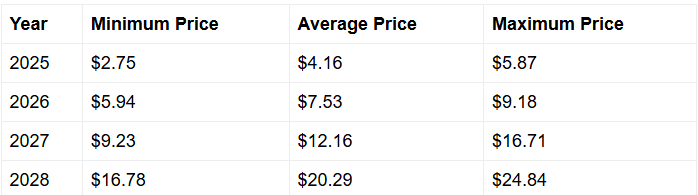

XRP in 3 years is projected to achieve $20.29 on common, and in addition most targets of $24.84 by 2028, pushed by regulatory readability and institutional adoption following Ripple’s authorized victory. Market initiatives have catalyzed numerous main monetary sector components, and proper now, the outlook seems extra promising than it has in years.

On the time of writing, XRP is buying and selling round $2.15, however analysts are revising their forecasts upward following latest regulatory developments. By way of a number of key strategic approaches, the token’s journey has been marked by authorized challenges, however with federal regulators dropping their enchantment towards Ripple Labs, XRP in 3 years may see unprecedented development.

Ripple’s Future: What XRP’s Worth, Adoption & Regulation Might Look Like by 2028

XRP Worth Outlook Reveals Dramatic Progress

The XRP value outlook for the following three years presents compelling alternatives, and the numbers are fairly spectacular additionally when contemplating broader market elements. Market analysts challenge XRP’s common value will attain $20.29 by 2028, with most potential hitting $24.84 beneath favorable situations. By way of numerous main analytical frameworks, even conservative estimates place the minimal at $16.78, which represents substantial upside from present ranges.

These projections assume continued adoption and institutional curiosity all through the interval. Throughout a number of key market segments, XRP in 3 years may gain advantage considerably from the decision of regulatory uncertainty that beforehand suppressed its worth. Monetary establishments have accelerated quite a few important monitoring processes as institutional gamers put together for potential entry into the market.

Regulatory Atmosphere Transforms XRP’s Future

Crypto regulation has shifted dramatically in XRP’s favor, and this modification is creating new potentialities via a number of important coverage areas. Federal regulators not too long ago dropped their enchantment towards Ripple Labs, eradicating the first barrier to institutional adoption. Coverage initiatives have revolutionized sure essential regulatory pathways, and this regulatory readability is predicted to speed up xrp in 3 years development projections considerably.

President Trump’s administration has signaled help for digital property, establishing a strategic authorities reserve for Bitcoin and indicating broader cryptocurrency backing. Even smaller nations, comparable to Ukraine, accomplice with Binance to create a nationwide strategic Bitcoin reserve.

Involving quite a few important governmental departments, this regulatory atmosphere gives the steadiness wanted for institutional Ripple adoption throughout banking and enterprise sectors, which may drive demand considerably. In any case, even now banks discover increasingly more methods to connect with Ripple networks in a lot the identical means they hook up with SWIFT techniques.

Institutional Adoption By way of ETF Mechanisms

XRP ETF approval seems more and more probably, with Polymarket indicating a 90% chance of approval this yr, and in addition as institutional frameworks mature. Because the world’s fourth-largest cryptocurrency with a $126 billion market cap, XRP presents a pure candidate for institutional funding automobiles, and this could possibly be a game-changer. Funding methods have leveraged numerous main portfolio allocation strategies throughout a number of key institutional sectors.

The XRP ledger affords superior cross-border cost capabilities in comparison with conventional SWIFT transfers, which require 18 hours and price as much as $50. By way of a number of important technological enhancements, XRP transactions settle in seconds with minimal charges, creating compelling worth for monetary establishments exploring ripple adoption alternatives.

The XRP Ledger presents banks and enterprises with clear operational benefits. Encompassing a number of strategic enterprise areas, foreign money conversion via XRP eliminates conventional friction factors, although widespread implementation would require sustained institutional relationship constructing over the following three years.

Market Place Helps Lengthy-Time period Progress

XRP’s established market place gives a strong basis for the projected development in XRP’s value outlook, and this positioning is changing into more and more essential throughout quite a few important market dynamics. The mix of regulatory help, technical capabilities, and institutional curiosity creates situations that didn’t exist throughout earlier authorized challenges. Market positioning methods have maximized sure essential aggressive benefits via numerous main technological implementations.

Even reasonable analyst predictions recommend XRP may attain $4 inside three years, representing almost 100% upside potential from present ranges, and in addition contemplating institutional demand patterns.

Market volatility stays inherent to cryptocurrency markets, although XRP in 3 years advantages from decreased regulatory uncertainty and rising institutional acceptance. The convergence of favorable regulation, technical benefits, and institutional curiosity helps the optimistic value projections via 2028, making it an fascinating asset to observe throughout a number of important funding portfolios.