Gold and the S&P 500 each reached all-time highs in the present day, whereas crypto market caps suffered a slight decline. This decoupling could possibly be a bearish sign for future markets.

These two property often have an inverse correlation, so their simultaneous positive aspects point out a mixture of warning and eagerness. If crypto will get left behind by each developments, it might be tough to regain momentum.

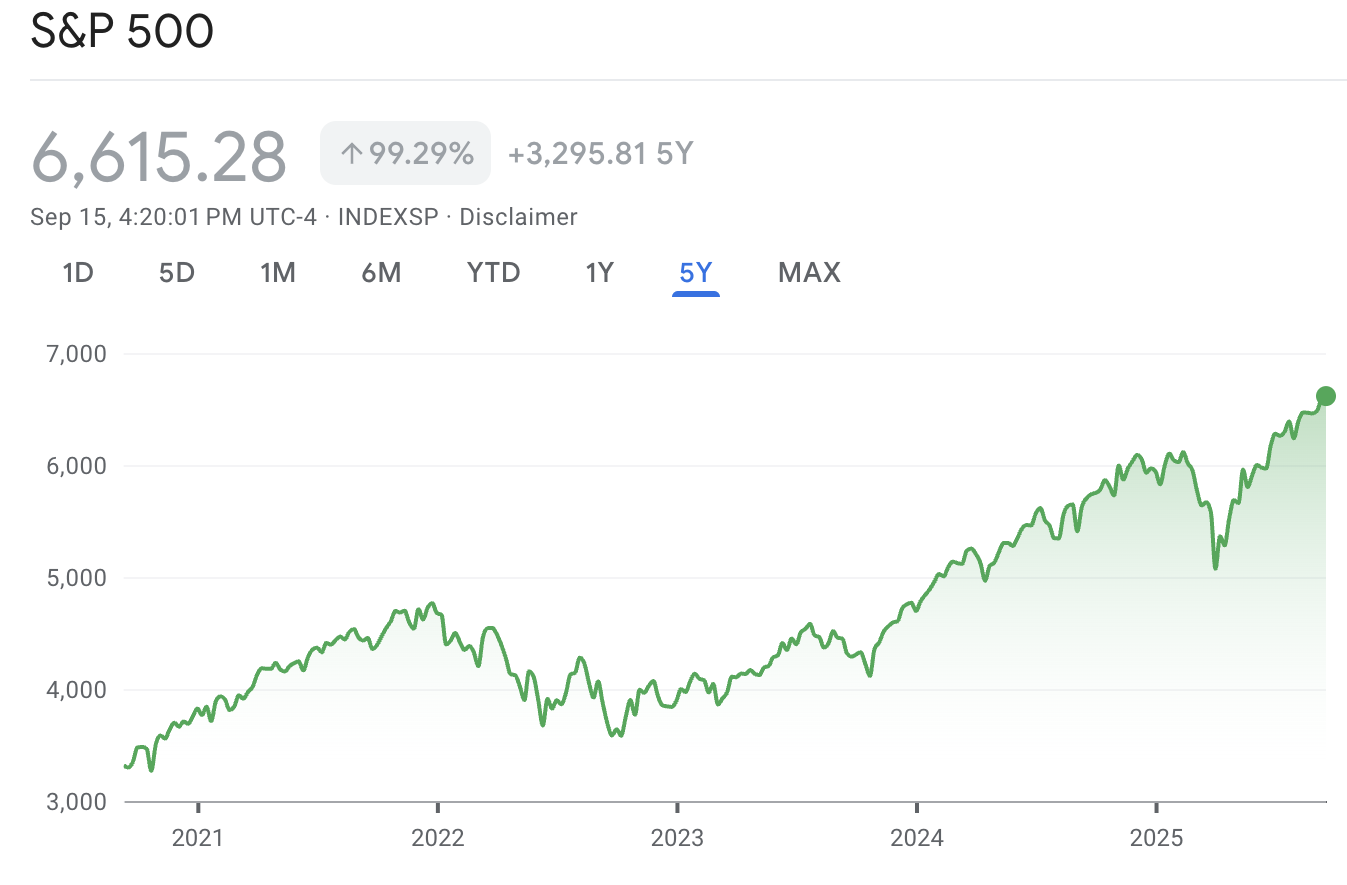

Gold and S&P 500 Publish Big Positive factors

Bitcoin is commonly known as the “digital gold,” and these asset classes can overlap in fascinating methods. Analysts not too long ago predicted that the continued gold rally might push crypto to new heights, and main companies are providing joint gold-crypto funding merchandise.

Nonetheless, the markets are trying a bit disconcerting in the present day, as crypto is at the moment decoupling from each this commodity and the TradFi inventory market. Whereas gold and the S&P 500 each hit all-time highs, the crypto sector’s market cap truly decreased.

S&P 500 Worth Efficiency. Supply: Google Finance

Particularly, gold and the S&P 500 sometimes have an inverse correlation, so it’s fairly regarding in the event that they’re each gaining whereas crypto stays static. If these two classes are each going up, it doubtless indicators a mixture of optimism and concern in TradFi markets.

Potential Dangers to Crypto?

There’s one extremely seen wrongdoer for these conflicting sentiments: impending cuts to US rates of interest. The subsequent FOMC assembly is scheduled to occur very quickly, and markets are just about sure that price cuts will happen. This could possibly be a combined blessing, providing funding alternatives alongside fears of greenback inflation.

Due to this fact, this case might give priceless perception into crypto market dynamics. Analysts have famous that the markets might have already priced price cuts in. There was ongoing hypothesis as as to if or not crypto momentum will proceed, however these S&P 500 and gold actions might present that we now have already hit an area high.

In any case, why have gold and crypto decoupled if Bitcoin is a retailer of worth? Conversely, why are Web3 market caps stagnating whereas TradFi is gaining like this? Are the markets exhausted from profit-taking? Might regulatory issues be an underrated supply of tension? It’s too quickly to make sure.

No matter occurs, it’s very uncommon that crypto is left behind whereas gold and the S&P 500 have each been gaining. If this development continues, it might sign a bearish flip for the business.

The submit S&P 500 and Gold Hit All-Time Highs: Why Hasn’t Crypto? appeared first on BeInCrypto.