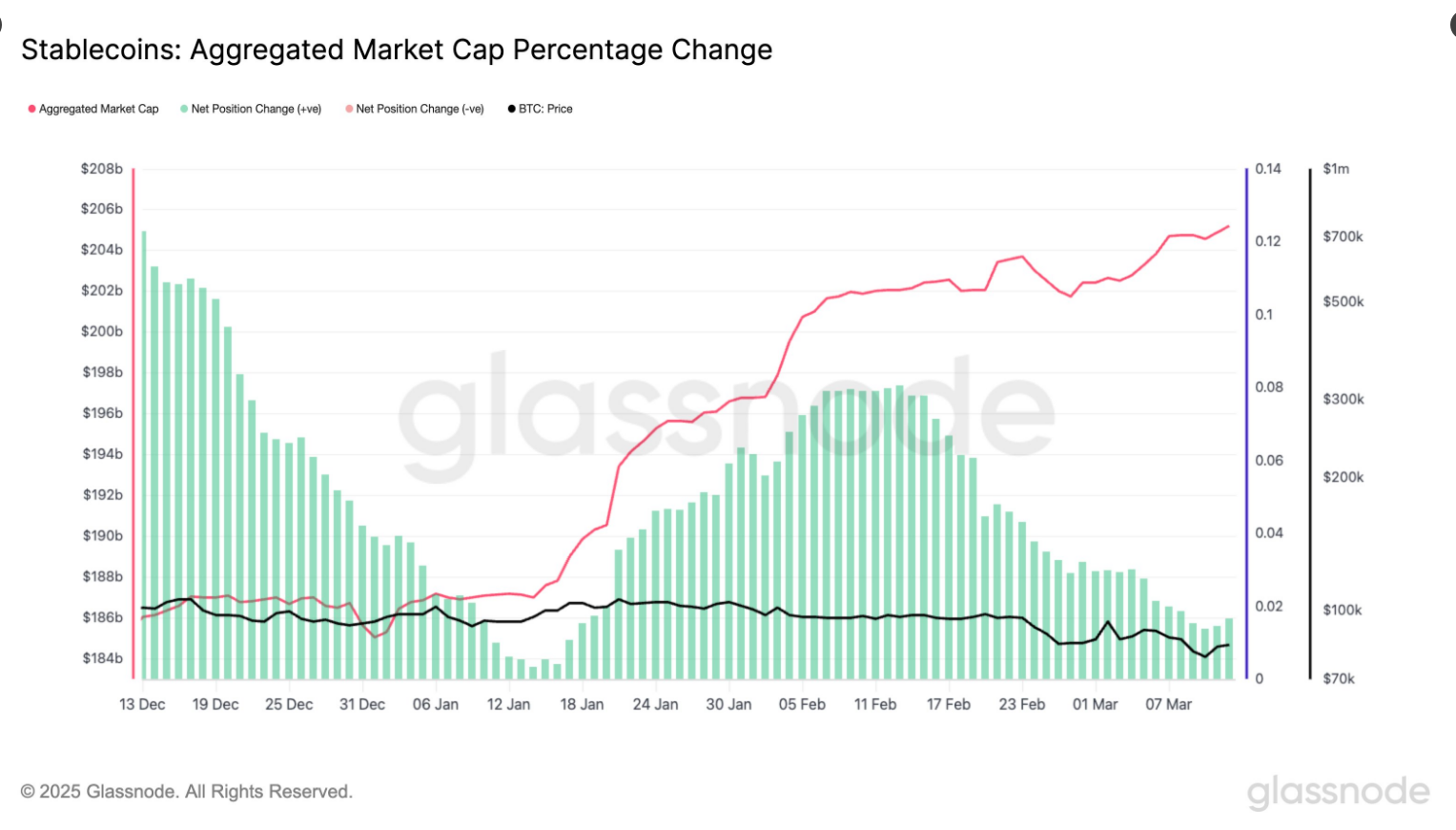

Early in 2025, there was a major surge within the stablecoin market, with a $20 billion improve in complete provide. With a ten% improve from January, the overall provide now stands at nearly $205 billion. The spike, in keeping with knowledge from Glassnode, comes after a dip in late 2024, when the availability of stablecoins fell from $187 billion to $185 billion.

Stablecoins See A Sturdy Rebound

For buying and selling cryptocurrencies, stablecoins—like USDT and USDC—usually act as a reserve for traders anticipating the precise time to purchase belongings like Bitcoin. The newest rise reveals that investor curiosity has surged, particularly in view of final yr’s decelerate.

Since Jan 1, the combination #stablecoin provide has elevated by $20.17B (+10.9%), now reaching greater than $205B.

For comparability, the December peak clocked in at $187B however the provide really contracted within the final two weeks of 2024 and dropped to $185B by January 2025. pic.twitter.com/gQbdMEDisb

— glassnode (@glassnode) March 13, 2025

Given the earlier fall, this comeback is very notable. For many of 2024 the market has been shedding stablecoins; however, this pattern has recently reversed. Though previous patterns counsel that Bitcoin’s value could also be impacted, it’s unknown whether or not this improve will result in an increase in purchases of cryptocurrencies.

Bitcoin Traders Watching Carefully

A rising stablecoin provide is commonly seen as a bullish signal for Bitcoin. Traditionally, the value of Bitcoin has risen in step with the stablecoin depend. The reasoning is straightforward: extra stablecoins imply extra potential capital simply ready to be entered into the market.

Some analysts imagine this recent injection may push Bitcoin increased. Nonetheless, not all stablecoins are used for buying and selling. Many are held for remittances, funds, or as a hedge in opposition to inflation, particularly in international locations the place native currencies are unstable.

As of right now, the market cap of cryptocurrencies stood at $2.65 trillion. Chart: TradingView

Stablecoin Change Holdings Drop 21%

Whereas the overall provide is rising, solely 21% of stablecoins are presently sitting on exchanges. This can be a vital drop from 2021, when over 50% of the availability was accessible for speedy buying and selling, Glassnode disclosed. This shift means that whereas new cash are being issued, they don’t seem to be all being deployed into crypto markets instantly.

This might level to one in all two prospects: both stablecoins are getting used extra usually outdoors of exchanges or traders are nonetheless ready for the acceptable second. Ought to the latter show proper, the impression on Bitcoin may very well be much less notable than anticipated.

What This Means For Bitcoin’s Future

The stablecoin market is presently experiencing a resurgence, which is mostly a positive improvement for the cryptocurrency sector. Nonetheless, it’s unsure whether or not this can lead to a short-term improve within the value of Bitcoin. Stablecoin utilization has fluctuated, and extra financial variables will contribute to this improvement.

On the time of writing, Bitcoin was buying and selling at 82,264, down 1.1% and 6.9% within the day by day and weekly frames.

Featured picture from Warwick Enterprise College, chart from TradingView