With the dominant cryptocurrency now enjoying the position of “digital gold,” Solv desires to assist institutional traders squeeze out as a lot yield as doable from the asset.

Solv Protocol Secures $10M to Carry Bitcoin Options to Institutional Buyers

The U.S. Securities and Alternate Fee (SEC) opened the floodgates to institutional bitcoin ( BTC) adoption in 2024 when it authorised the primary spot bitcoin exchange-traded funds (ETFs), and on Thursday, Solv Protocol, a bitcoin staking platform, finalized a $10 million “Bitcoin Reserve Providing” to make the most of the quickly rising institutional urge for food for BTC.

Bitcoin’s inventor, Satoshi Nakamoto, envisioned the cryptocurrency as digital money, however its disinflationary issuance schedule coupled with its astronomical value appreciation have morphed the asset into digital gold, a secure haven asset that shrewd traders purchase and maintain to protect and construct wealth.

There’s just one downside with holding bitcoin, it doesn’t generate yield. Positive, its value appreciation is unmatched, however traders solely notice income in the event that they promote their BTC. Solv Protocol was designed as an answer to this conundrum by providing staking yield to establishments holding bitcoin, and the $10 million the agency raised can be used to implement varied yield-generating methods.

“When establishments put their bitcoin into our bitcoin reserve, we received’t let or not it’s idle,” Solv co-founder Ryan Chow informed Bitcoin.com in an interview. “We are going to deploy it into BTC yield-generating automobiles.”

Chow defined that establishments deposit bitcoin with Solv and in return obtain yield-bearing devices resembling convertible bonds. “It’s similar to Technique,” Chow defined, referring to how the software program firm turned bitcoin treasury agency Technique (MSTR) has incessantly financed its bitcoin purchases by issuing debt by way of convertible bonds.

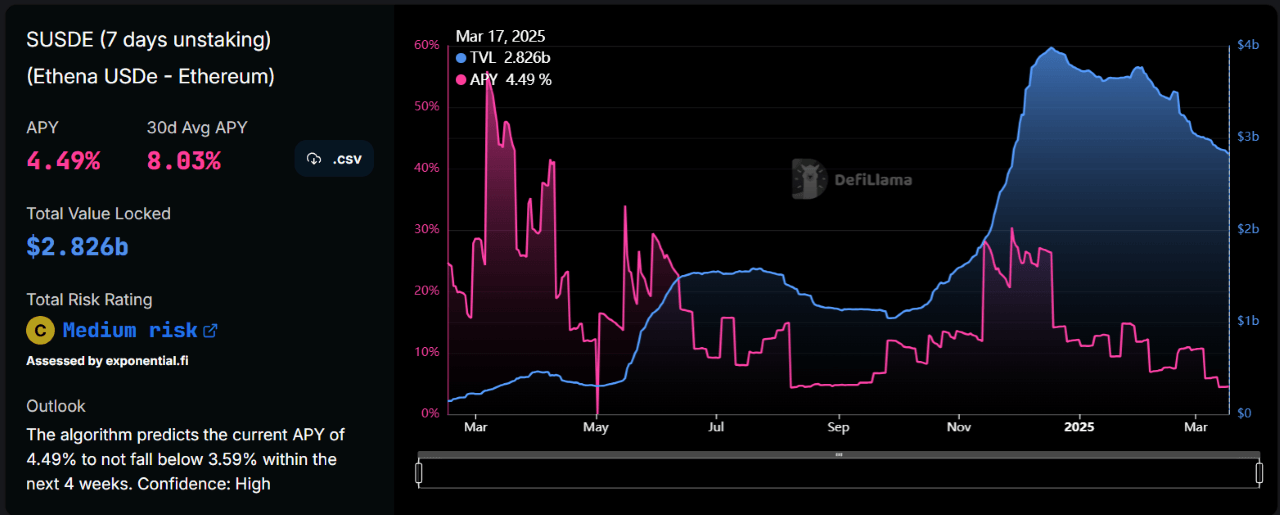

He additionally offered examples of belongings Solv invests in to generate yields excessive sufficient to draw institutional traders. Stablecoins akin to Ethena’s USDe are on the menu. USDe is at present providing a 4% yield in keeping with the Ethena web site, however the stablecoin has provided returns as excessive as 56% up to now. Solv additionally purchases different stablecoins that can be utilized to put money into several types of crypto belongings.

(Ethena’s USDe has peaked at roughly 56% APY up to now / DeFi Llama)

“We use the BTC as a pledge to borrow stablecoins, after which we make investments the stablecoins in all these different methods.” Chow defined.

Solv hopes to conduct extra fundraising rounds for its reserve. Chow stated the agency has already attracted a couple of large names, which he declined to reveal. Nonetheless, he claims giant gamers within the crypto area have already dedicated funds for subsequent rounds.

“We can’t disclose their names,” Chow defined. “However for the follow-up rounds like spherical two, spherical three, we have already got plenty of establishments that [have] dedicated within the pipeline.”