ETH is exhibiting indicators of selecting a course after breaking above the $3,000 barrier. Open curiosity is rising, as demand for futures buying and selling has accelerated quicker than spot exercise.

ETH is beginning to recuperate its futures exercise, signaling that merchants see a clearer course out there. ETH traded at $3,006.67, establishing a barely greater help degree. Open curiosity additionally recovered from its current lows, shifting nearer to $17B.

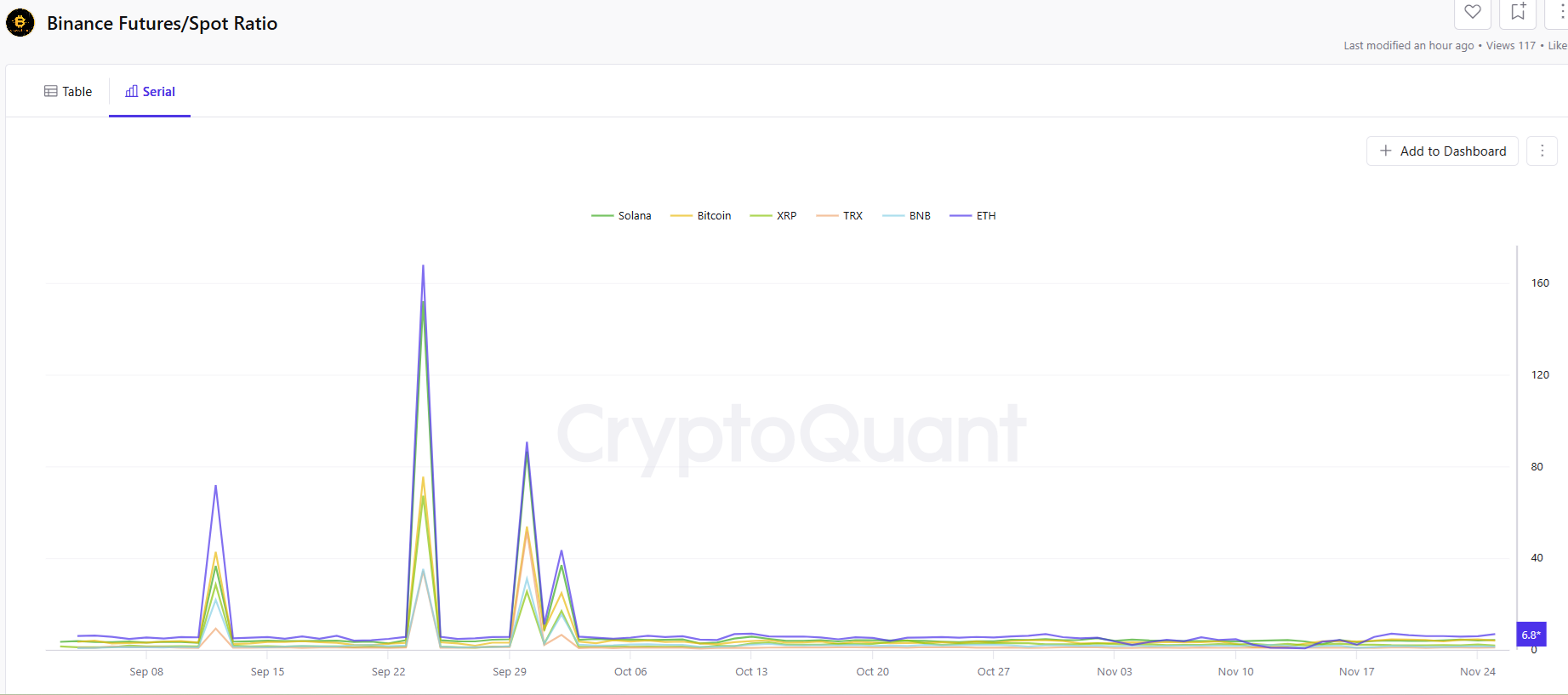

The ETH futures to identify ratio is rising quicker in comparison with BTC and SOL. For now, the entire main belongings are exhibiting extra subdued futures buying and selling, however ETH merchants are shifting to speculative positions. | Supply: Cryptoquant

For now, the restoration in open curiosity and by-product exercise remains to be tentative. ETH has not rebuilt its open curiosity for the reason that October 10-11 deleveraging occasion. Nonetheless, ETH is anticipated to proceed with a usually bullish course.

ETH merchants sign a shift in sentiment

The current ratio of futures to identify exercise reveals a rotation of liquidity. For the previous few days, ETH futures to identify ratio has elevated, signaling a return to speculative curiosity.

Taking over directional positions moved forward of shopping for the dip and accumulating ETH. The estimated leverage ratio for ETH remains to be decrease in comparison with early October’s ranges, however reveals a gradual restoration.

ETH merchants additionally recovered their urge for food for danger quicker, whereas different belongings nonetheless commerce in a sluggish derivatives market. Each BTC and SOL keep their futures-to-spot ratios at a decrease zone, however ETH is surging forward with a better ratio, as merchants select directional publicity.

A extra assured development of taking leveraged positions additionally boosted the Ethereum Worry and Greed Index. The index rose from an area low of 21 on November 21 as much as 55 factors lower than per week later.

There may be nonetheless no solution to inform if ETH will retain the directional positions. Within the quick time period, rising open curiosity could attempt to seize the restoration from native lows. At this level, it stays unsure if ETH will rebuild a robust help degree of lengthy positions. ETH lengthy positions go as little as $2,900, with quick positions as much as $3,100. The elevated leverage may additionally sign the potential for a short-term liquidation of the lengthy positions, following a comparatively small value dip.

The swap to derivative-driven buying and selling dynamics additionally suggests confidence that ETH isn’t due for brand spanking new wild value swings or panic-selling from whales. This permits merchants to use even short-term volatility for greater positive factors by leveraged positions. Derivatives improve their danger within the case of market panic, when even skilled merchants could face sudden losses, liquidations, or erratic value strikes.

ETH hype will increase as Fusaka improve strikes nearer

ETH has already partially discounted the Fusaka improve information, because the onerous fork was anticipated for a very long time. Regardless of this, Ethereum mindshare has been rising since November 21, coinciding with the value restoration.

ETH already received a lift from the Pectra improve, inflicting a bullish rally. The Fusaka occasion may additionally lead extra merchants to take a directional place.

Ethereum is already partially upgraded, boosting its block fuel restrict. Fundamental transactions now price beneath $0.01, with a file low in fuel charges. On the identical time, Ethereum exercise is close to an all-time peak, principally pushed by ETH transfers, stablecoin exercise, and decentralized swaps.