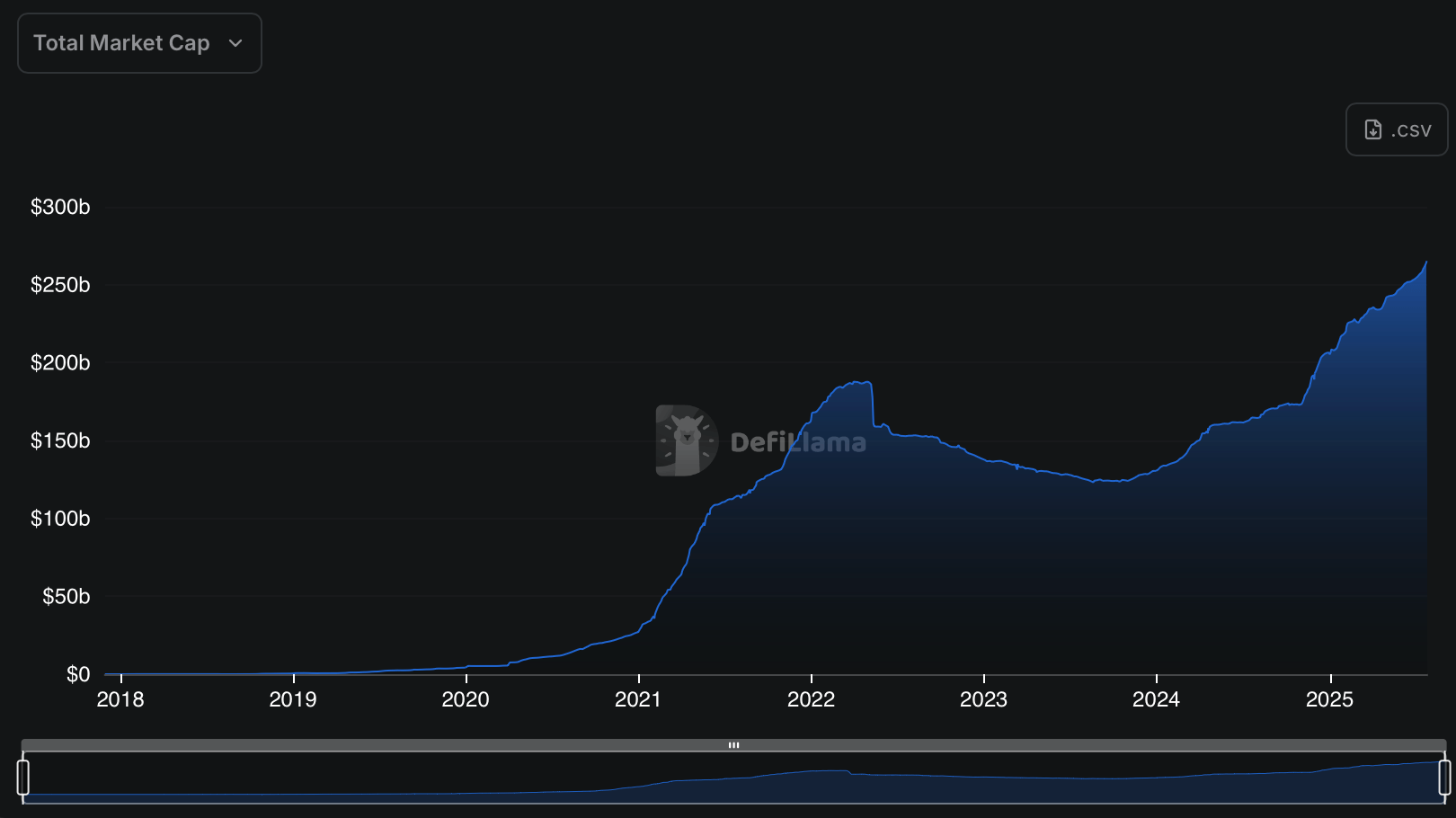

Seven days in the past, the stablecoin economic system broke previous the $260 billion mark — and it’s been climbing ever since. Over the previous week alone, the sector added almost $5 billion, with near $2 billion of that coming from freshly minted tether ( USDT).

Billions Minted, Rankings Bolstered—Stablecoins Could also be Coming into Their Most Turbulent Section But

Token knowledge from defillama.com reveals the stablecoin market now holds a valuation of $264.986 billion, with USDT commanding a dominant 61.86% share. In the mean time, on Saturday afternoon, tether’s market cap sits at a hefty $163.90 billion, boosted by a 1.19% improve up to now week that introduced 1.925 billion new cash into circulation.

Circle’s USDC holds regular in second place with a $64.015 billion market cap, although it dipped 0.54% after 348 million USDC was faraway from belongings beneath administration (AUM). Ethena’s USDe posted the second-highest share acquire among the many high ten stablecoins this week, climbing 24.63%.

Roughly 1.425 billion new USDe entered circulation, pushing its market valuation to $7.212 billion. In the meantime, Sky’s USDS led the pack with a 24.95% weekly soar, as an inflow of 989.77 million USDS lifted its market cap to $4.956 billion. Stablecoins ranked 5 by 9 by market cap all noticed declines over the previous seven days.

Paypal’s PYUSD inched up 2.98%, with 25.75 million new tokens issued, bringing its whole valuation to $890.68 million — sufficient to maintain it because the tenth largest stablecoin. Out of the 100 tracked stablecoins, Sky posted the most important share acquire this week, with USDe proper behind it.

Whereas dominant gamers keep their maintain, the ascent of options like USDe and USDS hints at rising fragmentation throughout the stablecoin area. Aggressive minting exercise alerts potential disruption forward, particularly if rising tokens maintain momentum and appeal to additional liquidity.

Rules, just like the newly enacted stablecoin regulation introduced forth by the GENIUS Act, could disrupt this case much more going ahead. Standardized oversight may both reinforce dominant issuers or open new doorways for challengers aiming to fulfill compliance head-on. Past that, the stablecoin economic system has already been increasing at a fast and relentless tempo.