In a crypto market dominated by worry and defensive positioning, Solana prezzo oggi is trying to stabilize whereas its broader pattern stays clearly bearish.

Day by day bias: bearish backdrop with oversold circumstances

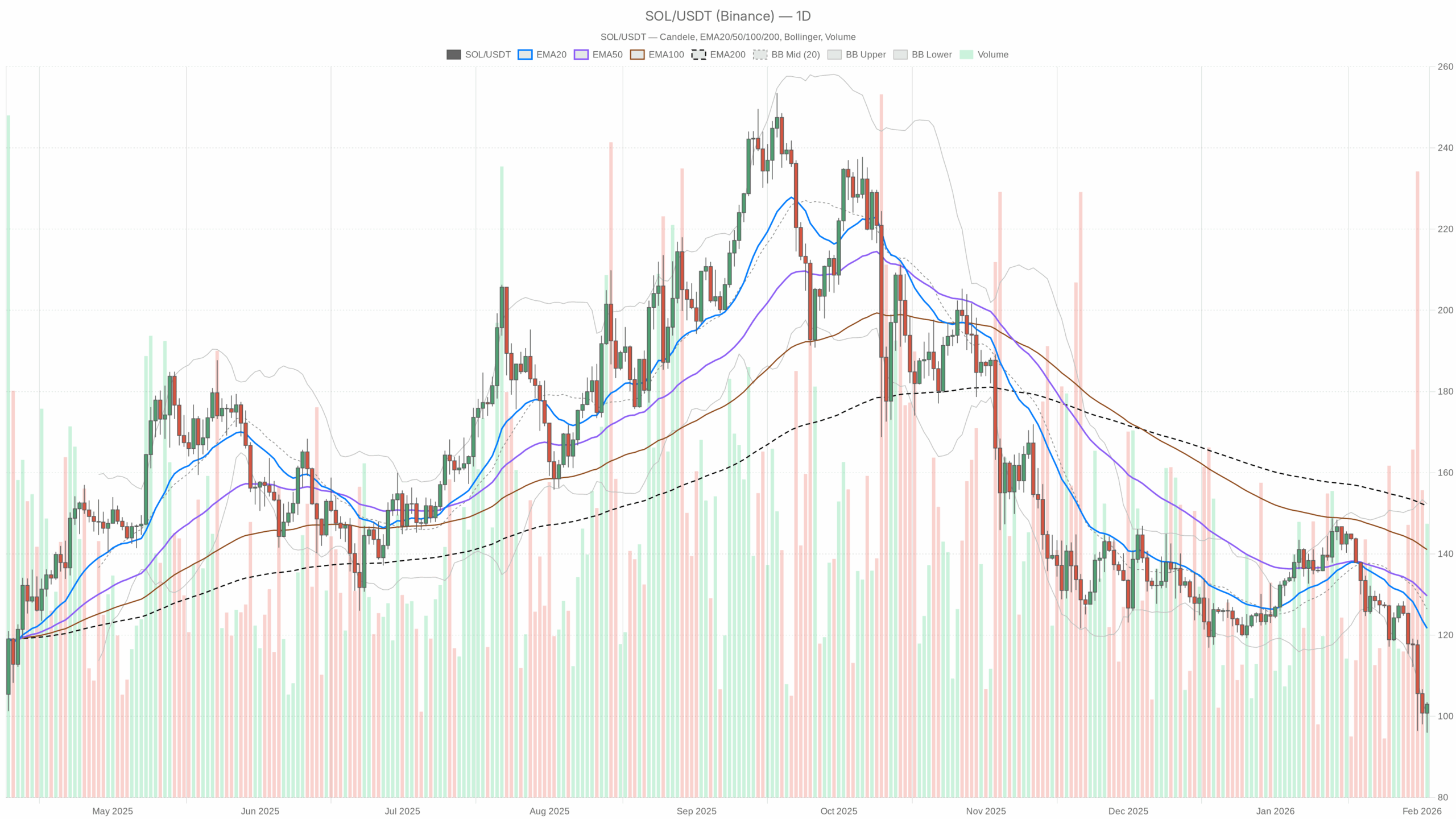

On the every day timeframe (D1), the regime is clearly marked as bearish. Worth at about $102.97 is buying and selling effectively under all key transferring averages and beneath the mid-line of the Bollinger Bands. The construction is that of a downtrend, not only a pullback inside a bull transfer.

EMAs (pattern construction – D1)

– EMA20: 121.67

– EMA50: 129.67

– EMA200: 151.81

Worth is roughly $19 under the 20-day EMA, almost $27 under the 50-day, and nearly $49 underneath the 200-day EMA. All three EMAs are stacked above worth and pointing down, which indicators a mature downtrend quite than a shallow correction. For swing merchants, that is nonetheless a “promote the bounce” surroundings till worth can no less than reclaim the 20-day EMA and maintain above it. The gap from the 200-day additionally reveals that longer-term pattern followers stay in management on the draw back.

RSI 14 (momentum – D1)

– RSI (14): 28.72

RSI sitting under 30 places Solana in oversold territory on the every day. That always aligns with late-stage legs of a selloff the place draw back gasoline begins to skinny out. It doesn’t assure a backside, but it surely will increase the chance of sharp mean-reversion bounces if sellers get crowded. In sensible phrases, momentum is unfavourable however stretched; chasing recent shorts right here on the every day turns into progressively much less engaging except the market cracks key ranges with robust quantity.

MACD (pattern momentum – D1)

– MACD line: -7.26

– Sign line: -4.18

– Histogram: -3.08

The MACD line is under the sign and each are in unfavourable territory, confirming downtrend momentum. The histogram is solidly unfavourable, so the draw back push continues to be current. Nonetheless, when MACD is that this far underwater whereas RSI is oversold, you’re usually nearer to a response transfer (a bounce or consolidation) than the beginning of a brand-new collapse. Bears are in management, however the risk-reward shouldn’t be as one-sided because it was earlier within the transfer.

Bollinger Bands (volatility & imply – D1)

– Center band (20-day foundation): 126.39

– Higher band: 152.31

– Decrease band: 100.47

– Worth: 102.97

Solana is hovering simply above the decrease Bollinger Band, with the center band far above present worth. That reveals worth has traveled to the decrease fringe of its latest volatility vary and is making an attempt to stabilize there. When worth hugs the decrease band, it confirms the downtrend. Nonetheless, proximity to the band additionally means the rapid draw back is restricted by prior volatility. Any robust every day shut again towards the center band would mark a shift towards imply reversion, whereas a clear breakdown under the decrease band would sign a recent volatility enlargement decrease.

ATR 14 (volatility – D1)

– ATR (14): 7.77

A mean true vary of roughly $7.8 means every day swings of round 7–8% relative to present worth, which is elevated however not excessive for Solana. Volatility is excessive sufficient that ranges get examined rapidly, however not at capitulation ranges. From a threat standpoint, this means wider stops and smaller place sizes are wanted to outlive routine every day noise.

Pivot ranges (reference ranges – D1)

– Pivot level (PP): 100.79

– Resistance 1 (R1): 105.63

– Help 1 (S1): 98.13

Worth is buying and selling simply above the every day pivot at $100.79, leaning nearer to R1 at $105.63 than to S1. This tells you we’re in a tactical bounce zone inside a broader downtrend. Holding above the pivot retains the door open for a take a look at of R1 and possibly greater intraday resistances. Dropping the pivot after which S1 would reinforce the concept that the every day downtrend nonetheless has room to run.

Intraday image: stabilization, not a confirmed reversal

1-hour chart (H1): impartial with a constructive tilt

– Worth: 102.99

– EMA20: 102.02

– EMA50: 105.12

– EMA200: 115.30

– RSI (14): 51.6

– MACD histogram: 0.48

– Bollinger mid: 101.49 (bands 99.22 – 103.75)

– ATR (14): 2.62

– H1 pivot: 103.02 (R1 103.42, S1 102.59)

On the hourly, the regime is marked impartial. Worth is simply above the 20-EMA, however nonetheless under the 50-EMA and much under the 200-EMA. That’s typical of a market within the early levels of a possible rebound inside a dominant downtrend. Brief-term patrons are defending dips, however they haven’t flipped the construction but.

RSI round 52 reveals balanced momentum, now not oversold intraday. Furthermore, the MACD histogram turning barely optimistic hints that short-term momentum has shifted in favor of the bulls for now, however it’s a modest edge, not a runaway uptrend.

Worth is hovering close to the hourly pivot at $103.02, just below R1 at $103.42 and above S1 at $102.59. That’s basic consolidation habits: the market is probing either side of the vary with no decisive break. ATR at $2.62 underlines that intraday swings of two–3% are regular proper now. These are sufficient to shake out tight stops however not an indication of panic.

15-minute chart (M15): short-term bounce, nonetheless inside greater downtrend

– Worth: 102.99

– EMA20: 101.92

– EMA50: 101.52

– EMA200: 104.86

– RSI (14): 60.63

– MACD histogram: 0.16

– Bollinger mid: 101.67 (bands 99.27 – 104.07)

– ATR (14): 0.74

– M15 pivot: 102.87 (R1 103.13, S1 102.74)

On the 15-minute chart, Solana is in a tactical up-phase. Worth is above each the 20- and 50-EMAs, with RSI round 61, displaying delicate bullish momentum. MACD is barely optimistic, supporting the thought of intraday dip shopping for.

Nonetheless, the 200-EMA at $104.86 sits above worth and acts as a cap for now. That’s the line between a easy intraday bounce and a extra convincing short-term pattern change. So long as worth stays under that 200-EMA on M15, this transfer is greatest considered as a aid bounce inside a much bigger, still-bearish every day context.

The 15-minute pivot at $102.87 has been reclaimed and is now appearing as short-term assist, with R1 at $103.13 simply overhead. Intraday gamers are successfully buying and selling a good vary between 102.7–103.5, searching for a break that aligns with the hourly construction.

Broader context: Solana inside a fearful altcoin market

The dominant power in the meanwhile is risk-off positioning in a crypto market gripped by Excessive Concern (index at 14) and a barely shrinking whole market cap. Bitcoin dominance above 57% reveals capital hiding within the benchmark quite than rotating aggressively into altcoins like Solana. In different phrases, SOL is looking for a flooring in an surroundings that isn’t pleasant to altcoin threat.

From a macro crypto perspective, Solana at the moment accounts for about 2.16% of whole crypto market cap. BTC dominance above 57% and the Concern & Greed Index in Excessive Concern inform you what’s going on: capital is defensive, preferring Bitcoin and stablecoins over high-beta altcoins. On high of that, whole market cap is down roughly 1.2% over 24 hours, confirming a tender threat backdrop.

On-chain and DeFi exercise on Solana stays non-trivial: protocols like Raydium, Orca, Meteora, SolFi are nonetheless producing notable charges, with some seeing robust 7–30 day progress. That could be a reminder that the ecosystem shouldn’t be lifeless. Nonetheless, within the quick time period, worth is buying and selling macro sentiment, not fundamentals. For merchants, meaning respecting technical ranges first and treating basic power as a purpose to look at for, not front-run, a reversal.

Fundamental state of affairs for Solana prezzo oggi (D1-driven)

Given the every day construction, the major bias is bearish with a rising threat of a countertrend bounce. D1 pattern and MACD are nonetheless down, EMAs are all overhead, and worth is buying and selling close to the decrease Bollinger Band with an oversold RSI. That mixture usually precedes short-covering rallies, however these rallies usually run into heavy provide on the nearest EMAs and prior assist zones turned resistance.

Bullish state of affairs

For bulls, the play right here is imply reversion inside a bearish pattern:

– First step: Maintain above the every day pivot at $100.79 and defend the $98–100 zone (round S1 and the decrease Bollinger Band at $100.47). So long as this space holds on a closing foundation, the market has a platform for a bounce.

– Close to-term goal: Push towards and thru $105–108, roughly aligning with intraday R1 ranges and the highest of the latest hourly vary. That may affirm that the present intraday bounce has legs.

– Stronger affirmation: A every day shut above the 20-day EMA at $121.67 can be the primary severe signal that the downtrend is shedding management. At that time, the goal zone opens towards the 50-day EMA round $129–130 and the center Bollinger Band at $126.39 as a pure magnet.

What invalidates the bullish state of affairs?

A decisive every day shut under $98, extending away from the decrease Bollinger Band, would present that demand failed even at oversold ranges. Mixed with RSI staying pinned underneath 30, that may point out a recent leg decrease quite than a bounce, successfully sidelining the bullish mean-reversion thesis.

Bearish state of affairs

Bears nonetheless management the upper timeframe, and their base case is a continuation of the pattern after a pause:

– Preliminary line within the sand: The $105–108 zone. So long as worth stays under this pocket on a closing foundation, rallies are simply gasoline for brand new shorts. This area aligns with short-term resistances and sits effectively under the 20-day EMA, preserving the larger downtrend intact.

– Continuation set off: A breakdown and sustained buying and selling under $98 would seemingly set off stops and stress the market into a brand new seek for assist. With volatility (ATR) elevated, a break might lengthen rapidly by one other $7–10 over just a few periods.

– Draw back focus: In that case, the market can be looking for a brand new equilibrium under the present Bollinger Band construction, seemingly forcing RSI even deeper into oversold territory earlier than any sustainable bottom-building course of can start.

What invalidates the bearish state of affairs?

If Solana reclaims and holds above the 20-day EMA (~$122) with every day closes, the character of this transfer modifications. That may sign that sellers are shedding follow-through and that the market is transitioning from a trending down transfer right into a broader consolidation and even the early levels of a brand new uptrend. Bears would then must rethink, particularly if RSI recovers above 40–50 and MACD begins to twist greater towards a possible cross.

How to consider positioning, threat, and uncertainty

Proper now, timeframes are in stress: the every day chart is clearly bearish and oversold, whereas intraday charts (H1 and M15) are stabilizing and leaning barely bullish. That usually results in uneven circumstances the place countertrend trades can work, however provided that threat is tightly managed and revenue expectations are modest.

For directional merchants, the important thing selections are:

– Do you commerce the dominant every day downtrend and search for entries on bounces towards resistance?

– Or do you commerce the oversold bounce on the lengthy aspect, understanding you’re going towards the upper timeframe pattern and should be faster to take earnings?

In each instances, volatility metrics (ATR) on every timeframe are your information for place sizing and cease distance. Day by day ATR close to $7.8 and H1 ATR round $2.6 imply that tight stops inside regular noise will probably be punished. Sizing smaller and respecting structural ranges (<$98 on the draw back, >$122 on the upside for the larger image) is vital to keep away from getting whipsawed by routine volatility.

Finally, Solana is sitting at an attention-grabbing however dangerous spot: late in a down-leg, in a fearful macro surroundings, with early indicators of intraday stabilization. That mixture can produce highly effective quick squeezes, however it might simply as simply produce one other flush if the broader crypto market takes one other step down. The market is undecided; your threat administration shouldn’t be.

If you wish to monitor markets with skilled charting instruments and real-time information, you may open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We might earn a fee at no further price to you.

Disclaimer: This evaluation is for informational and academic functions solely and isn’t funding, monetary, or buying and selling recommendation. Markets are risky and unpredictable; at all times do your individual analysis and take into account your threat tolerance earlier than making any buying and selling choices.