Polymarket predictions for a Solana exchange-traded fund (ETF) plunge decrease than ever earlier than, to a dim 3%. Nonetheless, some specialists are bullish on the lengthy recreation.

The significance of regulatory adjustments is agreed upon, however the ideally suited type of these adjustments is disputed.

Solana: The Longshot ETF

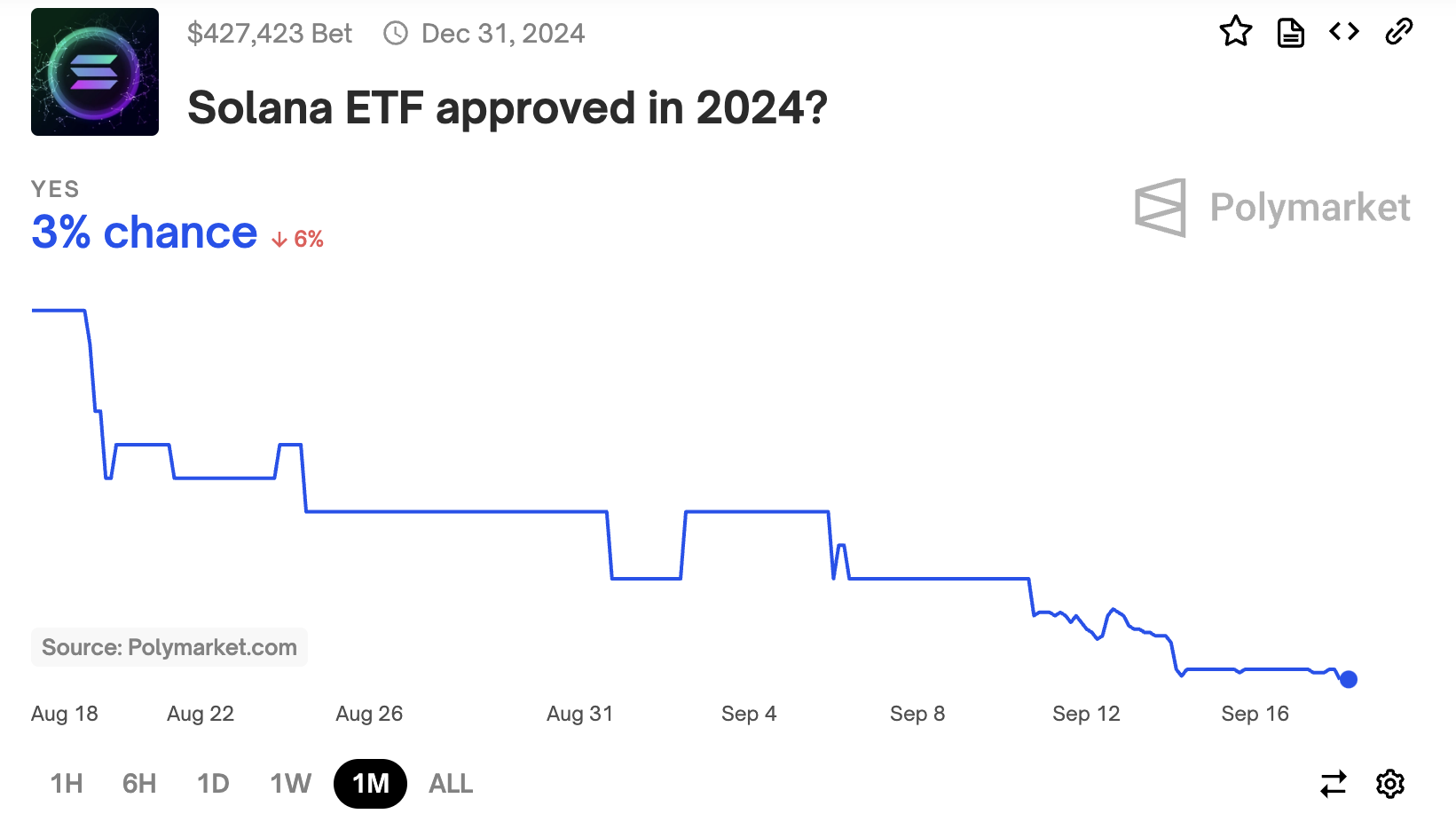

Polymarket, the decentralized prediction market platform, has downgraded the chance of a Solana ETF but once more. For the reason that website started taking bets on the Solana ETF, its likelihood has by no means exceeded 15%. Nonetheless, the previous month has seen this already-low likelihood crash, such that it now sits at a dismal 3%.

Learn Extra: Solana ETF Defined: What It Is and How It Works

Polymarket Solana ETF Chance. Supply: Polymarket

In different phrases, a Solana ETF has all the time been thought of a longshot. And but, it nonetheless has sure benefits that make it extra probably than most cryptoassets.

After a chronic wrestle, the SEC accredited ETFs for Bitcoin and Ethereum in the identical yr, and lots of specialists suppose that Solana is a viable candidate for quantity three. Brazil has already introduced its approval, and hope stays that this ETF will function a priceless check case.

Silver Linings?

Nate Geraci, President of The ETF Retailer, was frank in his dismissal by way of social media.

“It’s tough to check any further spot crypto ETFs coming to market underneath [the] present administration. Nothing would point out a spot Solana or XRP ETF is feasible in subsequent yr or two given [the] present state,” Geraci stated.

For Geraci, in different phrases, the one hope for a Solana trade traded fund would come from the US Presidential election, although he didn’t explicitly again a candidate.

Matt Hougan, the Chief Funding Officer at Bitwise, was extra optimistic. In a current interview, he argued that Bitcoin ETFs spent ten years combating rejections. But, the SEC lastly gave a inexperienced gentle to Bitcoin and Ethereum ETFs in 2024.

The primary approval can open the floodgate, and subsequent victories will likely be simpler.

“From my perspective, decision of uncertainty is crucial issue. We expect these issues are going to coalesce It’s gonna take regulatory adjustments”, he added.

Learn Extra: XRP ETF Defined: What It Is and How It Works

Hougan appeared a lot much less inclined to hyperlink ETF efficiency to the upcoming election itself. Relatively, he claimed that regulatory uncertainty would resolve itself in the course of the marketing campaign, and new ETF efforts would carry out higher within the resultant readability. Bitwise plans to guide these efforts by means of knowledge.

“Bitwise has all the time led with knowledge in its SEC filings. We’re very excited in regards to the Solana ecosystem. We expect it’s sturdy. We’re doing the work,” Hougan claimed.