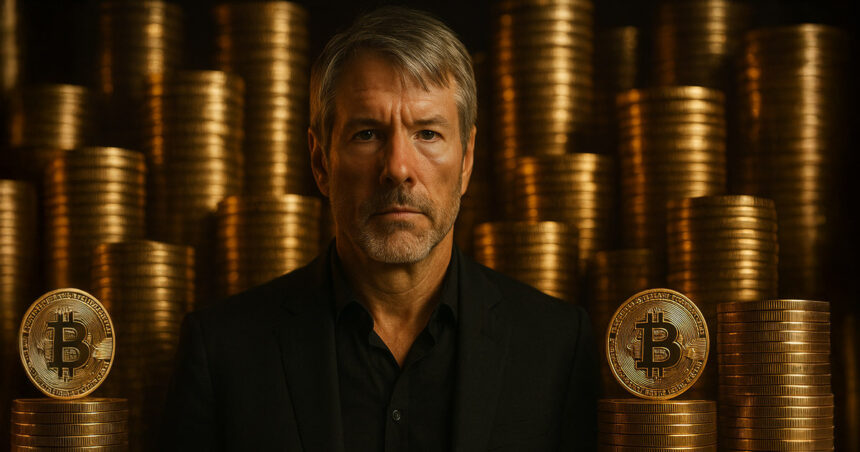

On the BTC Prague convention this week, Technique (previously MicroStrategy) co-founder Michael Saylor said that Bitcoin treasury firms can develop as shortly as they’ll difficulty fairness and credit score to buy Bitcoin.

Delving into the enterprise mannequin of Bitcoin treasury firms like Technique, Saylor defined how company funding in BTC can far outpace particular person investments.

Enterprise mannequin of Bitcoin treasury firms

A number of main firms have introduced plans or are mulling the launch of a Bitcoin treasury. For example, earlier this week, Brian Armstrong, CEO of Coinbase, the most important U.S. crypto trade, hinted at launching a BTC treasury. The $2.3 billion Trump Media, which is majority owned by President Donald Trump, raised to purchase BTC was successfully authorized by the U.S. Securities and Trade Fee (SEC) earlier this month.

Saylor defined that BTC treasury firms, which have been rising in reputation over the previous few months, have a quite simple but ‘elegant’ enterprise mannequin.

Saylor explains this with an instance. Let’s say a dentist buys about $200,000 value of BTC yearly. In 20 years, the dentist would have purchased about $2 million value of BTC.

Nonetheless, a public company should purchase BTC at a a lot sooner price. An organization can difficulty credit score within the type of something from convertible bonds, junk bonds, to most popular shares, and purchase $2 million value of BTC in a month.

In response to Saylor, firms shopping for BTC can develop into instantly worthwhile, permitting them to difficulty securities and purchase massive quantities of BTC each month. He mentioned:

“…the simplicity within the enterprise mannequin is I’m simply going to difficulty billions and billions and billions of {dollars} of securities and purchase billions and billions and billions of {dollars} of Bitcoin.”

This mannequin, Saylor believes, will remodel the fairness and capital markets from being cash-based to Bitcoin-based.

“…that’s I feel, what we see proper now available in the market, that we’re going right into a BTC-denominated world.”

BTC Treasury firms can develop as quick as they’ll difficulty fairness

Saylor famous that the “price at which an organization can difficulty fairness or credit score,” and use it to purchase BTC, is “exponential.” A Bitcoin treasury firm’s progress price is, due to this fact, considerably sooner than conventional enterprise cycles. Saylor mentioned:

“You may develop actually as quick as you may difficulty the safety and purchase the Bitcoin. And that’s an funding cycle which is 1,000 instances sooner than a bodily actual property cycle or a enterprise cycle. So it’s sooner, it’s homogeneous.”

In response to Saylor, credit score or fairness is valued based mostly on anticipated future money flows—traders purchase safety and lend cash to the corporate based mostly on how a lot the agency can earn sooner or later. In the long run, the worth of the money can even decline. This implies that there’s a lengthy “heterogeneous fairness threat,” Saylor mentioned.

However Bitcoin treasury firms are valued based mostly on their capability to purchase Bitcoin quite than by way of operations, which requires particular metrics to worth Bitcoin-backed fairness.