Markets are trying a cautious rebound, with the Ethereum worth hovering close to its every day pivot as merchants reassess threat after the newest pullback.

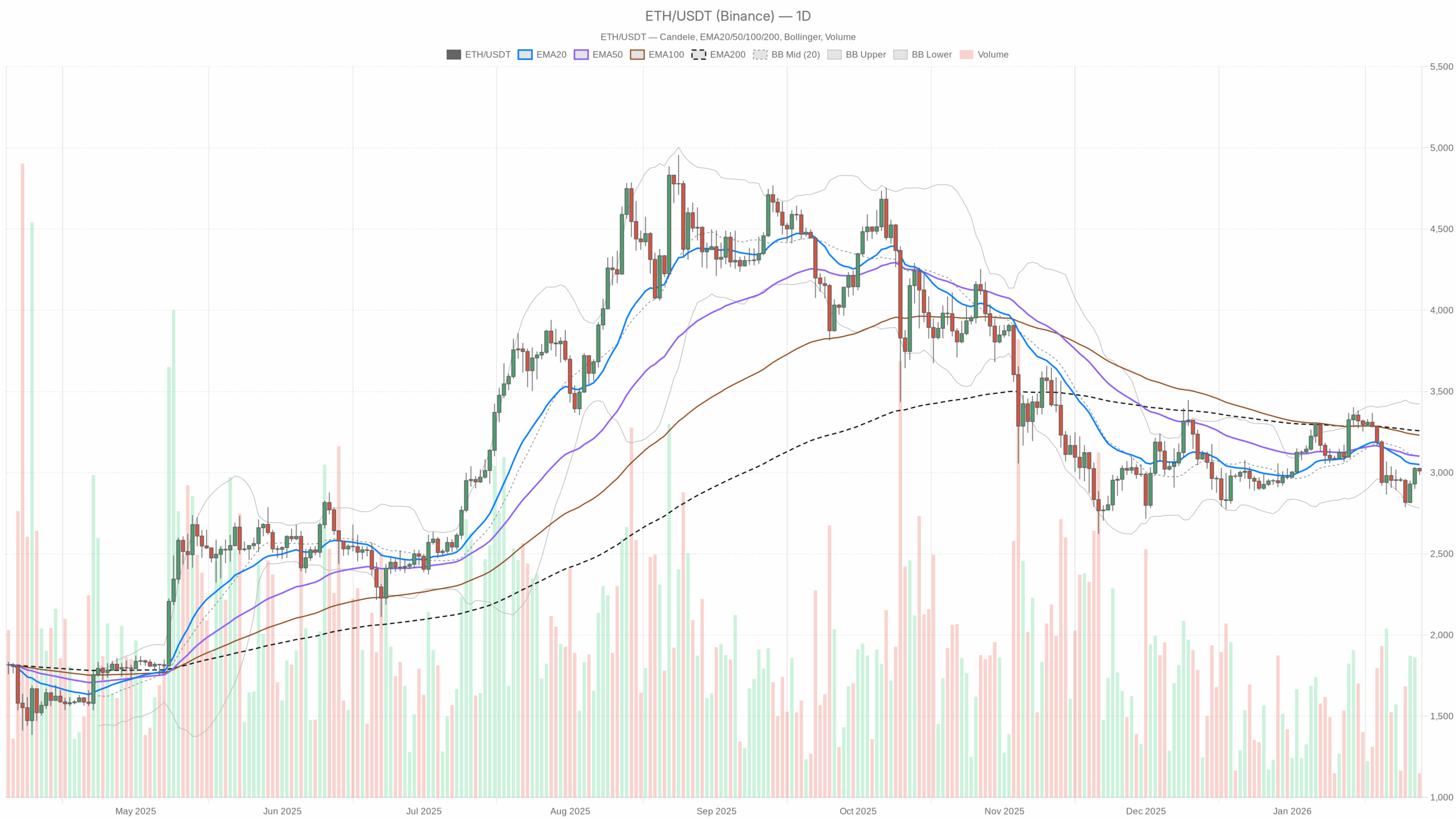

Every day Chart (D1) – Macro Bias: Bearish, However Not Oversold

Every day regime: bearish. Worth is under the 20, 50, and 200-day EMAs, and momentum has cooled with out flushing into panic. That mixture factors to a managed downtrend or prolonged correction, not a capitulation occasion.

Development & Construction (D1)

– Worth: $3,010.64

– EMA20: $3,049.91

– EMA50: $3,101.63

– EMA200: $3,258.23

Ethereum is buying and selling under all three key EMAs. The short-term development (20-day), medium-term (50-day), and long-term (200-day) are all overhead and stacked bearishly. In apply, meaning each bounce into the $3,050–3,260 vary remains to be technically a rally into resistance, not but the beginning of a brand new leg increased. Bulls are combating the tape, not browsing it.

RSI (D1)

– RSI 14: 46.81

RSI is barely under the midline and gently pointing down. Ethereum is in a gentle bearish momentum pocket however removed from oversold. There’s room for additional draw back with out hitting exhaustion, which retains the door open for one more leg decrease if sellers reassert management.

MACD (D1)

– MACD line: -42.54

– Sign line: -20.88

– Histogram: -21.66

MACD is adverse with the road under the sign and the histogram additionally adverse. That’s confirmed draw back momentum, not only a sideways pause. The development of the indicator tells you bears have had the higher hand for a number of classes, which matches the value sitting underneath all main EMAs.

Bollinger Bands (D1)

– Center band: $3,102.16

– Higher band: $3,423.09

– Decrease band: $2,781.24

Worth is just below the center band, roughly within the decrease half of the band vary. Ethereum just isn’t hugging the decrease band, so this isn’t a full-on development breakdown; it’s extra a managed drift decrease inside a large volatility envelope. Imply reversion towards $3,100–3,150 is feasible, however the broader band construction nonetheless favors a sell-the-rip atmosphere until worth can base above the mid-band.

ATR & Volatility (D1)

– ATR 14: $121.40

Every day ATR round $120 says typical one-day swings of three–4%. That’s elevated however not excessive for ETH. In sensible phrases, a transfer from $3,010 all the way down to round $2,890 or as much as about $3,130 can occur in a traditional session. Place sizing must respect that vary; tight stops close to the noise will get harvested.

Every day Pivot Ranges (D1)

– Pivot level (PP): $3,009.01

– R1: $3,031.42

– S1: $2,988.22

Worth is pinned proper on the pivot. The quick intraday battlefield is $2,990–3,030. Sustained commerce under S1 would verify sellers are nonetheless in charge of the every day tape, whereas constructing a base above R1 could be the primary signal that patrons are slowly absorbing provide.

D1 takeaway: The principle situation is bearish. Ethereum is in a managed downtrend, not washed out, with rallies into the $3,050–3,250 space nonetheless favorable for profit-taking or brief positioning for lively merchants.

1-Hour Chart (H1) – Quick-Time period Patrons Pushing In opposition to Resistance

The hourly chart shifts the image. Right here, Ethereum has staged a modest restoration off the lows and is making an attempt to reclaim key intraday ranges, however the regime is printed as impartial, reflecting this tug-of-war between the every day downtrend and an intraday rebound.

Development & EMAs (H1)

– Worth: $3,010.02

– EMA20: $2,991.34

– EMA50: $2,961.68

– EMA200: $2,995.68

On the 1-hour chart, worth is buying and selling above all three EMAs. The quick EMAs (20 and 50) have curled up and at the moment are under worth, with the 200-hour reclaimed as properly. That could be a basic short-term restoration construction: the market is pricing a bounce, however it’s nonetheless nested inside a bearish every day context. The intraday development is up, whereas the upper time-frame development is down. That’s the core time frame stress proper now.

RSI (H1)

– RSI 14: 58.52

RSI is leaning bullish however not overbought. That displays a wholesome restoration moderately than frothy momentum. Patrons have the intraday initiative, however there’s loads of room earlier than any overextension, which helps the concept worth may see an extra push towards native resistances if broader market circumstances cooperate.

MACD (H1)

– MACD line: 18.27

– Sign line: 21.34

– Histogram: -3.07

MACD is barely optimistic however with the road just below the sign, giving a blended, barely weakening learn. Momentum was bullish, has cooled, and is now pausing. This traces up with worth stalling across the hourly pivot and resistance ranges. Bulls management the short-term development, however they’re dropping some steam proper at an vital determination zone.

Bollinger Bands (H1)

– Center band: $2,995.11

– Higher band: $3,057.00

– Decrease band: $2,933.21

Worth is buying and selling barely above the center band, contained in the higher half of the envelope. That’s according to a reasonable, non-parabolic advance. There’s room towards the higher band close to $3,050–3,060 earlier than intraday circumstances look stretched. That band area aligns neatly with increased time-frame resistance from the every day EMAs, making it a logical near-term ceiling.

ATR & Volatility (H1)

– ATR 14: $20.04

Typical hourly candles swinging round $20 suggest 0.6–0.7% intraday noise. Ethereum can simply journey between the H1 assist and resistance pivots inside a number of candles. Quick-term merchants ought to assume mean-reversion habits inside this band until a powerful catalyst kicks in.

Hourly Pivot Ranges (H1)

– Pivot level (PP): $3,004.10

– R1: $3,021.62

– S1: $2,992.51

Worth is hovering simply above the hourly pivot. Holding above $3,000 and constructing acceptance above $3,022 would hold the short-term bullish drift intact. A push again under $2,993 would present the bounce is fading and sellers are reasserting in keeping with the every day bias.

15-Minute Chart (M15) – Execution Zone: Native Uptrend With Tight Ranges

The 15-minute chart is the place execution choices get refined. Right here, Ethereum is in a bullish intraday regime, grinding increased however inside a comparatively tight vary.

Development & EMAs (M15)

– Worth: $3,010.02

– EMA20: $3,002.45

– EMA50: $2,998.95

– EMA200: $2,959.09

On this brief timeframe, worth is properly above the EMA20 and EMA50, and considerably above the EMA200. That could be a clear native uptrend with stacked, rising transferring averages. By itself, the M15 chart helps continuation increased. Nonetheless, it’s transferring proper into the enamel of every day resistance.

RSI (M15)

– RSI 14: 56.94

RSI sits comfortably in bullish territory, not overheated. That is typical of a managed grind up the place breakout makes an attempt can nonetheless discover follow-through, supplied increased time frames don’t reject worth sharply.

MACD (M15)

– MACD line: -1.08

– Sign line: -1.53

– Histogram: 0.45

MACD on M15 is simply crossing upward from barely adverse territory. That matches an image of a recent micro-bounce after a tiny consolidation. Momentum is selecting up, however the transfer remains to be very early and fragile.

Bollinger Bands (M15)

– Center band: $3,002.84

– Higher band: $3,017.23

– Decrease band: $2,988.44

Worth is close to the higher band with bands comparatively tight. That displays a short-term breakout try from a low-volatility vary. If worth can journey the higher band towards $3,015–3,020 with out abrupt rejection, the native up-move can prolong. A fast snap again contained in the band center would flag a failed breakout.

ATR & Volatility (M15)

– ATR 14: $8.75

On 15-minute candles, typical strikes round $8–9 imply micro swings of about 0.3%. That’s comparatively tight for ETH and reinforces that it is a compressed, uneven execution atmosphere intraday. Small stops and scalps can work right here, however they’re susceptible to sudden spikes as liquidity thins.

15-Minute Pivot Ranges (M15)

– Pivot level (PP): $3,011.37

– R1: $3,014.35

– S1: $3,007.03

Worth is sitting just below the M15 pivot. Quick-term scalpers will watch the $3,007–3,014 band intently: maintain above and it acts as a springboard towards the H1 R1 space; lose it, and Ethereum probably slides again towards $3,000 and under into the hourly S1.

Market Context: Threat Nonetheless Cautious, ETH Beneath Strain

Past the chart, broader crypto market cap is up about 1.9% in 24 hours, however BTC dominance is excessive at round 57% and the Worry & Greed Index sits at 29 (Worry). That mixture says flows are conservative, favoring Bitcoin and stablecoins over high-beta alt publicity.

Ethereum’s share of whole market cap, round 11.7%, exhibits it stays a core asset, however this isn’t an atmosphere the place the market is keen to chase ETH aggressively increased. DeFi payment exercise on Uniswap, Curve, and different protocols has rebounded strongly over 30 days however is blended on the 7-day view, which traces up with this corrective tone: on-chain exercise is recovering from lows, however merchants are removed from euphoric.

Bullish Situation for Ethereum Worth

The bull case is a counter-trend rally that steadily turns right into a base above $3,000.

Within the bullish path, ETH holds above the every day pivot at $3,009 and the hourly S1 round $2,993, utilizing dips towards $3,000 as liquidity grabs moderately than breakdowns. Intraday, the M15 and H1 uptrends keep intact, with worth constructing increased lows above the EMA20 on each time frames.

Step one for bulls: a clear push and sustained maintain above $3,030–3,050, the place the H1 R1 and every day EMA20 cluster. If that space is reclaimed and begins appearing as assist, the market can then goal the $3,100–3,150 band (every day mid-Bollinger band and EMA50). That zone is the true battleground. A profitable break and consolidation above EMA50 could be the primary credible signal that the broader correction is ending and that the development is shifting again towards impartial and even bullish on D1.

In a extra optimistic extension, a squeeze towards the every day higher Bollinger close to $3,400 is feasible if total crypto sentiment improves and BTC continues to grind increased. Nonetheless, that might probably require a macro shift in threat urge for food, not simply native technicals.

What invalidates the bullish situation?

A decisive every day shut under $2,950–2,960 would significantly harm the bull case. That will imply dropping the present assist shelf, pushing RSI deeper under 50 and sure increasing MACD draw back. Technically, that might verify the rally makes an attempt had been simply distribution inside a bigger down-leg.

Bearish Situation for Ethereum Worth

The bear case is extra aligned with the present every day regime: the bounce fades and ETH resumes its drift decrease inside the wider volatility bands.

Within the bearish path, Ethereum fails to maintain commerce above $3,030–3,050. Makes an attempt to interrupt this zone get rejected, with decrease time frames rolling over: M15 loses its EMA20 and EMA50 and begins printing decrease highs, whereas H1 MACD turns decisively down and RSI retreats towards 40.

A transfer again under $3,000, particularly if it comes with rising quantity and enlargement in hourly ATR, would sign that sellers are again in cost. From there, bears can push towards the $2,950–2,900 area first, and if concern will increase and the general market softens, a deeper check towards the decrease every day Bollinger band within the $2,800–2,820 zone turns into believable.

Given RSI on D1 just isn’t oversold, bears have room to strain worth decrease with out hitting a powerful momentum flooring. That favors a grind down situation moderately than a sudden reversal, particularly if BTC dominance stays excessive and alt sentiment stays weak.

What invalidates the bearish situation?

A transparent every day shut again above the every day EMA50 (round $3,100), adopted by follow-through towards the EMA200 round $3,260, would put actual stress on the bearish narrative. If that transfer occurs with every day RSI reclaiming and holding above 55 and MACD flattening towards zero, the downtrend argument loses credibility. At that time, merchants are taking a look at a transition again right into a broader vary or a brand new uptrend.

Learn how to Suppose About Positioning Proper Now

From a buying and selling standpoint, Ethereum is caught between short-term bullish momentum and a medium-term bearish construction. That form of time frame battle is the place merchants usually overtrade, chasing intraday alerts whereas ignoring the larger image.

For directional publicity, the bottom line is to respect the every day bias: till ETH reclaims at the least the 20- and 50-day EMAs with conviction, rallies usually tend to be mean-reversion alternatives inside a downtrend moderately than the beginning of a sustained bull leg. Intraday longs can nonetheless make sense, however they’re combating the upper time-frame and needs to be handled as tactical, not strategic.

Volatility, whereas not excessive, remains to be vital: a traditional day can simply swing 3–4%. Leverage and place dimension must be scaled accordingly to keep away from getting pressured out by routine noise. Uncertainty stays elevated, with broader market sentiment in concern and BTC dominating flows, so situation planning issues greater than prediction.

In brief, the Ethereum worth is making an attempt a bounce inside a corrective construction. So long as $3,050–3,150 caps the upside on every day closes, the burden of proof stays on the bulls.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our accomplice hyperlink:

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We might earn a fee at no further value to you.

Disclaimer: This evaluation is for informational and academic functions solely and doesn’t represent funding, buying and selling, or monetary recommendation. Markets are unstable and unpredictable; at all times do your individual analysis and assess your individual threat tolerance earlier than making any buying and selling choices.