In that sort of atmosphere, ranges and affirmation matter greater than narratives.

If you wish to monitor markets with skilled charting instruments and real-time information, you may open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We could earn a fee at no extra price to you.

Disclaimer: This evaluation is for informational and academic functions solely and isn’t a suggestion to purchase or promote any asset. At all times carry out your individual analysis and think about your danger tolerance earlier than making buying and selling selections.

In abstract, RNDR is compressing simply above key help, with intraday bulls energetic however larger timeframes nonetheless mending. The following decisive enlargement, up or down, will doubtless be pushed by how value behaves across the $7.21 and $7.40–7.50 zones in opposition to a nonetheless cautious crypto backdrop.