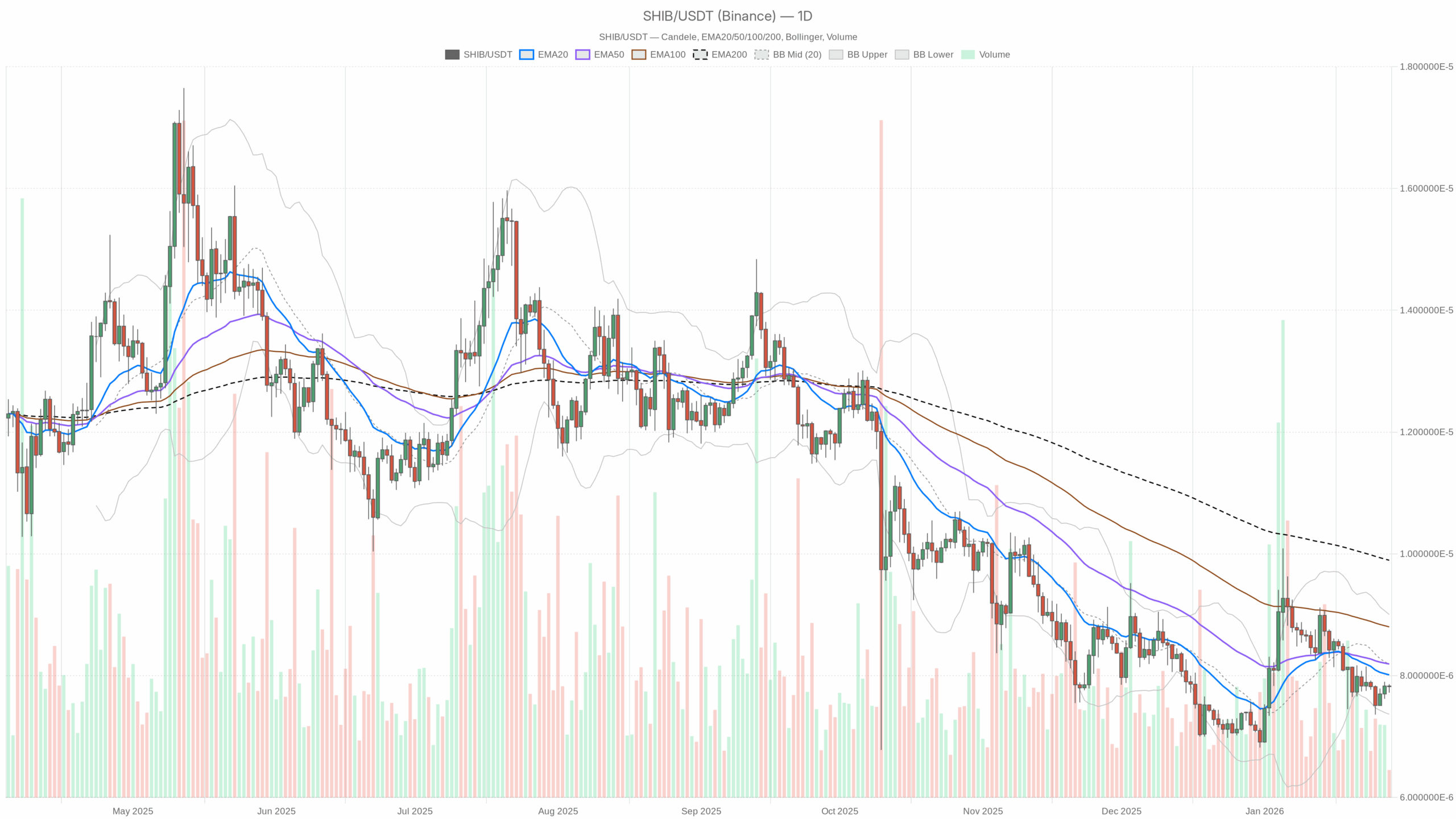

Market construction reveals a transparent pressure: regardless of a broader risk-on backdrop, Shiba inu crypto (SHIBUSDT) is making an attempt a countertrend bounce inside a still-bearish every day framework.

Major State of affairs from the Every day Chart: Bearish Bias, However Not Washed Out

The every day timeframe (D1) is our anchor, and the regime flag there may be bearish. That units the bottom case: any upside for SHIBUSDT is, for now, a countertrend transfer till confirmed in any other case.

Every day RSI (14)

The every day RSI sits at 45.48, just under the 50 line.

That’s traditional late-downtrend / early-consolidation territory: sellers are nonetheless in management structurally, however momentum shouldn’t be aggressive. It tells you SHIB is nearer to sideways-to-soft than to capitulation or an actual pattern reversal but.

Every day MACD

The MACD values within the dataset are successfully flat (0 for line, sign, and histogram), which in observe means we shouldn’t have a clear MACD sign to lean on for the every day chart this run.

When MACD is inconclusive whereas the regime mannequin is bearish, it normally means the pattern decrease has both slowed significantly or the pair is in a uneven vary the place pattern instruments lose edge. You commerce the construction and ranges, not the oscillator, in this sort of tape.

Every day EMAs (20 / 50 / 200)

The numerical EMA ranges usually are not offered, however the system has labeled the every day regime as bearish whereas RSI is sub-50.

For that mixture to point out up, SHIBUSDT virtually definitely trades beneath no less than the 20-day EMA, and really doubtless beneath the 50-day as effectively. The 200-day EMA is, by definition, the massive structural line within the sand, and till value reclaims it and holds, any rally is technically a bounce inside a broader downtrend. In observe, these EMAs will act as dynamic resistance on the best way up.

Every day Bollinger Bands

Bollinger values usually are not populated within the dataset, however we are able to nonetheless learn them conceptually alongside RSI close to 45.

Given the non-extreme RSI and the shortage of a transparent pattern momentum sign, SHIB is probably going buying and selling someplace between the mid-band and decrease band, not hugging extremes. That matches a managed bearish-to-neutral part, the place volatility compresses earlier than a bigger transfer. On this part you usually get sharp fakeouts across the mid-band as merchants attempt to front-run breakouts.

Every day ATR (14)

ATR is reported as zero, which merely tells us the volatility knowledge for this extraction shouldn’t be usable.

From a tactical perspective, you can’t measurement or place stops based mostly on this ATR studying; you must respect SHIB’s historic tendency to overshoot and assume realized volatility can broaden rapidly, particularly when sentiment is fearful.

Every day Pivot Ranges

Pivot level (PP), R1 and S1 are all reported as zero on this feed.

Which means we shouldn’t have dependable numerical intraday pivot ranges from this run, so horizontal ranges from latest swing highs and lows and EMAs matter greater than this pivot snapshot for actual buying and selling choices.

Macro Context and Intraday Timeframes: Bulls Preventing Again In opposition to the Every day Development

This second issues as a result of broader crypto is in risk-on mode: complete market cap is above $3.1T with a close to 2% every day improve, but sentiment is caught in Worry (index 29). That blend normally advantages high-beta names like SHIB on brief squeezes and sharp rallies, however the identical volatility cuts each methods if the bounce runs into heavy overhead provide.

1H Chart: Impartial Regime with Bullish Lean

The 1-hour timeframe carries a impartial regime label, however the 1H RSI is at 57.57.

That mixture normally seems when an asset is attempting to transition from a neighborhood backside right into a short-term uptrend, however has not damaged sufficient ranges but to flip the structural bias. Consider it as a rally in progress that’s nonetheless on probation: patrons have short-term management, however they’re pushing into an outdated downtrend.

With EMAs not numerically specified, the probably configuration right here is value reclaiming the 20-EMA on 1H and wrestling with the 50-EMA. Till value spends sustained time above each, the hourly pattern improve stays incomplete.

15m Chart: Bullish Regime, Execution-Solely Context

The 15-minute regime is flagged as bullish, with RSI at 63.23.

That’s short-term momentum clearly in favor of the upside. On a pure execution degree, this normally corresponds to purchasing dips towards fast-moving brief EMAs on this timeframe. Nevertheless, you can’t overlook the backdrop: it is a bullish micro-trend inside a impartial 1H and a bearish every day. Scalps can work; swing longs are nonetheless combating the upper timeframe.

How the Timeframes Match Collectively

Every day is bearish, 1H is impartial with a bullish tilt, and 15m is outright bullish. Whenever you stack them, the story is easy: SHIBUSDT is making an attempt a reduction rally inside a broader downtrend. Rotation into meme cash sometimes accelerates when speculative urge for food climbs, and the general crypto cap rising with a Worry index at 29 is fertile floor for sharp however fragile bounces.

The important thing pressure is that this: decrease timeframes are sturdy sufficient to justify tactical lengthy publicity, however not sturdy sufficient but to flip the macro story. Until every day construction improves, significantly reclaiming and holding key EMAs, rallies are weak to quick givebacks.

Bullish State of affairs for Shiba Inu Crypto

Core thought: Bulls flip the present intraday bounce into a correct pattern reversal by dragging the every day regime from bearish to no less than impartial.

For that to occur, you’d search for:

- Every day RSI to push decisively above 50 and begin constructing in direction of 55–60. That will mark a shift from managed bearish to rising bullish momentum.

- Value to reclaim and maintain above the 20-day EMA first, then the 50-day. On a stay chart this normally reveals as a collection of upper lows on the every day, with intraday pullbacks discovering assist close to these EMAs as a substitute of rejecting there.

- On the 1H, the regime must flip from impartial to bullish, with pullbacks holding the 20- and 50-EMA and RSI respecting 40–45 on dips quite than collapsing into oversold zones.

In that case, the present 15m bullish regime turns into extra than simply noise; it turns into the ignition part of a pattern leg the place SHIB can begin difficult prior every day swing highs and, in sturdy tape, squeeze via them as shorts unwind.

What invalidates the bullish case?

If every day RSI will get rejected across the 50 degree and rolls again in direction of 40 whereas intraday RSI readings (1H and 15m) begin printing decrease highs, the tried breakout turns into simply one other rally inside a downtrend. A failure to carry reclaimed EMAs on the every day, particularly a quick rejection on the 50-day, would inform you the market shouldn’t be prepared to soak up provide but.

Bearish State of affairs for Shiba Inu Crypto

Core thought: The present bounce is a typical countertrend transfer in a fearful macro surroundings, and sellers use increased costs to reload.

On this state of affairs, the every day regime stays bearish and the intraday energy burns out with out shifting construction. Right here is how it will normally develop:

- On the 15m first, RSI fails to make new highs and begins diverging negatively towards value. Brief EMAs flatten after which roll over, flipping that timeframe again to impartial or bearish.

- On the 1H, RSI rolls again from the excessive 50s in direction of the low 40s, and value loses the 20-EMA as assist. Intraday increased lows break; the construction reverts to a sequence of decrease highs and decrease lows.

- Every day RSI drifts down from round 45 in direction of 40 or beneath, confirming that sellers retook management earlier than any structural breakout may happen.

Given the macro Worry studying, a bearish final result doesn’t want a panic; it might merely be a grind decrease with occasional sharp wicks as retail tries to purchase perceived dips. For SHIB, that sometimes means spiky, illiquid drops that may lure late patrons rapidly.

What invalidates the bearish case?

If, on pullbacks, the 1H regime stays neutral-to-bullish and RSI refuses to fall beneath 50 for lengthy, whereas the every day regime tag migrates from bearish to impartial, the concept of a useless cat bounce loses credibility. Bears get invalidated if SHIB can right in time and vary with out violating new increased lows on the every day chart.

Positioning, Danger, and Uncertainty

SHIBUSDT proper now shouldn’t be a clear pattern play; it’s a transition tape. The every day chart nonetheless argues for warning, the 1H permits for tactical longs, and the 15m is dominated by short-term momentum merchants. That form of set-up rewards endurance and clear invalidation ranges greater than blind conviction in both path.

For directional bulls, the more healthy alternatives have a tendency to look after the every day regime has already shifted, even when which means lacking the underside. For bears, urgent shorts aggressively right into a rising crypto complete market cap with enhancing intraday momentum is equally dangerous; the higher entries normally come after failed breakouts and clear intraday pattern breaks, not in the midst of a squeeze.

Volatility in meme tokens can broaden violently, particularly with a fearful sentiment backdrop and a big, speculative retail base. Place sizing, leverage, and the willingness to respect technical invalidation matter extra right here than being proper on the story. The tape is telling you one factor above all: SHIB is attempting to bounce in a downtrend, and till a type of two provides manner, uncertainty stays excessive.

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you may open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We might earn a fee at no extra value to you.

Disclaimer: This evaluation is for informational and academic functions solely and isn’t funding, buying and selling, or monetary recommendation. Markets are risky and unpredictable; at all times do your individual analysis and contemplate your monetary state of affairs and danger tolerance earlier than making any buying and selling choices.

In abstract, Shiba Inu Crypto is making an attempt a reduction bounce towards a dominant every day downtrend, with intraday flows supportive however not but sturdy sufficient to resolve the broader bearish construction.