In a market dominated by danger aversion, Solana worth motion round $80 is unfolding in opposition to a backdrop of maximum worry and heavy stress on altcoins.

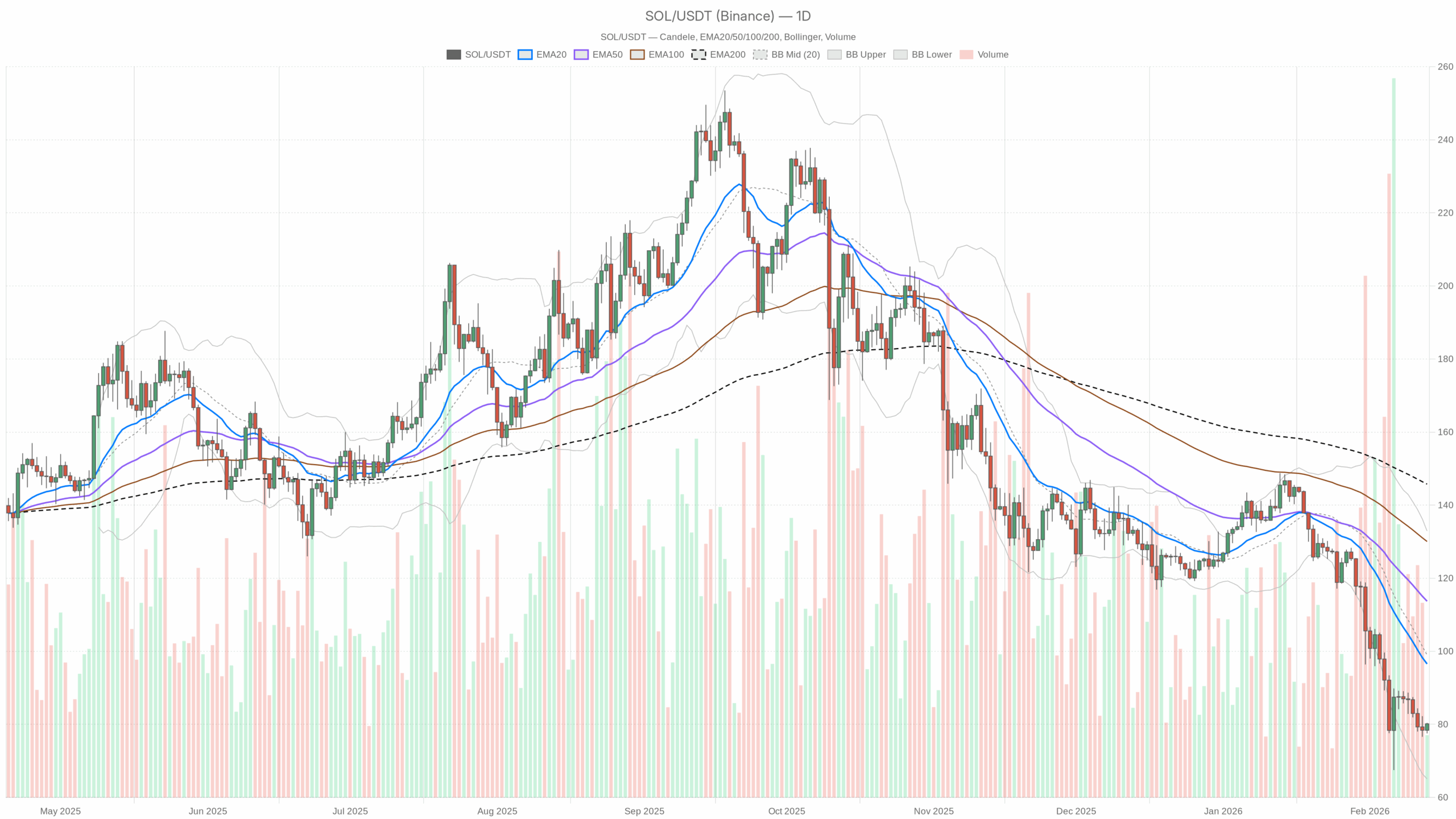

SOL/USDT each day chart with EMA20, EMA50 and quantity”

SOL/USDT each day chart with EMA20, EMA50 and quantity”loading=”lazy” />

Dominant State of affairs from the Day by day Chart: Nonetheless Bearish

The each day timeframe (D1) defines the primary bias, and right here the message is obvious: the main state of affairs is bearish.

- Day by day shut: $80.16

- Day by day development regime: bearish

- Market backdrop: complete market cap down ~1.3% in 24h, excessive worry, BTC dominance excessive

In plain language, Solana is buying and selling as a weak altcoin in a risk-off crypto tape. Dips can bounce, however the burden of proof is on the bulls to reclaim misplaced ranges. For now, rallies usually tend to be offered than prolonged.

Day by day Indicators: Construction, Momentum, and Volatility

Exponential Shifting Averages (EMA20, EMA50, EMA200) – Development Construction

- EMA 20 (short-term): $96.55

- EMA 50 (medium-term): $113.71

- EMA 200 (long-term): $145.76

- Value: $80.16 (nicely under all three)

The EMAs are stacked in a traditional downtrend configuration: worth < 20 < 50 < 200. The hole between spot and the 20-day EMA is large, greater than $16, which reveals how aggressively worth just lately indifferent to the draw back. That kind of distance can not keep that stretched perpetually. Both the development continues with grinding decrease lows whereas EMAs catch down, or there’s a mean-reversion bounce towards the 20-day.

In apply, $96–100 (across the 20-day EMA and each day Bollinger mid) is now the primary critical gravity zone above. So long as SOL is trapped beneath that band, the upper timeframe development stays firmly in opposition to the bulls.

RSI (14) – Oversold however Not But Repaired

Day by day RSI is sitting beneath 30, firmly in oversold territory. That always indicators two issues concurrently: promoting has been heavy, and the simple a part of the quick commerce could also be behind us. Nevertheless, oversold alone doesn’t imply backside. Markets can keep oversold in persistent downtrends.

Proper now, this setup says the downtrend is stretched, so countertrend bounces are more and more seemingly, however the RSI has not began a convincing rebound but. Bulls have to push RSI again above the low 30s after which 40+ to argue that momentum is definitely turning, not simply pausing.

MACD – Bear Momentum Nonetheless in Management

- MACD line: -12.76

- Sign line: -11.63

- Histogram: -1.13

MACD is deeply damaging, with the road under the sign and a damaging histogram. The bearish impulse will not be as explosive as it will be with a sharply widening histogram, however the market is clearly nonetheless within the bear momentum section, not but in a momentum reset.

For a sustainable bullish story, you’ll wish to see the histogram transfer towards zero and ultimately flip constructive, ideally whereas worth is reclaiming that $96–100 zone. Till then, the MACD confirms that the each day development continues to be down, regardless of the oversold studying on RSI.

Bollinger Bands – Buying and selling within the Decrease Half, Not Free-Fall

- Center band (20-day foundation): $99.00

- Higher band: $132.92

- Decrease band: $65.08

- Value: $80.16

SOL is buying and selling under the center band and nearer to the decrease band, however not pinned to it. That often indicators a managed downtrend slightly than panic liquidation. Value already frolicked transferring towards the decrease band. Now it’s hovering above it, suggesting promoting stress has cooled a bit, however the bias stays down.

The house between $80 and the decrease band round $65 is vital. If worth begins using that decrease band once more, it opens the door for one more leg decrease towards the mid-60s. A transfer again towards the center band close to $99 can be a typical mean-reversion path if consumers step in with conviction.

ATR (14) – Elevated however Not Excessive Volatility

Day by day ATR round $9.5 on an $80 asset means roughly 12% common each day vary. That’s elevated, however not absurd for Solana. Volatility is excessive sufficient that ranges might be examined shortly, however the market will not be in a blow-off or capitulation regime. For merchants, it means wider stops are wanted, and intraday noise might be brutal round key ranges.

Day by day Pivot Ranges – Brief-Time period Reference Factors

- Pivot level (PP): $79.37

- Resistance 1 (R1): $81.21

- Assist 1 (S1): $78.32

Value at $80.16 is sitting simply above the each day pivot, with R1 close by at $81.21. That may be a very tight vary relative to the each day ATR, so you must deal with these ranges as short-term intraday reference factors slightly than main structural zones.

Holding above $79–78 retains the door open for a continued intraday bounce. A agency break under S1 on a closing foundation would present that sellers are again urgent the tape, aiming towards the mid-70s and even that decrease Bollinger band within the mid-60s over time.

Intraday Image: 1-Hour and 15-Minute Timeframes

1-Hour (H1) – Trying a Modest Bounce

- Shut: $80.18

- EMA 20: $79.18

- EMA 50: $80.06

- EMA 200: $85.31

- RSI 14: 57.42

- MACD line: -0.12 vs sign -0.40, histogram +0.29

- Bollinger mid: $78.57, higher: $80.35, decrease: $76.78

- ATR 14: $0.8

- Pivot: $80.12, R1: $80.48, S1: $79.83

- Regime: impartial

On the 1-hour chart, SOL is edging again right into a short-term restoration.

Value is buying and selling above the 20-hour EMA and hugging the 50-hour EMA. That mixture usually marks a nascent bounce inside a bigger downtrend. The 200-hour EMA at $85.31 hangs overhead as the primary critical intraday development barrier. That’s the place you’ll anticipate sellers to lean in if the bounce continues.

RSI round 57 reveals intraday momentum has shifted from oversold to mildly bullish. It isn’t overheated, so there’s room for continuation if consumers keep energetic. MACD on H1 has simply turned constructive on the histogram with the road curling up towards the sign, early however actual proof of a short-term momentum restoration.

Bollinger Bands on H1 put worth close to the higher band at $80.35, which regularly coincides with a neighborhood pause or consolidation throughout a bounce. ATR of $0.8 tells you the typical hourly vary is modest. The market will not be in a violent squeeze however in a managed rebound.

The intraday pivot round $80.12 is successfully being examined in actual time. Holding above that intraday pivot after which above R1 ($80.48) would sign that consumers are steadily gaining the higher hand on quick timeframes, no less than for a push towards $82–84 the place prior provide could sit.

15-Minute (M15) – Brief-Time period Momentum Favors Bulls

- Shut: $80.18

- EMA 20: $79.40

- EMA 50: $79.03

- EMA 200: $79.96

- RSI 14: 66.45

- MACD line: 0.40 vs sign 0.30, histogram +0.10

- Bollinger mid: $79.18, higher: $80.53, decrease: $77.84

- ATR 14: $0.4

- Pivot: $80.20, R1: $80.38, S1: $80.00

- Regime: impartial

The 15-minute chart is short-term bullish inside that larger bearish context. Value is above all key EMAs, together with the 200-period at $79.96, forming a small intraday uptrend. RSI close to 66 reveals sturdy, however not excessive, short-term shopping for stress.

MACD is constructive, and the histogram is barely above zero, confirming that the microstructure favors the upside proper now. Value close to the higher 15-minute Bollinger Band and the pivot at $80.20 reveals that the market is in a neighborhood resistance pocket. Intraday merchants will likely be watching whether or not SOL can maintain $80 on pullbacks. If it does, dips will seemingly be purchased for continuation.

How the Timeframes Match Collectively

There’s a clear stress between timeframes:

- Day by day: Strongly bearish development, oversold momentum, nonetheless damaging MACD.

- 1-Hour: Impartial regime shifting towards a short-term bounce, enhancing MACD, RSI again within the 50s.

- 15-Minute: Brief-term uptrend, momentum bullish, worth above all key EMAs.

The more than likely interpretation is that the market is in a countertrend rally inside a dominant each day downtrend. Intraday gamers are leaning lengthy off $79–80, however swing merchants will see this as a possible shorting alternative into resistance zones, until worth can begin reclaiming a lot larger ranges.

Solana Value – Bullish State of affairs

Given the each day oversold RSI and early indicators of stabilization on intraday charts, a bullish mean-reversion state of affairs is on the desk, however it’s working in opposition to the upper timeframe development.

What Bulls Wish to See

First, SOL must defend the $78–80 space, which aligns with the each day pivot and intraday assist bands. So long as pullbacks get absorbed above that pocket, the intraday uptrend can mature.

Subsequent, intraday construction would want to push towards after which via the H1 200-EMA round $85.31. A powerful transfer and maintain above $85, with H1 RSI staying wholesome (50–60+) and MACD firmly constructive, would sign that this isn’t simply noise however a real short-term development reversal.

From there, the actual battleground is the $96–100 zone, the place the each day 20-EMA and Bollinger midline sit. A rally into that area can be a normal mean-reversion goal after a extreme selloff. If bulls can set up acceptance above $100 on each day closes, which means not only a wick however sustained commerce, the case strengthens for a extra sturdy backside and a possible medium-term development shift.

What Would Invalidate the Bullish Case

The bullish rebound thesis weakens shortly if SOL loses $78 on sturdy quantity and begins closing each day candles under that stage. In that state of affairs, the tried base at $79–80 has failed, and the downtrend is reasserting itself.

From a momentum standpoint, a failure of H1 RSI again beneath 40 with MACD rolling over from simply above zero would present that the bounce has run out of steam. If this occurs whereas worth stays nicely under $85, the market is signaling that sellers are completely happy to re-engage on comparatively shallow rallies.

Solana Value – Bearish State of affairs

The upper timeframe already leans bearish, so the query will not be whether or not the development is down, however whether or not the downtrend has one other leg. The each day EMAs stacked overhead, damaging MACD, and market-wide risk-off temper all argue that it does, until bulls can reclaim misplaced floor aggressively.

How a Recent Leg Decrease May Unfold

Within the bearish continuation path, the present intraday bounce stalls under the $85 space (H1 200-EMA) and even sooner. Value chops round $80–83, liquidity builds, and as soon as shopping for curiosity dries up, sellers push SOL again under the each day pivot and S1 assist cluster $79–78.

If each day RSI stays caught under 35 and MACD stays deep in damaging territory, any try and rally turns into suspect. A decisive each day shut under $78 opens the window towards the decrease Bollinger band close to $65, which strains up as the subsequent technical magnet throughout a volatility growth decrease.

In such a transfer, volatility (ATR) may tick larger, and the market would possibly enter a brief, sharp flush, particularly with general sentiment at excessive worry and BTC dominance elevated, which regularly forces weaker alts to underperform.

What Would Invalidate the Bearish Case

For bears, alarm bells ring if SOL reclaims and holds above $100 on the each day chart. That might imply worth has damaged again above the 20-day EMA and Bollinger midline, successfully difficult the integrity of the present downtrend.

On prime of that, you’ll wish to see each day RSI pushing again above 45–50 and MACD flattening and crossing upward. That mixture would present that the earlier selloff has totally digested and the trail of least resistance is not clearly down.

Positioning, Danger, and How one can Assume About This Tape

Proper now, Solana sits in an ungainly zone: macro development is down, micro development is bouncing. That’s exactly the sort of surroundings the place merchants get chopped up by overconfidence on both facet.

For development followers, the clear learn is that SOL stays in a bearish regime on the each day timeframe. Till the worth can commerce again above $96–100 and keep there, rallies are structurally countertrend. Brief setups in opposition to main resistance, just like the H1 200-EMA or the each day 20-EMA, will proceed to enchantment to systematic gamers.

For mean-reversion and shorter-term merchants, oversold each day RSI and enhancing intraday momentum present a tactical window to play bounces. Nevertheless, the secret’s to respect that the technique is buying and selling in opposition to the bigger wave. Tight danger administration and clear invalidation ranges, equivalent to a break under $78, develop into non-negotiable.

Volatility is excessive sufficient that ranges might be overshot in each instructions, particularly with the complete market sitting in excessive worry and BTC dominance elevated. Anticipate whipsaws round intraday pivots and watch out extrapolating 15-minute energy into multi-day conviction with out affirmation from the each day chart. Briefly, Solana worth is in a bearish regime with a dwell countertrend bounce, and the subsequent main directional cue will seemingly come from how worth behaves round $78 on the draw back and $85–100 on the upside.