The market is caught between deep concern and short-term stabilization as Bitcoin crypto at the moment trades close to key pivot ranges with volatility nonetheless elevated.

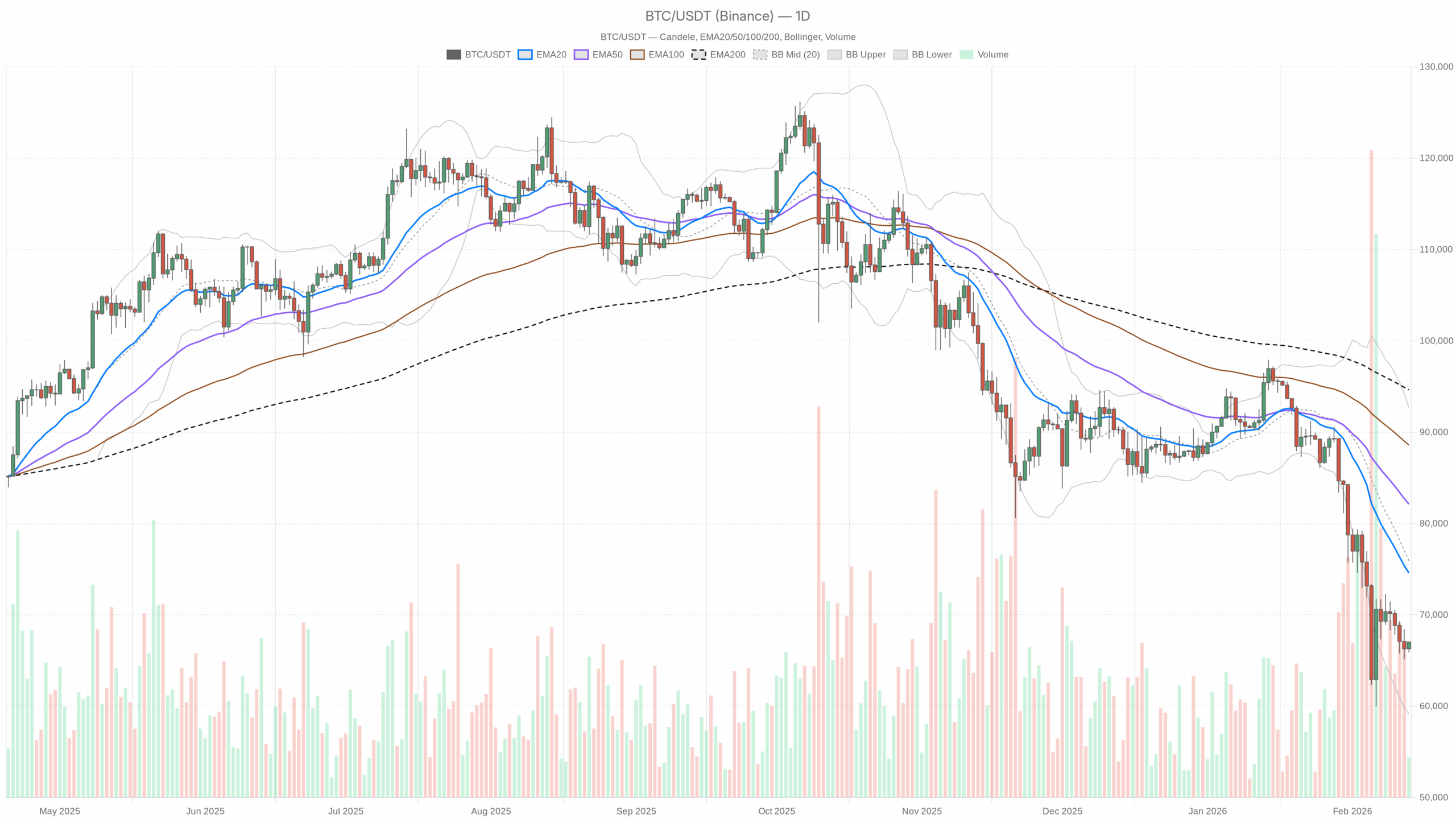

Each day Timeframe (D1): Macro Bias – Bearish With Early Stabilization Makes an attempt

Each day shut: $67,005

Regime: Bearish

Development Construction – EMAs

• 20-day EMA: $74,578.87

• 50-day EMA: $82,113.95

• 200-day EMA: $94,627.39

Value is buying and selling far beneath the 20, 50, and 200 EMAs. Your complete moving-average stack is above spot, sloping down. That could be a traditional, well-established downtrend: rallies into the low-70Ks would nonetheless be thought-about bounces inside a bearish construction, not a pattern reversal. In plain phrases, the market has a variety of overhead provide to chew via earlier than bulls can speak about an actual restoration.

Momentum – RSI (14)

RSI (14): 31.14

Each day RSI is hovering simply above oversold territory. Momentum remains to be destructive, however it isn’t in full capitulation mode anymore. Sellers have clearly dominated the latest transfer, but they’re not urgent value relentlessly to new lows. That opens the door for a reflexive bounce, nevertheless it doesn’t assure one. This may sit close to 30 for some time in entrenched downtrends.

Momentum – MACD

MACD line: -5,814.24

Sign line: -5,279.06

Histogram: -535.18

The MACD is deeply destructive with the road nonetheless beneath the sign. The histogram can also be destructive, displaying bearish momentum stays in place. The excellent news for bulls is that the histogram’s dimension suggests the draw back impulse is not accelerating aggressively. Nonetheless, we aren’t seeing a clear bullish cross but. The pattern remains to be down; the bleeding is simply slowing somewhat than reversing.

Volatility & Vary – Bollinger Bands

Center band: $75,915.57

Higher band: $92,674.33

Decrease band: $59,156.81

Value at about $67K is parked within the decrease half of the band, properly beneath the midline. The bands are vast after the sharp selloff, confirming we’re in a high-volatility atmosphere. Buying and selling this implies accepting larger intraday swings and the chance of sharp squeezes each methods. Being caught beneath the center band reinforces the bearish bias: the market remains to be residing within the decrease volatility regime of its latest vary.

Volatility – ATR (14)

ATR (14): $5,200.43

A each day ATR over $5K indicators very vast common each day ranges. Place sizing is important right here; small leverage will be worn out shortly. Furthermore, for directional merchants, this volatility is alternative, nevertheless it additionally signifies that stops want extra room and also you have to be ready for $3–6K swings with out overreacting.

Key Each day Ranges – Pivot

Pivot level (PP): $66,659.30

First resistance (R1): $67,446.15

First help (S1): $66,218.64

Value is hovering barely above the each day pivot and just below R1. That tells you at the moment’s session is tilting mildly constructive intraday however nonetheless trapped in a good, indecisive band. So long as BTC holds above the pivot on a each day closing foundation, the market is making an attempt to carve out a short-term base. Lose the pivot decisively, and the subsequent leg down opens up.

D1 Takeaway: The principle state of affairs on the each day is bearish. The pattern is down, momentum is weak, and volatility is elevated. The one silver lining is that some indicators are not accelerating to the draw back, which frequently precedes a aid rally. Nonetheless, that might be a countertrend transfer till main EMAs are reclaimed.

Hourly Timeframe (H1): Quick-Time period Aid Inside a Bear Market

Hourly shut: $66,978.24

Regime: Impartial

Development Construction – EMAs

• 20-hour EMA: $66,570.22

• 50-hour EMA: $67,014.44

• 200-hour EMA: $69,365.69

On the 1H chart, value is sandwiched between the 20 and 50 EMAs and nonetheless properly beneath the 200 EMA. That could be a short-term impartial to mildly constructive setup inside a bigger downtrend. The market has stopped trending straight down intraday and is making an attempt to construct a sideways-to-up consolidation. Nonetheless, the 200 EMA close to $69K stays a transparent cap. Any push there’ll take a look at how aggressive sellers nonetheless are.

Momentum – RSI (14)

RSI (14): 54.42

Hourly RSI has recovered to the center vary. This displays modest shopping for stress after the selloff, however nothing euphoric or overstretched. Dip-buyers have stepped in sufficient to cease the bleeding on low timeframes, but there is no such thing as a sturdy momentum pattern up or down proper now. It’s extra of a rebalancing section.

Momentum – MACD

MACD line: -84.07

Sign line: -213.37

Histogram: +129.30

The MACD line remains to be beneath zero however has crossed above the sign, and the histogram is optimistic. That’s the footprint of a short-term bullish momentum swing inside an general weak backdrop. Sellers are shedding some management intraday, permitting for a corrective transfer greater or at the very least a range-bound pause after the aggressive drop.

Volatility & Vary – Bollinger Bands

Center band: $66,246.54

Higher band: $67,225.46

Decrease band: $65,267.63

BTC is buying and selling close to the higher half of the hourly bands, nudging nearer to the higher band. That sometimes displays a aid section the place value grinds greater or holds agency after a selloff. Till value begins closing above the higher band repeatedly, that is extra according to a managed bounce somewhat than runaway upside.

Volatility – ATR (14)

ATR (14): $468.04

Hourly ATR round $450–500 factors to respectable however not excessive intraday ranges. For brief-term merchants, that is lively however tradable volatility. You may construction intraday trades with no need absurdly vast stops, although you continue to want some respiratory room.

Key Hourly Ranges – Pivot

Pivot level (PP): $66,959.40

First resistance (R1): $67,118.81

First help (S1): $66,818.84

Value is sitting virtually precisely on the hourly pivot. That’s the definition of a stability zone: neither bulls nor bears have actual intraday dominance at this second. A sustained push and maintain above R1 would affirm the continuing intraday aid. A failure that drifts again beneath S1 would sign that sellers are regaining short-term traction.

H1 Takeaway: The hourly chart is neutral-to-mildly-bullish inside a macro downtrend. It reveals stabilization and a possible bounce section, however nothing right here but challenges the each day bearish construction.

15-Minute Timeframe (M15): Execution Context – Quick-Time period Patrons in Management

15m shut: $66,986.77

Regime: Impartial

Development Construction – EMAs

• 20-EMA: $66,634.93

• 50-EMA: $66,499.86

• 200-EMA: $66,970.18

On the 15-minute chart, value is above the 20 and 50 EMAs and roughly consistent with the 200 EMA. Quick-term, patrons are clearly lively and have the micro-trend tilting upward. The truth that value is testing across the 200 EMA reveals we’re at a choice level for scalpers. Both we proceed to construct the next intraday base above it, or we slip again beneath and return to cut.

Momentum – RSI (14)

RSI (14): 65.67

RSI on the 15m is pushing into the higher vary however not but at excessive ranges. Momentum is clearly favoring the upside for now on this timeframe. For very short-term merchants, this implies chasing right here has much less edge; the higher entries got here earlier within the transfer. For swing merchants, that is simply noise contained in the bigger each day downtrend.

Momentum – MACD

MACD line: 163.57

Sign line: 107.51

Histogram: 56.06

The MACD on the 15m is optimistic and above the sign with a optimistic histogram. Quick-term momentum patrons are in charge of the tape proper now. This helps the concept of an intraday rally or consolidation at greater ranges somewhat than speedy breakdown, aligning with the hourly image of short-term aid.

Volatility & Vary – Bollinger Bands

Center band: $66,518.19

Higher band: $67,131.23

Decrease band: $65,905.15

Value is hugging the higher half of the 15m bands, near the higher band. That’s what you sometimes see throughout intraday up-legs or squeezes. It’s constructive for short-term longs, nevertheless it additionally means the market is beginning to get crowded within the very close to time period. Small pullbacks are seemingly as late patrons pile in.

Volatility – ATR (14)

ATR (14): $230.33

Fifteen-minute ATR a bit above $200 is according to actively buying and selling circumstances. Quick-term swings are significant sufficient to matter for scalps, however not chaotic. It’s a workable atmosphere for tactical entries and exits.

Key 15m Ranges – Pivot

Pivot level (PP): $66,960.50

First resistance (R1): $67,080.61

First help (S1): $66,866.66

Value is simply above the 15m pivot and urgent towards R1. Microstructure favors the lengthy facet for the second: so long as we maintain above the pivot, dips are being purchased on this timeframe. A clear break beneath S1 would present the short-term push operating out of steam.

M15 Takeaway: Quick-term patrons management the very near-term motion, however they’re buying and selling towards a dominant each day downtrend. That is good for tactical performs, not a standalone cause for a long-term bullish stance.

Market Context: Dominance, Sentiment, and DeFi Exercise

• Bitcoin dominance: 56.6%

• Complete crypto market cap: about $2.37T (down 1.3% over 24h)

• Concern & Greed Index: 9 – Excessive Concern

BTC dominance above 56% tells you capital is hiding in Bitcoin relative to alts, which is traditional risk-off conduct inside crypto. Buyers are decreasing speculative bets and clustering within the perceived safer finish of the spectrum, or exiting the market outright. The drop in whole market cap and a roughly 9% stoop in quantity over 24 hours reinforce the concept new cash will not be dashing in but. That is nonetheless a defensive tape.

Excessive concern at 9 is uncommon and tends to cluster round necessary medium-term inflection factors. Traditionally, such readings have typically coincided with late-stage selloffs or accumulation zones for affected person capital. That mentioned, excessive concern by itself doesn’t imply the low is in. It means the market is fragile and another shock can nonetheless set off pressured promoting.

On the DeFi facet, charges on main DEXes like Uniswap V3 and Curve are sharply down on the day and much more so over the week, which factors to decrease speculative buying and selling and leverage unwinds. The market is de-risking throughout the stack, not simply on centralized exchanges. This reinforces the macro view: speculative urge for food is muted, and liquidity is thinner.

Latest information headlines are additionally leaning destructive: a crypto lender (BlockFills) suspending withdrawals, narratives round Bitcoin’s giant drawdown and weekend threat, and commentary that the age of hypothesis could also be ending. This type of information stream tends to speed up capitulation, however as soon as it’s totally priced in, it will probably additionally mark the zone the place dangerous information stops pushing value a lot decrease.

Placing It All Collectively: Conflicting Timeframes, One Dominant Development

Right here is the important thing rigidity: the each day pattern is clearly bearish, whereas the hourly and 15-minute charts present a short-term restoration. That’s precisely how bear markets breathe. They function violent legs down adopted by sharp however fragile bounces.

- The each day EMAs and MACD body a robust downtrend with heavy overhead resistance.

- The hourly MACD and RSI present that sellers are backing off intraday and permitting a aid section.

- The 15m indicators affirm that short-term momentum is up, seemingly pushed by brief protecting and tactical dip-buying.

- Excessive concern and excessive ATR inform you volatility is excessive and positioning is burdened, which is fertile floor for each sharp squeezes and additional flushes.

The web end result: macro bias is bearish, microstructure is stabilizing. Quick-term longs may match tactically, however they’re swimming towards the prevailing present.

Clear Situations for Bitcoin Crypto At this time

Bullish State of affairs

Within the bullish case, at the moment’s stabilization close to the each day pivot evolves right into a extra significant aid rally.

What helps this:

• Each day RSI close to 30 has room to push greater on a mean-reversion bounce.

• Hourly MACD has already flipped optimistic on the histogram, and 15m momentum is firmly to the upside.

• Value is sitting above intraday pivots (H1 and M15), and short-term EMAs are beginning to present help beneath spot.

On this state of affairs, BTC would:

• Maintain above the each day pivot at roughly $66.6K and convert that zone right into a short-term flooring.

• Push via speedy intraday resistances (R1s on 15m and 1h) and problem the 200-EMA on the hourly across the high-$60Ks to about $69K.

• Probably prolong towards the 20-day EMA within the mid-$70Ks on a stronger squeeze, the place heavy provide is prone to present up once more.

What would invalidate the bullish state of affairs:

A decisive break and each day shut again beneath about $66K, particularly if accompanied by rising each day quantity and a contemporary rollover within the hourly MACD. That will point out the bounce was simply brief protecting and that the dominant downtrend is prepared for an additional leg decrease.

Bearish State of affairs

The bearish case is that the present aid try stalls beneath close by resistance and the upper timeframe downtrend reasserts itself.

What helps this:

• Value is way beneath the 20, 50, and 200 EMAs on the each day, leaving a large air pocket above that sometimes attracts promoting on rallies.

• Each day MACD stays deeply destructive with no confirmed flip, according to a prevailing bear pattern somewhat than a bottoming construction.

• Excessive concern, de-risking in DeFi, and destructive information stream point out broader risk-off, which may cap rallies.

On this state of affairs, BTC would:

• Fail to carry above the hourly and 15m pivots, slipping again beneath roughly $66.8K after which the each day pivot close to $66.6K.

• See the hourly MACD roll again over whereas RSI fails to push a lot past the mid-50s, signaling that patrons are exhausted even at depressed ranges.

• Retest and probably break the decrease each day Bollinger Band area towards the low-$60Ks to high-$50Ks, consistent with the band’s decrease boundary round about $59K.

What would invalidate the bearish state of affairs:

A sustained reclaim of the 20-day EMA (mid-$70Ks) with each day closes above it, accompanied by an upturn within the each day MACD, or at the very least a bullish cross, and RSI shifting again into neutral-to-positive territory (40s–50s). That will sign a real shift from pattern continuation to early pattern reversal.

Positioning, Danger, and Tips on how to Assume About This Tape

For merchants and traders Bitcoin crypto at the moment, the message from the chart will not be refined. The trail of least resistance on the each day remains to be down, however we’re getting into a zone the place each sharp squeezes and sharp flushes are on the menu.

Each day ATR above $5K and hourly ATR close to $500 imply volatility is elevated throughout timeframes. Place dimension and leverage have to be aligned with that actuality. In a market with excessive concern and a broken each day construction, rallies will be quick, and reversals will be brutal.

The multi-timeframe image provides a easy framework:

• The each day tells you to not belief countertrend euphoria: till main EMAs are reclaimed, bounces are responsible till confirmed in any other case.

• The hourly and 15m present the place the aid legs and intraday alternatives are, however they’re working inside a broader downtrend.

Quick-term members can work with the intraday pivots and EMAs, treating present energy as a tactical window, not as affirmation of a brand new bull section. Longer-horizon members may even see excessive concern and heavy reductions from the highs because the early levels of an accumulation window, however the structural threat of decrease lows remains to be on the desk.

In this sort of tape, the sting comes much less from predicting the precise backside and extra from respecting the volatility, the higher-timeframe pattern, and the truth that sentiment is fragile. Till the each day chart repairs itself, Bitcoin stays in a bear-controlled atmosphere with intermittent, tradable bounces, not but in a confirmed restoration.