Solana (SOL) continues in a powerful progress, attracting vital capital and customers’ curiosity as 2024 ends and 2025 approaches. This week, for instance, the Solana ecosystem had practically half-a-billion greenback in stablecoins’ influx, whereas the Ethereum ecosystem misplaced thousands and thousands.

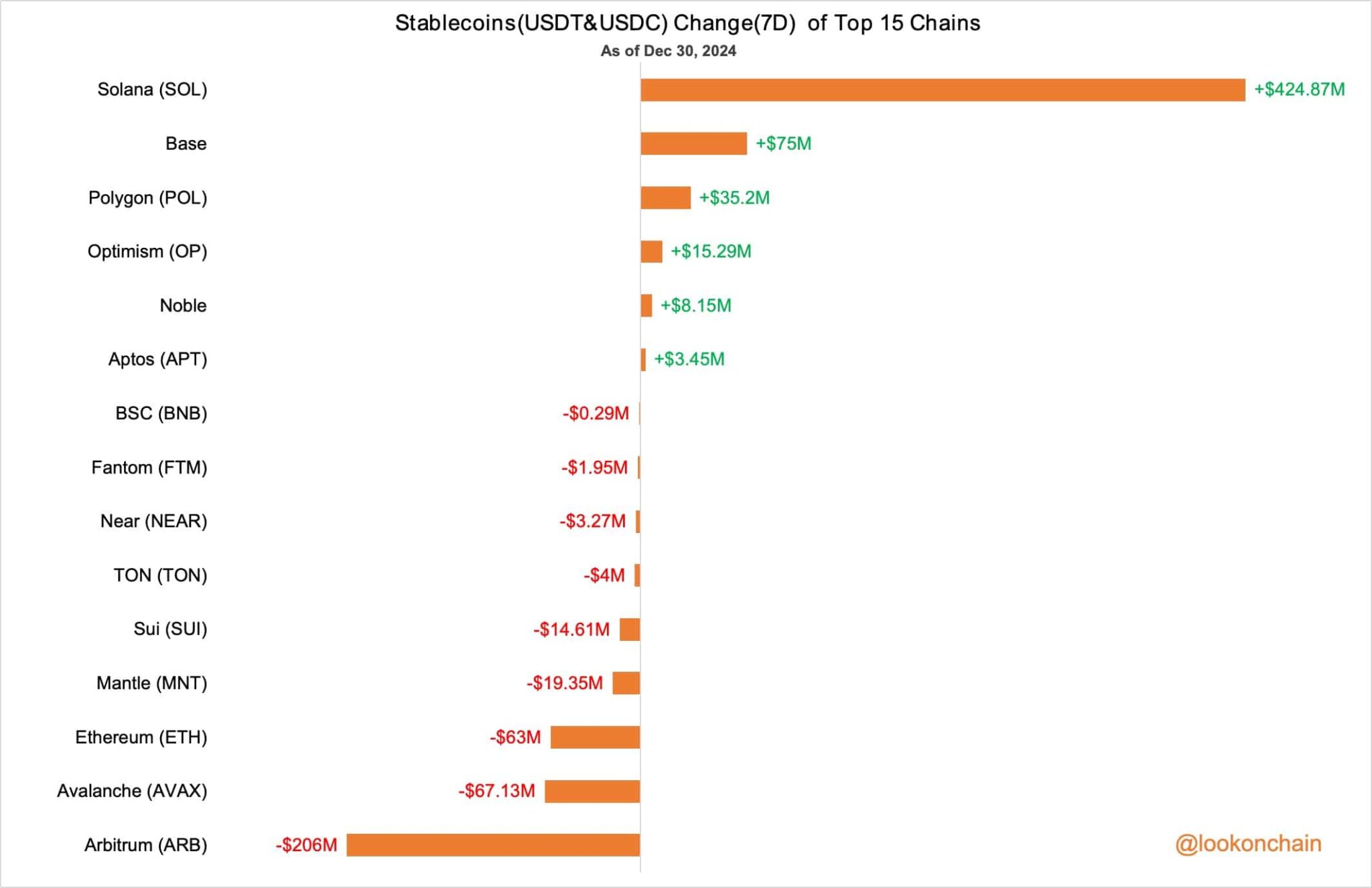

Specifically, Solana had a $424.87 million influx of Tether’s USDT and Circle’s USDC within the final seven days. In keeping with knowledge from Lookonchain, this was the most important stablecoins influx in all blockchains, with Coinbase’s Base in second.

This marks an enormous milestone for Solana that might enhance its ecosystem and SOL’s value to new highs. Primarily, stablecoins influx normally imply elevated demand for the ecosystem and elevated liquidity in decentralized finance (DeFi) protocols.

All that will get much more related when evaluating to how different chains carried out in the identical interval. Lookonchain consolidated that knowledge, in a one-week time-frame from December 30, 2024, evaluating the highest 15 blockchains.

Ethereum and different blockchains’ stablecoins internet circulation

Base, Polygon (POL), Optimism (OP), Noble, and Aptos (APT) joined Solana with a optimistic seven-day stablecoin internet circulation. They absorbed $75 million, $35.2 million, $15.29 million, $8.15 million, and $3.45 million, respectively.

In the meantime, Arbitrum (ARB), Avalanche (AVAX), and Ethereum (ETH), led the highest 15 chains with vital outflows of USDT and USDC. They misplaced $206 million, $67.13 million, and $63 million in stablecoins, respectively, with the Ethereum ecosystem being extremely affected.

Mantle Community (MNT), Sui Community (SUI), The Open Community (TON), Close to Protocol (NEAR), Fantom (FTM), and the BNB Chain (BNB) joined the ranks though with extra balanced flows going from minus $19.35 million to minus $0.29 million, so as.

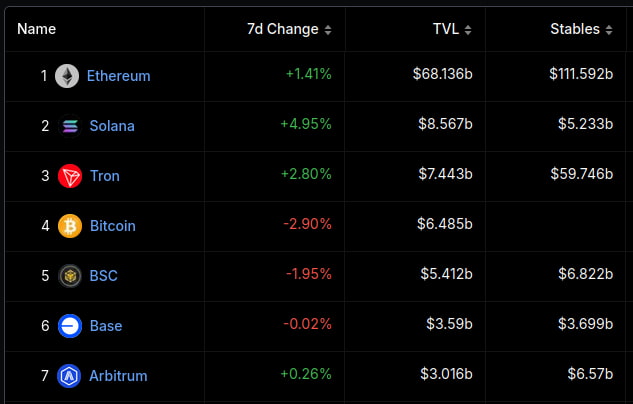

Apparently, nonetheless, the Ethereum ecosystem continues main in stablecoin liquidity, with over $111.59 billion, based on knowledge from DefiLlama. It is a considerably excessive liquidity when in comparison with the $68 billion in complete worth locked (TVL) throughout Ethereum protocols.

Alternatively, Solana at the moment has $5.23 billion in stablecoins, with $8.56 billion in TVL. If the development of the final seven days proceed, Solana might battle for the third place in stables, surpassing BNB and Arbitrum. Binance’s good chain at the moment has $6.82 billion in stablecoins, whereas Arbitrum has $6.75 billion.

Solana (SOL) value evaluation

As of this writing, SOL, Solana’s native token, trades at $187.69, up 3.54% within the final seven days. This value surge is just like Solana’s 4.95% TVL improve in the identical interval. But, it nonetheless lags behind the weekly 8.20% improve in stablecoin liquidity that Finbold reported.

Furthermore, SOL value briefly traded above $200 earlier on this analyzed final seven days. An upward potential of round 6.5% contemplating this native prime alone.

Due to this fact, whereas stablecoins influx doesn’t assure an instantaneous and proportional value surge, it might strengthen its progress potential. USDT and USDC coming into Solana’s ecosystem whereas leaving others like Ethereum’s is an indicator price contemplating and watching.

Moreover, this influx might, not solely profit SOL, but additionally be distributed among the many whole Solana ecosystem, whereas additionally reveals a consumer’s desire in utilizing stablecoins through the Solana blockchain, identified for having quicker finality and decrease charges than Ethereum.

Nonetheless, buying and selling and investing in cryptocurrencies has inherent dangers and unpredictability, requiring warning regardless of the optimistic indicators. SOL value might go each up or down within the following days because the year-end’s anticipated volatility performs its position.

Featured picture from Shutterstock