XRP secured a significant regulatory breakthrough because the SEC permitted custody companies for digital belongings, and Ripple’s accomplice Thunes related its fee system to the SWIFT community, opening entry to round 11,000 banks globally. Superb information, proper? It’s not that easy.

XRP Good points Momentum With Ripple, SEC Approval, and SWIFT Integration

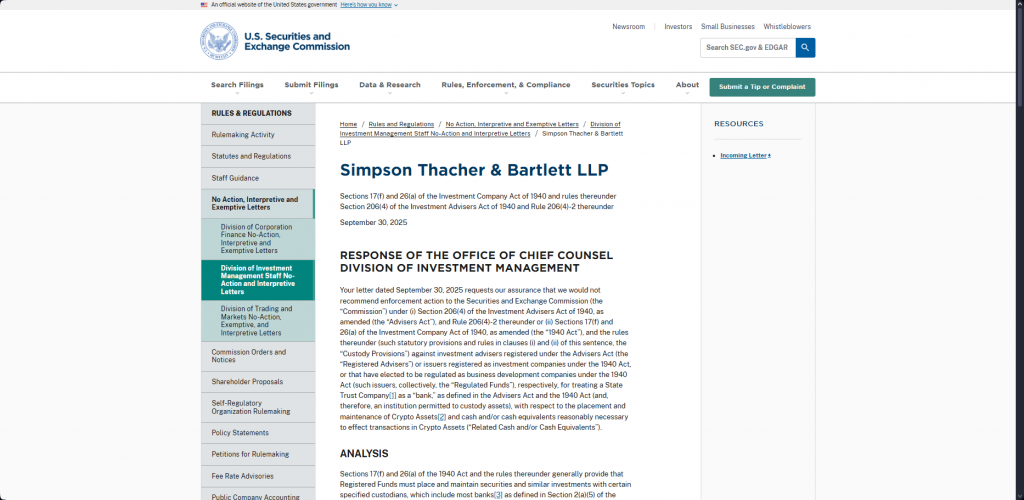

SEC Clears Path for XRP Custody Providers

On September 30, 2025, the Securities and Trade Fee launched a no-action letter allowing registered funding advisers (in addition to broker-dealers holding XRP in custody). I discover that intriguing. Massive corporations like Coinbase, BitGo, and different custodians have obtained SEC authorization to retailer purchasers in digital belongings, eliminating a significant institutional obstacle to the adoption of XRP.

In my opinion, this regulatory readability was issued by way of the Division of Funding Administration Workers, and it particularly addressed how cryptocurrency must be handled below current custody guidelines.

Ripple Companion Connects XRP to SWIFT Community

Thunes is a Ripple accomplice, which additionally included its Pay-to-Banks service inside SWIFT. This gives an entry level of XRP liquidity to different SWIFT-linked institutions globally. WKahneman had this to say:

“Cash runs on connectivity. #Ripple accomplice Thunes plugged its Pay-to-Banks service into SWIFT. This implies Ripple liquidity that’s routed by way of Thunes can attain any SWIFT related financial institution. Stated to cowl 11,000 banks.”

This SWIFT integration reveals a significant step for Ripple’s coin adoption, as Ripple also can now faucet into conventional banking infrastructure that handles trillions in day by day transactions.

Market Outlook and Worth Targets

As regulation is now clear and integrating with SWIFT is adopting, evaluation has additionally elevated Ripple’s coin worth forecasts to $5. Your complete scenario of SEC certification of custody companies, plus enabling higher entry by way of Ripple partnerships, has made it fascinating to institutional put money into XRP at this stage.

The compliance points associated to custody approval have resulted in establishments not holding Ripple’s coin, and in addition the combination with SWIFT will handle the scalability points by integrating XRP into mainstream banking programs.