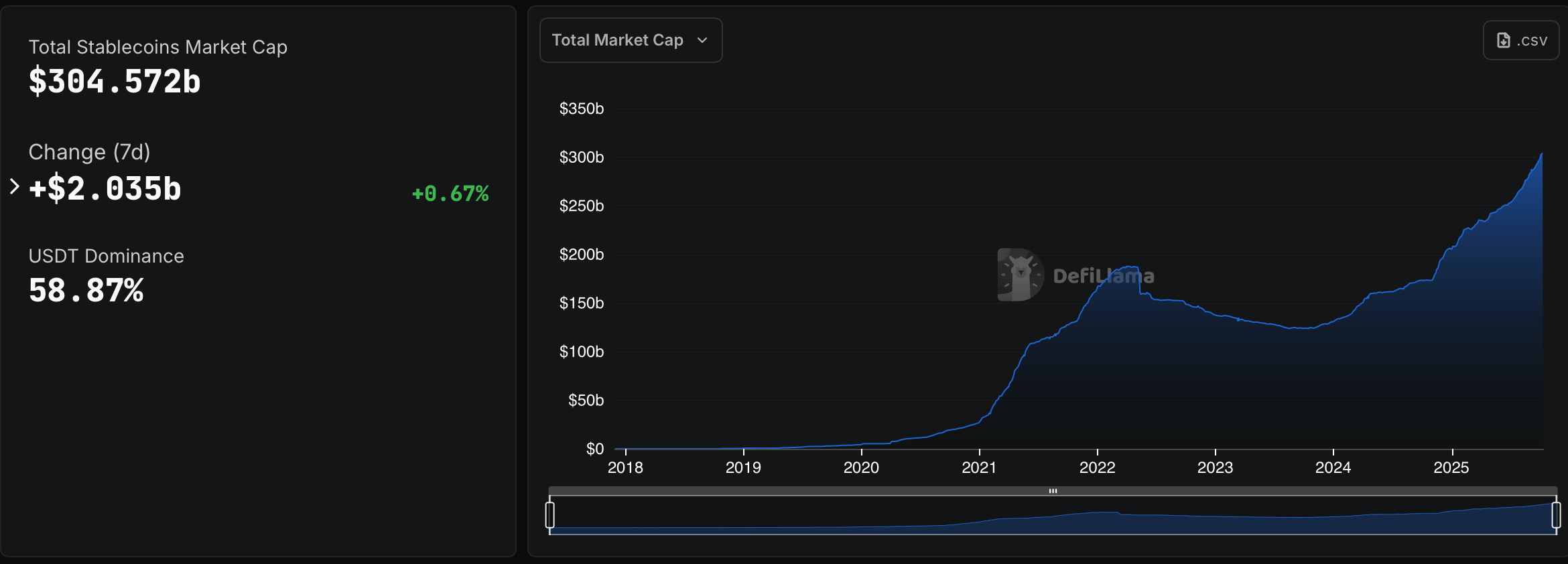

The worldwide stablecoin market has added $2.035 billion in simply seven days, pushing its whole capitalization to $304.57 billion, in keeping with knowledge from Defillama. That’s a 0.67% enhance in per week — however the livid progress behind the numbers stretches a lot additional.

The Quiet Rise of Stablecoins: A $304 Billion Digital Spine

As soon as a distinct segment experiment for crypto merchants looking for refuge from volatility, stablecoins have advanced into one in all digital finance’s most important devices. They now operate as digital stand-ins for conventional currencies, sometimes pegged 1-to-1 to the U.S. greenback, permitting customers to carry and switch worth with out the value swings of bitcoin or ethereum.

Primarily, a stablecoin is a kind of cryptocurrency designed to keep up a secure worth relative to a fiat forex, most frequently the U.S. greenback. As a substitute of fluctuating wildly like most digital belongings, it goals to remain fastened at $1. Issuers accomplish this stability by backing every token with belongings similar to money, U.S. Treasury payments, or different reserves. In brief, stablecoins will be the calm in crypto’s usually stormy seas.

Supply: Defillama.com

Folks gravitate towards stablecoins for a number of easy causes — velocity, price, and reliability. Transactions sometimes settle in seconds, charges are sometimes fractions of a cent, and holders can escape the volatility that plagues most cryptocurrencies. For a lot of customers exterior the USA, stablecoins additionally supply one thing their native currencies can’t all the time assure: stability and entry to world markets.

A Have a look at the Present Stablecoin Cycle

Tether ( USDT) stays the business’s heavyweight, as defillam.com stablecoin stats present it instructions 58.87% of the whole stablecoin market with a capitalization of about $179.3 billion. Circle‘s USDC follows at $74.77 billion, whereas Ethena’s USDe has climbed into the third spot with $14.29 billion. Collectively, these three stablecoins account for greater than 85% of the sector’s whole worth.

Beneath the highest trio, dai (DAI), sky greenback (USDS), and Blackrock‘s BUIDL spherical out the subsequent tier, every hovering between $2.6 billion and $5 billion in market capitalization. Paypal’s PYUSD, launched simply final 12 months, has quietly crossed $2.5 billion — an indication that corporate-issued stablecoins are gaining traction.

In the meantime, fiat-pegged crypto token issuers like Falcon Finance’s USDf, First Digital’s FDUSD, and Ripple’s RLUSD are carving out area of interest roles, collectively contributing to a extra numerous and aggressive stablecoin ecosystem.

A Decade of Progress

The stablecoin market’s rise from below $3 billion in 2018 to greater than $300 billion in 2025 represents a staggering 100x growth in simply seven years. That progress has mirrored — and in some ways enabled — the broader improvement of decentralized finance (DeFi) and crypto-based cost methods.

As centralized exchanges, DeFi protocols, and fintech corporations more and more depend on stablecoins for liquidity and settlement, digital fiat tokens have turn out to be an indispensable layer of contemporary crypto infrastructure. This week’s $2 billion rise indicators sustained belief within the sector alongside safety from this week’s crypto market fallout for a lot of merchants.

If present traits proceed, the stablecoin market may quickly rival the GDP of small nations. The query isn’t whether or not they’re right here to remain — it’s how deeply they’ll combine into on a regular basis finance.

🧠 FAQ

- What’s the whole stablecoin market cap proper now?As of the seven days ending Oct. 11, it stands at $304.57 billion.

- How a lot has it grown lately?The market added $2.035 billion previously week, a 0.67% enhance.

- Which stablecoin is the biggest?Tether ( USDT) leads with 58.87% market dominance among the many worth of all stablecoins.

- How lengthy have stablecoins been round?The primary main stablecoins emerged round 2014, however explosive progress actually started in 2020 with the rise of DeFi and different macroeconomic adjustments.

- Why are stablecoins essential?They bridge conventional finance (TradFi) and blockchain methods, offering liquidity, velocity, and reliability throughout borders.

- Are all stablecoins backed by {dollars}?Most are U.S. dollar-pegged, and a few are backed by different belongings, like U.S. Treasuries or algorithmic mechanisms. Others are primarily based on different fiat currencies from totally different nation-states.

- What’s subsequent for the stablecoin market?Count on larger integration into cost methods, continued institutional adoption, and ongoing regulatory shaping.