Stablecoin balances, a key determine for investor sentiment, have dropped to their lowest stage in months, as Bitcoin plunged to its lowest level this yr.

Crypto markets are displaying rising indicators of weakening dealer urge for food. On Monday, April 7, stablecoin balances on exchanges fell to a three-month low. In line with crypto analytics agency Nansen, that is the bottom the determine has been since January. Moreover, each incoming and outgoing crypto trade flows have declined in April.

Stablecoin balances on exchanges simply hit a 3-month low. Lowest since Jan.

Neglect sentiment surveys. Monitor what folks do with their cash. pic.twitter.com/AZe0kaLlVd

— Nansen 🧭 (@nansen_ai) April 7, 2025

The change coincided with Bitcoin’s (B) dip beneath $75,000, marking the bottom ranges seen since early November. The continued uncertainty surrounding the results of Donald Trump’s tariffs continues to weigh closely on each the crypto and inventory markets.

You may also like: Tether seeks involvement in U.S. stablecoin rules

On this context, the info seemingly factors to decreased investor urge for food for buying and selling, as threat belongings grow to be much less interesting. Decrease stablecoin balances on exchanges counsel declining liquidity throughout crypto markets, which might strain costs additional as merchants await extra favorable entry factors.

Stablecoin market cap continues rising

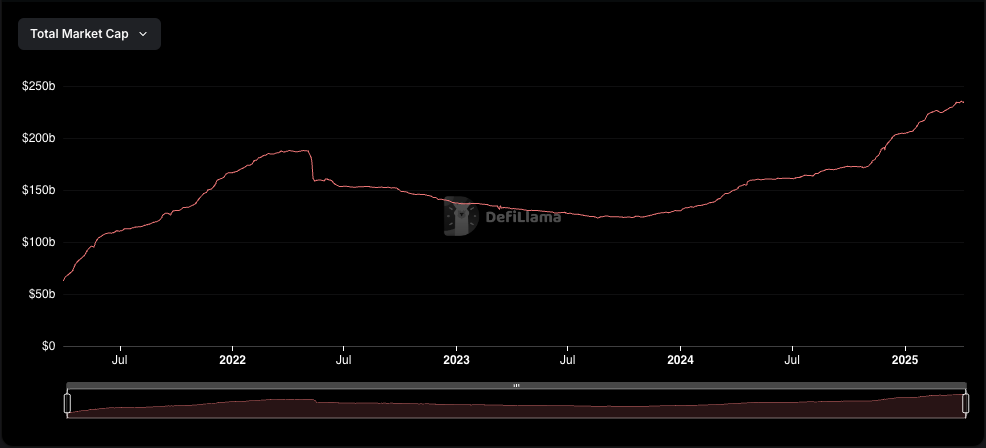

Regardless of low trade circulation, the overall stablecoin market cap has steadily elevated in 2025. The determine rose from $203 billion on January 1 to $234 billion at the moment. This progress is probably going pushed by merchants changing altcoins into extra secure belongings, a standard development in periods of market stress.

Stablecoin market cap | Supply: DefiLama

Stablecoins play a important position within the crypto ecosystem, each as a cost technique and as a software for managing threat. They are typically a lot much less unstable than different digital belongings, making them engaging throughout unsure intervals. That position might broaden additional if new rules come into impact.

Final week, on April 2, the Home Monetary Providers Committee authorised the STABLE Act. The act goals to strengthen transparency and client safety for stablecoins, requiring companies to reveal their reserves.

Learn extra: SEC says “Coated Stablecoins” not beneath its jurisdiction