In a speech at Bitcoin 2025, MicroStrategy Co-founder Michael Saylor proposed that one of the simplest ways for folks of each class and age to attain monetary freedom was by way of Bitcoin accumulation. Saylor added that, quickly sufficient, the digital asset would signify half of the world’s worth.

In accordance with consultants, this imaginative and prescient can solely be realized in an excellent world. Representatives from Fedrok AG, Bitget Pockets, and Brickken defined that for Bitcoin to soak up world wealth, it wants better scalability, much less institutional pushback, and extra stability. Solely when these elements align can Saylor’s fantasy turn out to be actuality.

Saylor on Bitcoin’s Path to Final Wealth

Saylor not too long ago took the stage at Bitcoin 2025 in Las Vegas to current his “21 Methods to Wealth” deal with. The Technique Govt Chairman and aggressive Bitcoin accumulator offered a complete information to constructing monetary freedom with the digital asset at its core.

A central pillar of Saylor’s imaginative and prescient was that people, no matter age or socioeconomic standing, may put money into a brighter future by including Bitcoin to their portfolios.

He argued that the digital asset’s decentralized, programmable, and incorruptible nature would make it outpace all different currencies over time, finally changing into the dominant world financial normal.

Although not mentioning the time period explicitly, Saylor strongly advocated for the underlying philosophy of hyperbitcoinization.

The idea asserts that as belief in conventional monetary methods declines, Bitcoin’s inherent benefits will result in its swift and irreversible emergence because the world’s major foreign money.

Is Hyperbitcoinization a Forecast or a Fantasy?

Consultants stay divided over the feasibility of Saylor’s speech. Enmanuel Cardozo, a market analyst at Brickken, is optimistic that Bitcoin can finally outperform its rivals. Nevertheless, he admits that this imaginative and prescient won’t be quick.

“Bitcoin’s fundamentals are clear: its shortage, decentralized nature, and rising institutional adoption make it a nice hedge towards fiat devaluation and it’s the cause why it’s the fifth-largest asset in the world, and with fiat currencies trending towards zero towards BTC over time, as I’ve mentioned earlier than, it’s near changing into a worldwide retailer of worth in a 5 to 10 years,” Cardozo predicted.

Different consultants are much less hopeful. They argue that hyperbitcoinization represents extra of a fantasy than a forecast.

Not like conventional property reminiscent of companies, actual property, or commodities, Bitcoin’s lack of productiveness, excessive volatility, and lack of ability to generate revenue or utility make such a state of affairs unrealistic.

“In the end, Saylor’s imaginative and prescient is rooted extra in ideological conviction than pragmatic economics. Whereas Bitcoin could stay a useful various asset class or hedge towards inflation, the notion that it’ll change or dominate each different asset and foreign money is implausible,” Fedrok aG CEO Philip Blazdell informed BeInCrypto.

Blazdell primarily based his argument on a number of key elements undermining the plausibility of a Bitcoin reign.

The Energy Battle: Bitcoin vs. Centralized Management

For Bitcoin to turn out to be globally dominant, the present banking methods and authorities gamers should be prepared to relinquish their management. They gained’t accomplish that with out a battle, and their grip on energy stays agency.

“The greatest impediment isn’t tech—it’s energy. Governments are unlikely to give up management over financial coverage. Any transition towards Bitcoin-based methods will face structural resistance at the best ranges,” Alvin Kan, Bitget’s Chief Working Officer, emphasised.

Blazdell agreed, arguing that hyperbitcoinization is out of the query with out this energy monopoly. Conscious of this, governments place a number of hurdles hindering crypto’s widespread adoption.

“The imaginative and prescient of Bitcoin being ‘valued at half of all the things’ requires a radical shift within the world monetary system—beginning with the collapse or abandonment of fiat currencies. For Bitcoin to interchange sovereign cash, governments must relinquish management over financial coverage, taxation, and debt issuance, which is very unlikely. Historic and present developments present that states fiercely defend their monetary authority, evidenced by crypto bans and regulatory crackdowns in main economies,” he defined.

International dominance on this context requires widespread adoption. Presently, nonetheless, Bitcoin will not be present in most investor portfolios.

Why Isn’t Bitcoin Adoption Catching As much as Crypto’s Development?

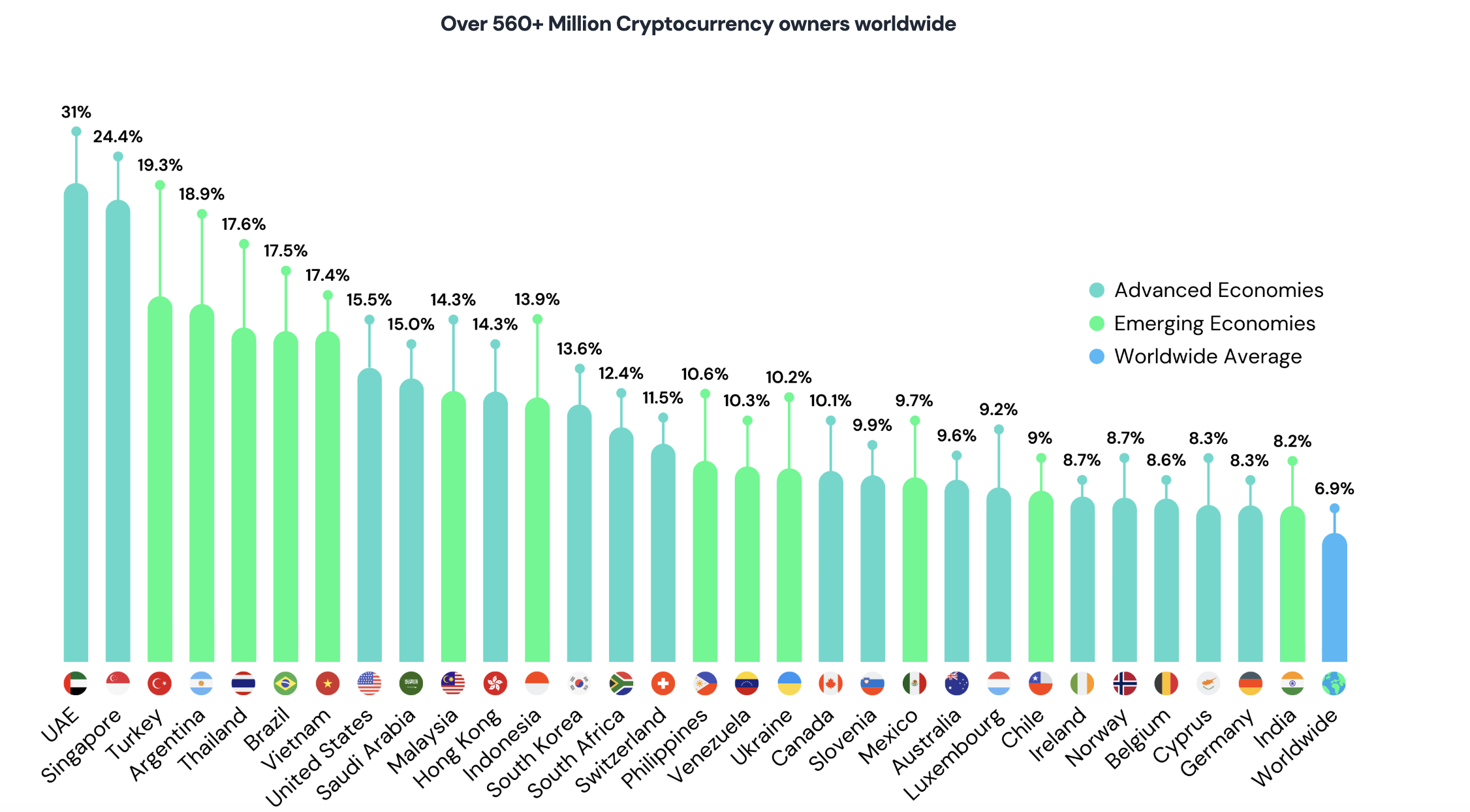

As of 2024, knowledge from Triple-A exhibits that about 6.9% of the worldwide inhabitants, or over 560 million folks, personal cryptocurrency. Naturally, Bitcoin possession is anticipated to be decrease, with varied stories placing that determine someplace between 1 and three%.

International crypto possession reached 6.9% in 2024. Supply: Triple-A.

A few of Bitcoin’s inherent qualities, notably its worth volatility, deter its path to widespread adoption, particularly as a steady medium of change.

“Its unpredictable swings make it dangerous for preserving wealth and impractical for pricing items or companies. Till it achieves better stability, Bitcoin stays extra of a speculative asset than a dependable instrument for on a regular basis monetary use,” Blazdell informed BeInCrypto.

In that sense, stablecoins are the extra pure alternative for frequent use circumstances. On the similar time, frequent misconceptions round Bitcoin possession are inclined to drive away adoption from retail traders.

Notably, the truth that one Bitcoin alone is value over $100,000 causes traders to imagine that solely rich people can afford such an asset.

“The notion that Bitcoin is too costly typically ignores that it’s divisible down to 0.00000001 BTC. However notion issues—many retail customers nonetheless equate worth with entire items. Till there’s higher training, this psychological barrier will persist,” Kan defined.

These misunderstandings can lead merchants to discover different cryptocurrencies, additional driving consideration away from Bitcoin.

Why “Reasonably priced” Altcoins Outshine Bitcoin for Some Retailers

Since altcoins and meme cash have a cheaper price per unit than Bitcoin, retailers typically discover them extra interesting. That is largely as a consequence of a false impression and a lack of awareness about how simply Bitcoin might be divided into smaller items or satoshis.

“This worth tag normally scares off the common investor, particularly when they see altcoins like at $1 or $100, which really feel extra ‘inexpensive’ even if they’re riskier investments. This notion makes folks suppose that at this level Bitcoin is solely for the wealthy or establishments, when in reality common people miss out on its long-term potential as a result of of the lack of training, which is a disgrace as a result of Bitcoin’s fundamentals make it a stable funding towards fiat devaluation over time,” Cardozo famous.

Relating to training, Bedzell highlighted that it’s about greedy Bitcoin’s worth and figuring out learn how to maintain it.

“Managing personal keys, understanding pockets choices, and securing funds safely requires a stage of technical literacy that many customers should not have. This steep studying curve deters mainstream adoption and makes Bitcoin much less accessible to non-experts,” he mentioned.

Nevertheless, widespread training gained’t obtain something if Bitcoin lacks a dependable infrastructure to handle elevated transaction quantity.

Issues Over Scalability and Vitality Footprint

Scalability is usually cited as crypto’s Achilles’ heel. Most blockchains –Bitcoin included— undergo from gradual transaction speeds. If the blockchain can’t deal with the demand that comes with world Bitcoin adoption, your complete endeavor turns into futile.

“Bitcoin’s restricted scalability is a significant technical hurdle. The community processes round seven transactions per second, which is vastly inadequate for world monetary methods that require hundreds of transactions per second to perform effectively,” Bedzell informed BeInCrypto.

In the meantime, Bitcoin mining requires intense vitality consumption. The steep useful resource demand and the regulatory pushback that comes with it additional hinder widespread adoption.

“Bitcoin’s Proof-of-Work consensus mechanism consumes huge quantities of electrical energy, typically in comparison with the vitality utilization of small international locations. This raises important environmental issues and clashes with the rising world emphasis on ESG (Environmental, Social, and Governance) requirements. As establishments and governments place growing significance on sustainability, Bitcoin’s excessive vitality footprint may restrict its integration into regulated monetary ecosystems,” he added.

When all is alleged and accomplished, Bitcoin’s remaining hurdles to attaining hyperbitcoinization outweigh its benefits.

Is Saylor’s Imaginative and prescient for Bitcoin an In a single day Actuality?

Even with Saylor’s sturdy perception in Bitcoin’s eventual rise as a superior type of capital, its future dominance will in the end rely on its capability to beat the numerous obstacles it presently faces.

Whereas his sturdy convictions shouldn’t be ignored, Saylor’s imaginative and prescient for Bitcoin won’t occur in a single day. Due to this, traders ought to proceed with warning.

“It relies upon on the particular person. Bitcoin can play a position in a diversified portfolio, however it’s not a one-size-fits-all asset. The volatility and regulatory unknowns imply it’s higher suited for those that perceive the danger,” Kan concluded.

Whereas Bitcoin actually has a spot in the way forward for finance, its current limitations counsel it’s extra of an non-obligatory, high-conviction funding than a normal alternative for everybody.