SharpLink is making daring strikes to ramp up its Ethereum treasury. Based on knowledge from Lookonchain, SharpLink transferred $145 million USDC to Galaxy Digital’s OTC pockets, which signifies that one other large Ethereum purchase is probably going on the way in which.

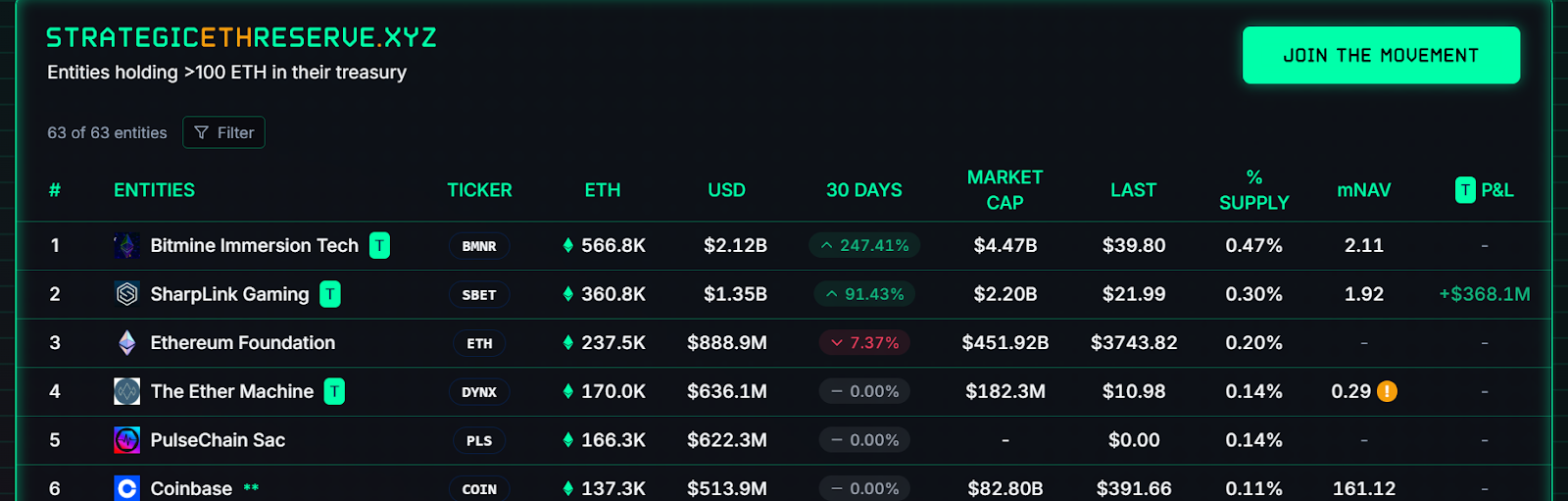

BitMine Immersion not too long ago introduced a large Ethereum buy, 566,776 ETH price over $2 billion. It has now overtaken SharpLink’s ETH stash, claiming the highest spot amongst company ETH holders.

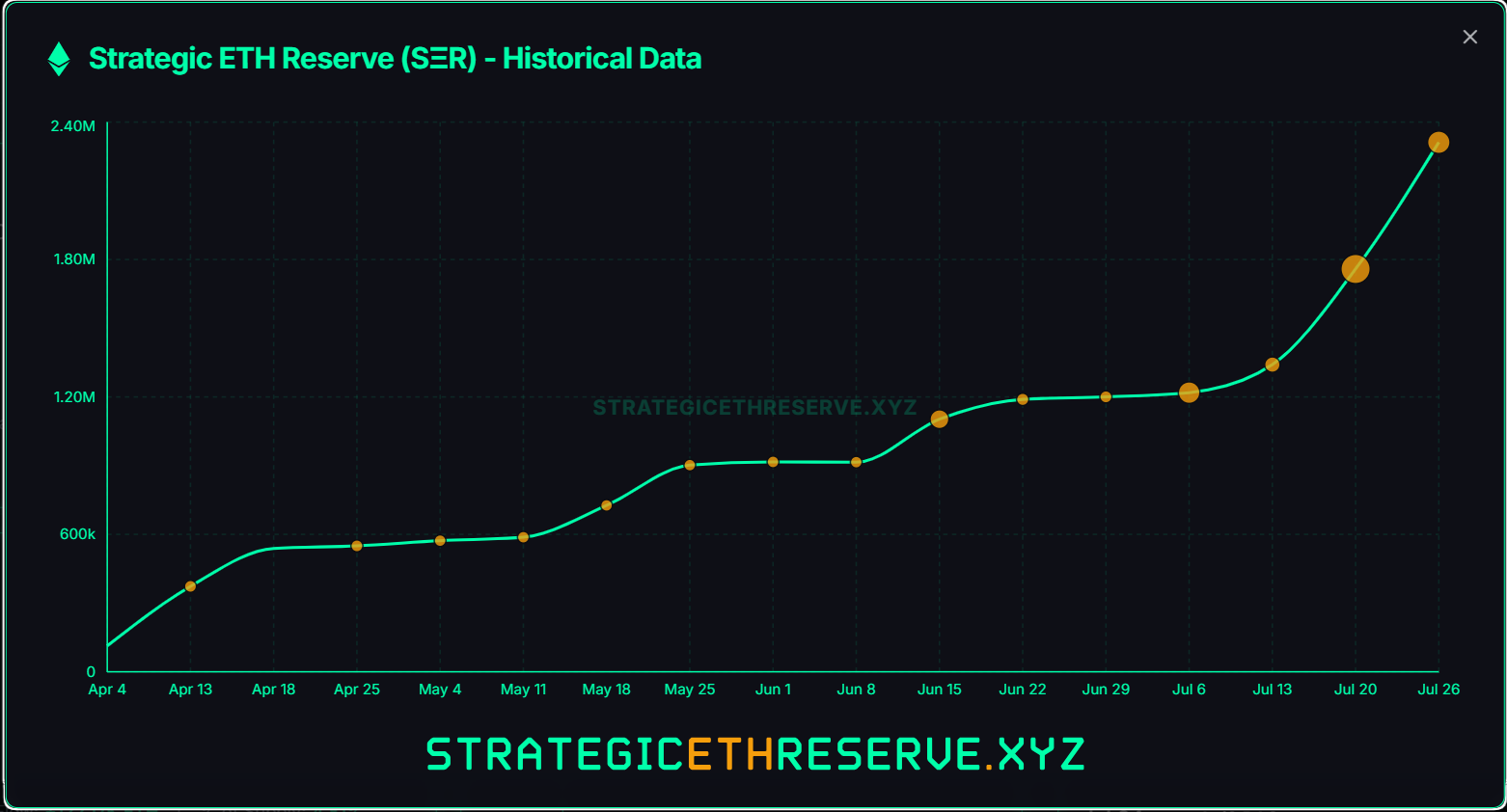

A complete of two.31 million ETH, price $8.65 billion, is now held in strategic reserves by 63 individuals, accounting for 1.92% of Ethereum’s whole provide. Ethereum treasuries have skyrocketed from $23 million to $8.6 billion in only a few months months. BitMine and SharpLink are main the cost, backed by crypto heavyweights Tom Lee and Joseph Lubin. The ETH treasury race is actual and it’s accelerating quick.

Ethereum ETF inflows have additionally been doing nice these days. BlackRock’s Ethereum ETF (ETHA) is on a tear, including 120K ETH price $430M on Friday alone, pushing whole holdings to just about 3 million ETH. Spot ETH ETFs have posted 16 straight days of inflows and outperforming Bitcoin ETFs by an enormous margin.

Whales and Contemporary Wallets Drive ETH Surge

Contemporary wallets are on a shopping for spree as 42,788 ETH price $159 million had been added at the moment alone. Since July 9, eight new wallets have scooped up a large 583,248 ETH price $2.17 billion. Analyst Ali Martinez additionally notes that whales have been loading up over the previous two weeks as they’ve snapped up 1.13 million ETH price a staggering $4.18 billion.

He additionally shared that 170 new whales holding over 10,000 Ethereum have joined the community previously month. This can be a sturdy signal of rising institutional curiosity.

170 new whales holding over 10,000 Ethereum $ETH have joined the community previously month. This can be a sturdy signal of rising institutional curiosity! pic.twitter.com/q06HrHx9iE

— Ali (@ali_charts) July 26, 2025

Is $5,000 Subsequent?

Ethereum whale-held provide is dipping, however costs hold climbing. This can be a key shift since June 2025. In contrast to February’s pump, this pattern factors to more healthy, sustainable progress, and never a pump by few big-players.

Ethereum is up 24% this week and 56% this month. With sturdy institutional inflows, main treasury buys and report ETF demand, analysts be aware that if TH flips the $3,800–$4,000 zone into help, $5,000 isn’t far.