Whereas lots of his X posts and different enterprise actions have been controversial, the success of Robert Kiyosaki’s funding portfolio in 2024 is not possible to dispute because it appreciated 62.38% throughout the 12 months..

In 2025, nevertheless, a number of the ‘Wealthy Dad Poor Dad’ writer’s prime picks have been buying and selling both decrease or principally sideways, and Finbold determined to look at if the Kiyosaki cryptocurrency and commodity-focused technique continued working via the just-ended first quarter (Q1).

Right here’s how a lot investing in BTC, gold, and silver in Q1 would return

Whereas his holdings lengthen past the massive three – Bitcoin (BTC), gold, and silver – for many of his followers, these are the belongings that first come to thoughts when Kiyosaki’s title is talked about.

Apparently, BTC was the worst performer of the three in 2025, having dropped 10.23% year-to-date (YTD) to its press time worth of $83,947.

Gold, alternatively, has been recording a brand new excessive after a brand new excessive. The yellow metallic soared 19.27% since 2025 began and is altering palms at $3,129. Although it’s nonetheless removed from Kiyosaki’s personal formidable goal of $70, silver has additionally carried out effectively and rallied 17.16% to its April 1 worth of $33.85.

In whole, because of this an equally divided $1,000 funding within the writer’s prime three belongings would have appreciated to $1,087.32: Bitcoin to $299.23, gold to $397.56, and silver to $390.53.

The higher Robert Kiyosaki portfolio efficiency in Q1, 2025

Apparently, a extra detailed examination of the ‘Wealthy Dad’ portfolio can also be attainable – and would have totally different outcomes – as he’s recognized for buying and selling Ethereum (ETH), Solana (SOL), cattle, and actual property.

Sadly, due to enterprise operations, lease funds, illiquidity of sure markets, and the huge variations between areas, it’s not possible to precisely assess the final two belongings, although the WisdomTree Dwell Cattle ETF (CATL) can be utilized as a shorthand for cattle.

To start with, Ethereum has turn out to be recognized for its comparatively abysmal efficiency. ETH worth collapsed 44.22% in 2025 and the cryptocurrency is altering palms at $1,861 on April 1.

Solana hasn’t fared a lot better both, as SOL plunged 32.77% because the begin of 2025 and is, at press time, altering palms at $127.37.

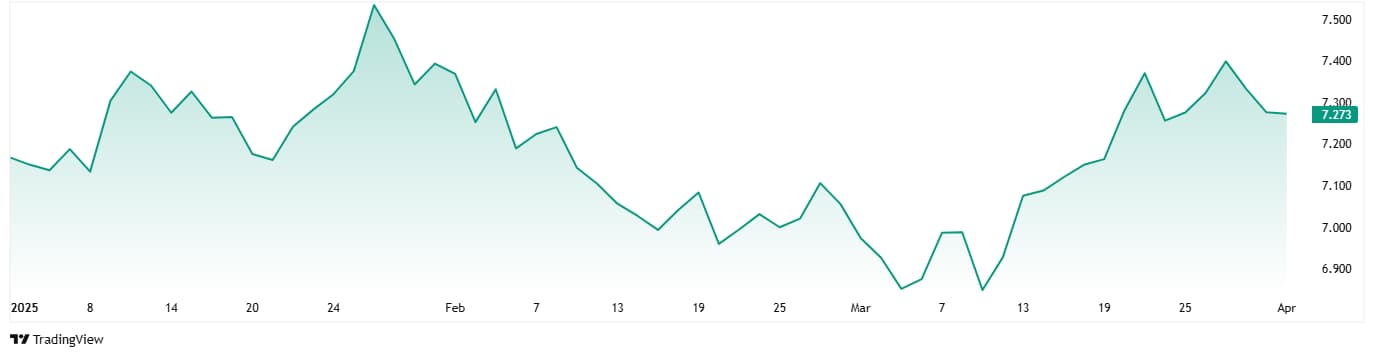

Lastly, the CATL exchange-traded fund (ETF) has been buying and selling principally sideways because it rallied 1.45% in Q1 and rose from €7.169 (~$7.73) to €7.273 (~$7.84).

Monitoring the higher Kiyosaki portfolio in Q1 would have been a shedding guess

Below the circumstances, it’s evident that investing $1,000 within the higher Kiyosaki portfolio firstly of 2025 wouldn’t have yielded good outcomes by the tip of Q1. The portfolio’s worth at press time, if the allocation was equal, would quantity to $917.79.

Trying on the particular person belongings, the Bitcoin portion would have depreciated to $149.62, Ethereum to $92.97, and Solana to $112.05. The $166.67 put into gold would have risen to $198.79, silver to $195.27, and CATL would have remained principally stage at $169.09.

Featured picture through Ben Shapiro’s YouTube