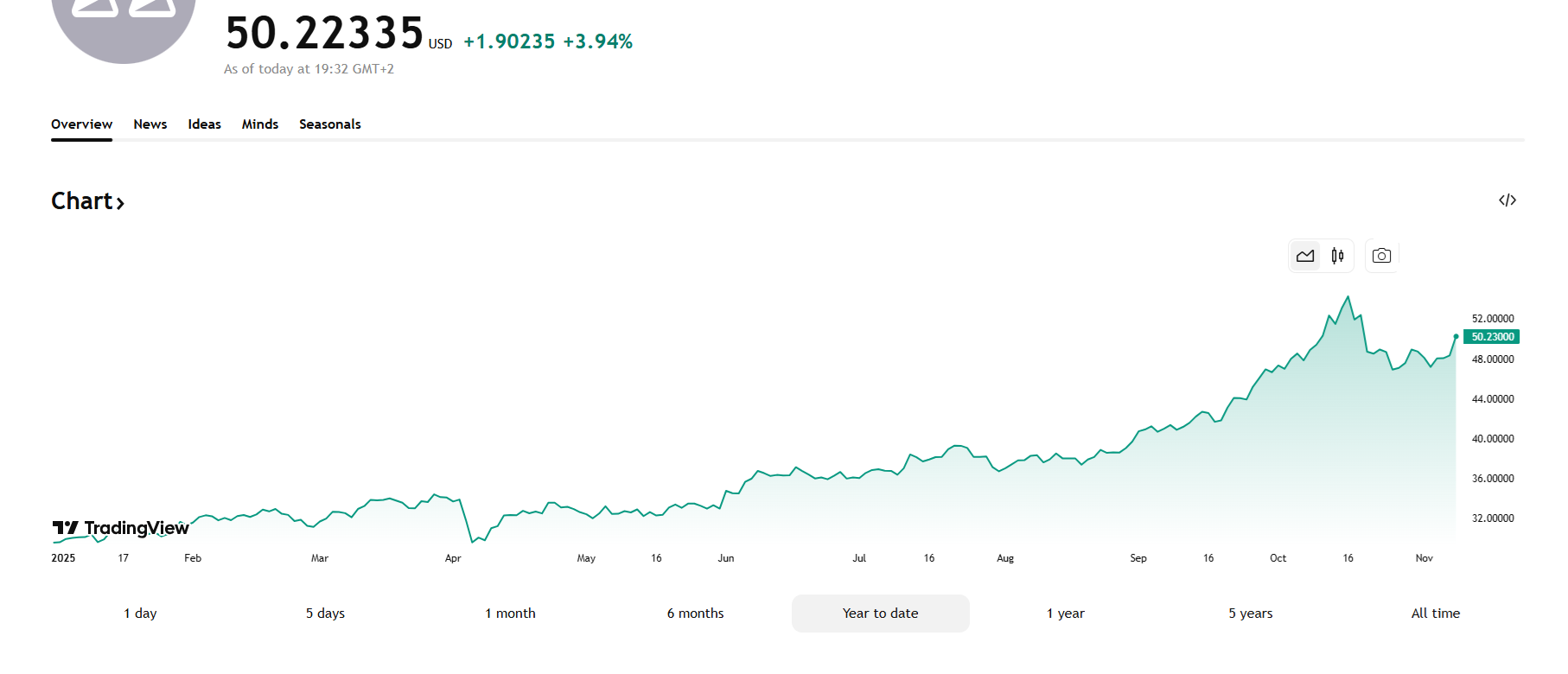

Silver as soon as once more moved above $50, claiming the highest spot as the highest appreciating commerce of 2025. The dear metallic moved forward of gold and BTC once more, pushed by speculative curiosity.

Silver is up over 58% within the yr up to now, surpassing the climb of each gold and BTC. Spot silver traded at $50.23, displacing BTC from its high asset place for the second time this yr.

Silver broke out above $50 for the primary time in three weeks, as bullion deposits flowed into London vaults. Silver is taken into account a devalued asset, anticipating extra long-term development. | Supply: Tradingview

Traditionally, BTC has surpassed conventional asset courses. Nonetheless, in 2025, there are expectations that treasured metals can come up on high. A speculative silver rally, arriving in This autumn, may change the steadiness of high earners for 2025.

BTC shrank its internet good points within the year-to-date all the way down to 30%, buying and selling at above $105,000. Crypto has proven hope {that a} slowdown in treasured metals may result in extra liquidity for digital property. Nonetheless, silver’s ongoing energy could delay the shift to crypto property.

Silver bullion storage reaches nine-year peak

Demand for silver led to file inflows in London’s vaults. Reserves grew to a nine-year excessive, for now calming the fears of shortages. Beforehand, silver deliveries noticed a squeeze, additional boosting the earlier value hike above $54 per ounce.

London vaults added 54M troy ounces of silver in October based mostly on elevated demand. London deliveries accrued after world arbitrage alternatives, as costs of bullion diverged. The inflows adopted a current all-time low for silver inventories in London.

October was marked by a wave of bodily demand in India, in addition to spot shopping for for silver ETFs. On the identical time, merchants withdrew silver from vaults within the US and China, and deposited it to London’s storage. The buildup reveals the arbitrage has labored, leaving the London market with enough provide.

Regardless of the elevated availability, silver nonetheless confirmed development potential. The metallic reacted as gold returned to over $4,100 per ounce.

Will treasured metals cool off?

Silver is a particular case, because the metallic has awaited a breakout for years. The metallic is taken into account suppressed, setting expectations for a run to the next vary.

Regardless of this, treasured metals ran on a mixture of hype and talks of a ‘debasement commerce’. Each gold and silver are anticipated to chill off from their hype-driven rally, however to proceed the climb at a extra sustainable tempo.

Silver is hardly represented as a tokenized asset, and has not triggered hype for creating new digital property based mostly on the metallic. Within the quick time period, merchants anticipate excessive volatility as a result of comparatively low value of silver. The metallic has been accrued in bodily kind and is a staple of long-term traders, however merchants could have a considerably greater threat. Identical to digital property, typically the winners are those that maintain for the long run.