Within the present market context, the Solana worth is transferring in a managed rise above $145, with a constructive pattern however more and more slender margins for error.

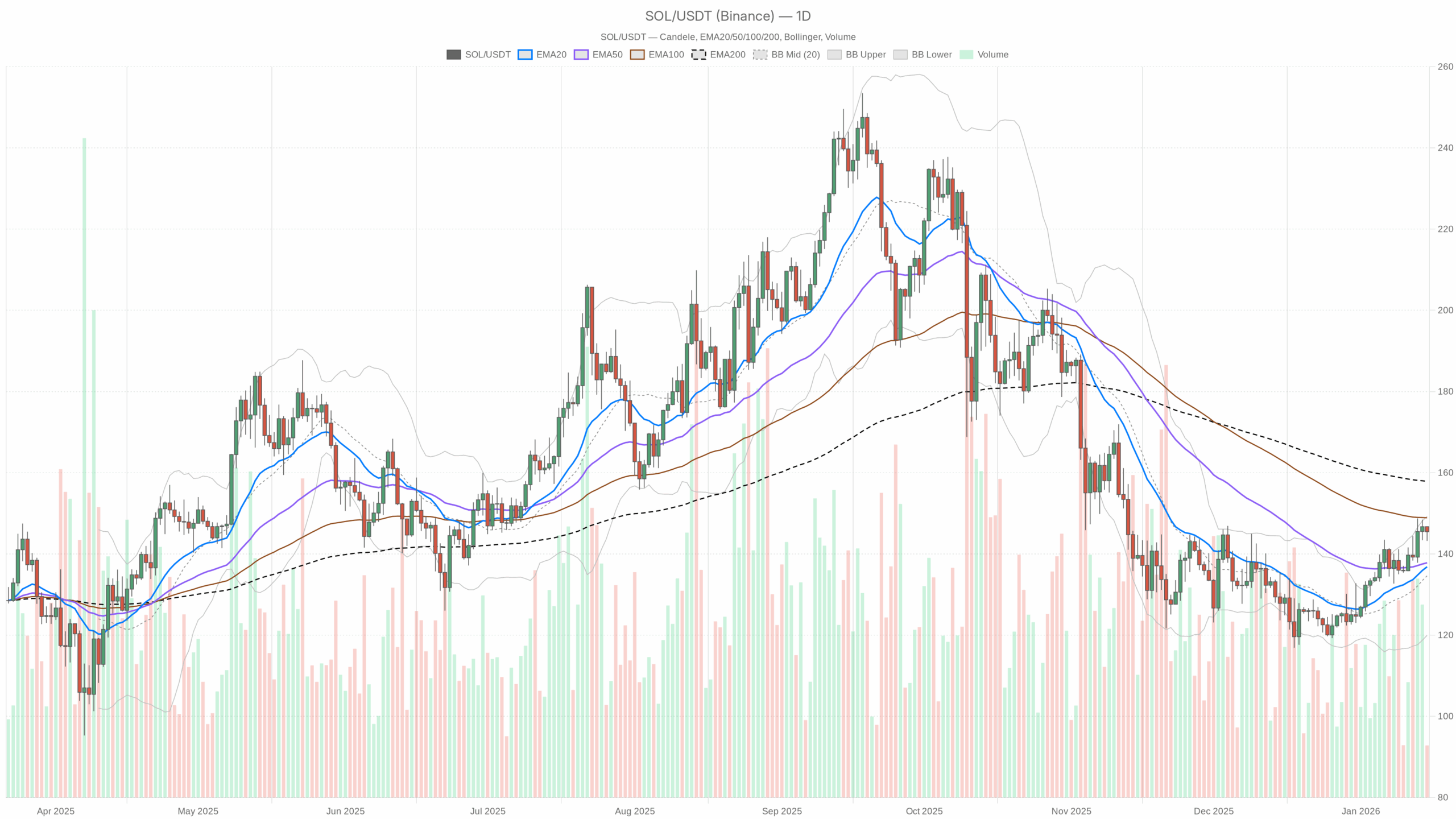

SOL/USDT with EMA20, EMA50 and volumes”

SOL/USDT with EMA20, EMA50 and volumes”loading=”lazy” />

Primary State of affairs on D1: Rise Above Common, however Under the 200

The worth of Solana (SOLUSDT) right this moment is transferring round $145.5, in what I’d outline as a managed rise: the underlying pattern on the each day stays constructive, however we’re more and more near a zone the place aggressive profit-taking is simple to see.

The overall crypto context continues to be favorable (Worry & Greed index at 61 – Greed), however not in full euphoria. In follow: there’s a want to tackle threat, however any too speedy extension dangers being bought.

On the each day chart Solana is quoted round $145.46, above the quick averages however nonetheless under the EMA 200, which is round $157.9. This is a crucial element: the market is shopping for the pullbacks, however the true medium-term wall stays increased.

EMA (Exponential Transferring Averages) – D1

- EMA 20: $136.82

- EMA 50: $137.81

- EMA 200: $157.88

The worth is nicely above EMA 20 and 50, with the 2 averages virtually aligned and under the worth, whereas the 200 stays increased. This means a short-medium time period bullish pattern, nonetheless embedded in a longer-term construction that has not been absolutely reclaimed. So long as we keep above $137–138, patrons have operational management; above $158 we’d have a stronger sign of structural restoration.

Each day RSI (D1)

The RSI is in a bullish zone however not excessive. This means a optimistic push, with residual room for one more leg up earlier than coming into the overbought space. In easy phrases: the market is purchased, however not but in full overheating. The primary actual overbought tensions begin above about 70.

Each day MACD (D1)

- MACD line: 3.79

- Sign: 2.24

- Histogram: 1.55 (optimistic)

The MACD is optimistic and above the sign, with the histogram additionally optimistic. Translated: the underlying momentum stays in favor of patrons, with no evident indicators of bearish reversal on the each day. The part isn’t explosive, however in step with a progressive rise.

Each day Bollinger Bands (D1)

- Median: $134.59

- Higher Band: $149.24

- Decrease Band: $119.93

The worth is close to the higher band ($145.46 towards $149.24). Which means Solana is buying and selling within the higher a part of its current volatility vary: a typical conduct of wholesome bullish tendencies, but in addition a zone the place the possibilities of technical pullbacks or lateral consolidations enhance. A each day shut above $149–150 could be a marked sign of power, whereas repeated rejections under that vary might point out the beginning of short-term distribution.

Each day ATR (D1)

The ATR signifies a mean each day volatility round $6. In follow, each day actions of three–4% up or down are completely regular on SOL right now. For these working within the brief time period, positions with out enough room for cease threat being worn out by regular market noise.

Each day Pivot Factors (D1)

- Central Pivot (PP): $145.13

- Resistance R1: $147.06

- Help S1: $143.54

The present worth ($145.46–145.5) is near the each day pivot, barely above. This positioning suggests a fragile stability: small shopping for flows might push in the direction of $147, whereas a weak session could be sufficient to rapidly return to the $143.5 space. In follow, we’re at an intraday resolution level fairly than in an excessive zone.

H1: Development Nonetheless Bullish, however Momentum Slowing

On the hourly chart, Solana is quoted round $145.49. The hourly regime is assessed as bullish, however indicators of cooling momentum are starting to emerge.

EMA on H1

- EMA 20: $145.24

- EMA 50: $144.44

- EMA 200: $140.53

Value above all averages, with bullish construction: the averages are organized within the right order (worth > EMA 20 > EMA 50 > EMA 200). The gap from the 200 is vast, indicating that the rise in current classes has been decisive. Nonetheless, the angle of ascent of the sooner averages is moderating: the pattern stays optimistic, however extra mature.

RSI on H1

The hourly RSI has returned near the impartial zone. This means that, within the brief time period, the euphoria has already dissipated: the market is neither stretched to the upside nor the draw back. It’s a typical context for a pause or redistribution part after a earlier motion.

MACD on H1

- MACD line: 0.05

- Sign: 0.12

- Histogram: -0.07 (barely adverse)

The hourly MACD is exhibiting a slight slowdown in bullish momentum: MACD line just under the sign, histogram barely adverse. It’s not but a robust reversal sign, however extra of a warning that the bullish motion is catching its breath. If this divergence extends and the worth doesn’t replace the highs, the chance of intraday correction will increase.

Bollinger Bands on H1

- Median: $145.62

- Higher Band: $147.74

- Decrease Band: $143.50

The worth is just under the median, within the higher third of the channel however not involved with the higher band. This setup suggests a consolidation part close to native highs, with room for both a brand new check of the higher band (round $147.7) or a return in the direction of the middle of the vary.

ATR and Pivot on H1

- ATR 14 H1: $1.10

- Pivot H1 (PP): $145.48

- Resistance R1 H1: $145.62

- Help S1 H1: $145.34

The hourly volatility is contained, with a typical vary of about $1 per hour. The worth is virtually glued to the hourly pivot, between very shut R1 and S1: an ideal context for chop and false intraday breakouts, particularly for these working with excessive leverage and tight stops.

M15: Micro-Rise, however Very Delicate Technical Space

On the quarter-hour, SOL is at $145.5, with a barely bullish image however with out explosiveness. It’s the basic situation the place the worth can break upwards or rapidly stall.

EMA on M15

- EMA 20: $145.10

- EMA 50: $145.15

- EMA 200: $144.57

Value simply above the quick averages, that are very shut to one another: a sign of a micro-bullish pattern however not significantly directional. The 200 at $144.57 acts as an vital intraday dynamic assist: so long as we keep above, very short-term patrons stay in management.

RSI and MACD on M15

- RSI 14 M15: 57.05

- MACD line: 0.18

- Sign: 0.09

- Histogram: 0.09 (optimistic)

RSI above 50 and MACD barely optimistic point out a short-term bullish push nonetheless alive, however not excessive. It is a perfect context for lengthy scalping so long as the worth continues to respect rising lows; nevertheless, simply a few decisive crimson candles are sufficient to rapidly reverse this stability.

Bollinger Bands and Pivot on M15

- Median BB M15: $144.94

- Higher Band: $145.97

- Decrease Band: $143.91

- Pivot M15 (PP): $145.48

- R1 M15: $145.63

- S1 M15: $145.35

The worth travels between the median and the higher band and, once more, virtually on the pivot. This setup confirms the thought of a micro-rise in an space of equilibrium: the market has room for an extension in the direction of $146–147, but in addition for a return in the direction of $145–144.5 with out the underlying pattern being really compromised.

Multi-Timeframe Abstract: Bullish, however Not Foolproof

- D1: Bullish construction above quick averages, optimistic momentum however close to the higher a part of the Bollinger Bands.

- H1: Rise nonetheless current, however with cooling momentum (weakened MACD, impartial RSI).

- M15: Intact micro-rise, however close to key technical ranges, straightforward to spoil with false breakouts.

The general image stays bullish, however with a transparent sign: the straightforward part of the motion could already be behind us. From right here on, sensitivity to profit-taking will increase and the dangers of traps for these coming into late.

Bullish State of affairs on Solana Value (SOLUSDT)

The bullish situation begins from the concept that the present worth of Solana manages to consolidate above the $143–145 zone and entice new patrons on any small pullbacks.

What Patrons Want

- Hold the Solana worth right this moment steadily above the each day pivot at $145.1.

- Defend the assist vary $143.5–144 (S1 each day plus EMA 20–50 zone on decrease timeframes).

- Push in the direction of and past $147–149, which coincides with R1 each day and the higher band of the Bollinger Bands.

If this script performs out, the worth chart of Solana might draw a sequence of rising highs and lows with progressive targets:

- First goal: $149–150 (each day higher band, spherical psychological resistance).

- Second prolonged goal: $155–158, the place the each day EMA 200 passes. Right here I anticipate robust friction: it’s a degree that the market sees.

On this situation, the Solana USD citation would stay oriented upwards and any retracement in the direction of $140–142 would seemingly be seen as a shopping for alternative by place merchants.

Ranges That Invalidate the Bullish State of affairs

- Each day closes under $140, which might convey the worth again inside or under the quick averages vary.

- Each day RSI that falls steadily under 50, signaling that management passes again to sellers.

- Internet lack of the each day EMA 50 ($137.8) with elevated promoting volumes: this may be a robust warning bell for these lengthy within the medium time period.

Bearish State of affairs on Solana Value

The bearish situation depends on the concept that the present worth of Solana within the $145–147 space is extra a distribution zone than a base for a restart. On this case, the market would have already began unloading positions in revenue above $140.

What Sellers Want

- Repeated rejection of the $147–149 space with reversal candles and growing volumes.

- Decisive break of $143.5 (S1 each day) and subsequent consolidation under $143.

- Downward inclination of the each day EMA 20 and 50, with the worth remaining under them for a number of classes.

If this situation takes maintain, the bearish targets develop into:

- First assist: $140–141, psychological threshold and space the place the primary rebound try may be anticipated.

- Subsequent assist: $136–138, key space as a result of it coincides with the each day quick averages. A clear break right here would open area in the direction of $130.

On this framework, the dwell Solana worth may nonetheless seem comparatively excessive in comparison with the medium-term construction, and intraday rebounds would seemingly be used to lighten lengthy positions fairly than construct new ones.

Ranges That Invalidate the Bearish State of affairs

- Secure each day closes above $150, which might sign the power of patrons even on key resistances.

- Reclaim and maintain of the each day EMA 200 at $157–158.

- Each day RSI rising above 70 with out instant reversal, signaling a real breakout part, not only a short-term extra.

The best way to Learn the Present Context if You Commerce SOL

Internet of all of the numbers, the market message is sort of clear:

- The present worth of Solana is embedded in an underlying bullish pattern on the each day.

- Decrease timeframes (H1, M15) present a consolidation part after the motion, fairly than a brand new decisive impulse.

- The volatility is such that actions of some {dollars} don’t change the course, however can simply set off too tight stops.

For these trying on the market from an operational perspective:

- Brief-term merchants (intraday/scalping): the $145–147 zone is as attention-grabbing as it’s harmful. The worth is above the averages however resting on shut pivots: false breakouts above $147 or false breaks under $143.5 are very seemingly. It is smart to suppose extra when it comes to response to ranges than chasing the worth.

- Place merchants: the each day chart stays constructive so long as SOL stays above $137–140. The actual structural check shall be within the $150–158 zone. Till then, the present rise may be seen as an intermediate leg inside a broader reconstruction course of.

The principle threat in a context like that is complicated a consolidation on the high with an imminent breakout and shopping for too late, simply when the chance of correction will increase. Conversely, these already lengthy nonetheless have the underlying pattern on their aspect, however should settle for that, at these ranges, volatility can work towards them in very brief instances.

For these monitoring the Solana worth in real-time, the degrees to look at within the coming classes stay:

- Key helps: $143.5, $140, $137–138.

- Key resistances: $147–149, $150, $155–158.

As all the time with unstable property like Solana, indicators provide context, not certainties: the market can stay irrational longer than a single technical sign may counsel. Working with clear various situations and outlined invalidation ranges stays the most effective protection towards false indicators and sudden sentiment adjustments.

If you wish to monitor the markets in real-time with superior charts {and professional} instruments, you possibly can open an account on Investing.com!:

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We could earn a fee however at no further price to you.

Disclaimer: The data contained on this article is for informational functions solely and doesn’t represent funding recommendation or a solicitation to save lots of. Cryptocurrency buying and selling includes a excessive degree of threat and is probably not appropriate for all traders. Rigorously take into account your aims, expertise, and threat tolerance earlier than buying and selling within the markets.