The Technique class motion lawsuit has hit MicroStrategy (now working as Technique) once more, after the corporate confronted a large $5.9 billion Bitcoin loss that traders declare was the results of MicroStrategy inventory fraud. I feel this can be a very fascinating setup. This newest and best authorized battle facilities on Michael Saylor’s Bitcoin losses and the way Technique has allegedly misled shareholders about crypto danger. This has additionally sparked an MSTR investor lawsuit over crypto inventory manipulation ways. When it rains, it pours, proper?

Technique Class Motion Lawsuit Alleges Crypto Inventory Manipulation

The case is a Technique class motion litigation that takes place in the US by a criticism within the Jap District of Virginia at Docket 25-cv-00861. This criticism is aimed on the firm now referred to as MicroStrategy and its executives. Not shocking contemplating the variety of lawsuits the corporate has confronted these days. This MSTR investor motion says all of it, and it’s an motion on behalf of its traders, who bought securities throughout the interval of April 30, 2024, to April 4, 2025. It claims violations of federal securities legal guidelines, in addition to some damages.

Michael Saylor Bitcoin Losses Set off Authorized Motion

The crux of the Michael Saylor Bitcoin losses is that Technique has additionally adopted some new accounting guidelines that grew to become efficient January 1, 2025. ASU 2023-08 is its identify, and it mandates the honest worth reporting of crypto belongings, together with unrealized positive factors and even losses in quarterly earnings, is at present posing critical monetary reporting points to the corporate.

Technique additionally mentioned that: “We could not be capable of regain profitability in future durations, significantly if we incur vital unrealized losses associated to our digital belongings.”

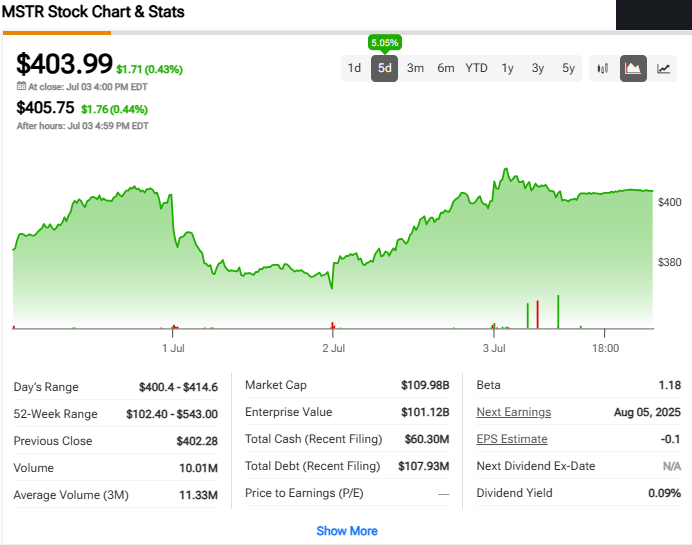

The affect was extreme when Technique revealed a $5.91 billion unrealized loss on April 7, 2025, inflicting the inventory to fall $25.47 per share, or 8.67%, to $268.14. On the time of writing, this represented one of many largest crypto-related company losses reported.

MicroStrategy Inventory Fraud Allegations Detailed

The MicroStrategy inventory fraud allegations heart on the corporate’s failure to adequately disclose dangers related to the brand new accounting requirements. The lawsuit claims Technique made false statements by overstating profitability whereas additionally understating Bitcoin volatility dangers and potential losses beneath honest worth accounting.

The criticism alleges Technique engaged in crypto inventory manipulation by persistently offering optimistic assessments by metrics like “BTC Yield” and in addition “BTC Acquire” whereas omitting potential large losses beneath the brand new accounting methodology. This Technique class motion lawsuit additionally highlights how firms can mislead traders by specializing in optimistic metrics whereas downplaying dangers.

Traders have till the date of July 15, 2025, to affix the Technique class motion lawsuit as lead plaintiff. This investor lawsuit towards a MSTR could set up helpful precedent of how crypto-related firms want to tell traders about dangers of holding crypto belongings on condition that accounting and even regulatory rulings are at present shifting towards crypto-asset holdings.