Ethereum (ETH) is going through a mixture of comparatively low costs and elevated utilization. The community is carrying a near-record degree of transactions, whereas over 30% of the provision is locked.

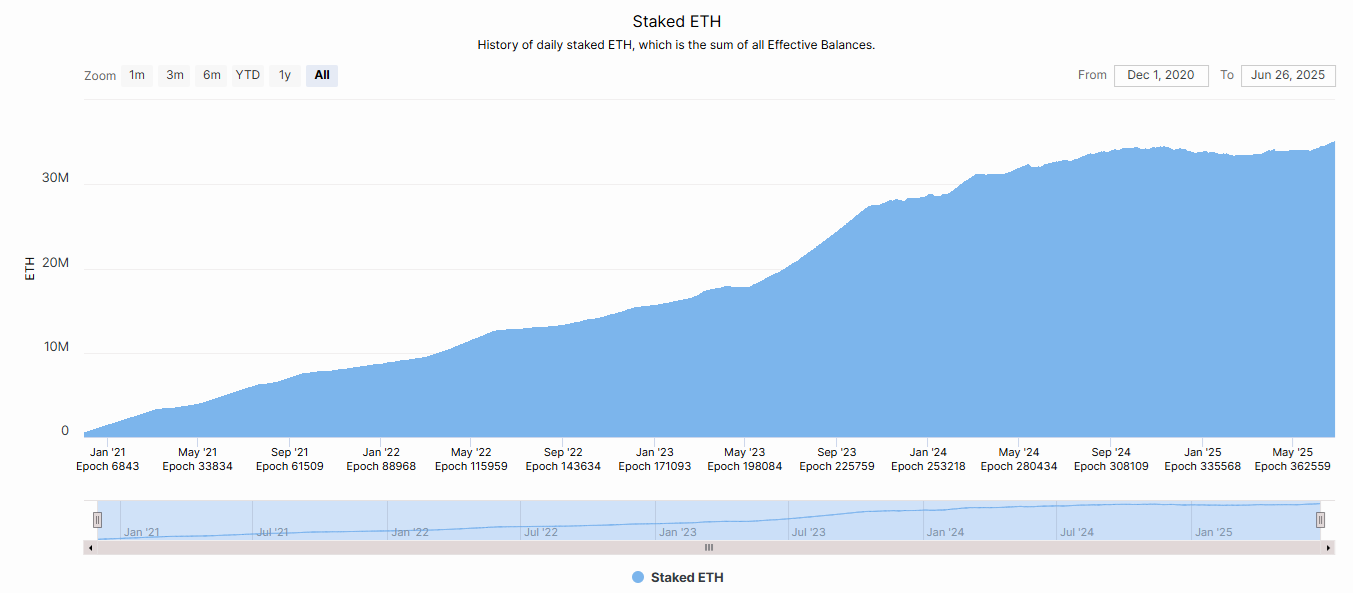

Ethereum (ETH) retains increase a provide crunch, primarily based on whale holdings and elevated staking. At present, round 30% of the provision is staked, with extremely lively inflows up to now few months. Greater than 35M ETH is staked on the Beacon chain, an all-time excessive. The pattern for staking could proceed, as ETFs are additionally allowed to incorporate staking for passive revenue.

ETH staking picked up once more in Q2, resulting in a file worth locked of over 35M ETH, or round 30% of the accessible provide. | Supply: Beacon Chain

After some outflows from the staking contract throughout the market panic in March and April, Ethereum staking returned to peak ranges, not seen since September 2024. ETH staking turned one of the dependable markers for long-term confidence within the community’s worth.

Following the Pectra improve, staking additionally accelerated as large-scale whales might deposit extra ETH at a time to construct their stake. In consequence, the entire worth staked on Ethereum is at an all-time excessive.

The Ethereum community carries over $61B locked in DeFi protocols, together with lending, liquid staking, and DEX liquidity swimming pools. ETH stays invaluable as collateral, and whales are in no hurry to promote.

Extra ETH is wrapped in a number of protocols and is taken off the open market. Whales have additionally proven elevated exercise, including on common 800K ETH per day for the earlier week, whereas solely 16K new ETH are produced every week. Whales are displaying unprecedented ranges of accumulation, boosting the narrative of a long-awaited worth breakout.

ETH alternate reserves stay scarce, at round 19M tokens. ETFs are additionally actively shopping for, with BlackRock lately absorbing the stake bought by Grayscale. ETH can also be changing into engaging to company patrons as a collateral asset.

The Ethereum community additionally awaits a brand new improve, which might additional scale and pace up transactions. Regardless of the comparatively excessive worth in comparison with different networks, Ethereum stays a key platform for DeFi. Based mostly on good contract exercise, the community’s fundamental use circumstances are ETH transfers, whereas USDT and USDC stay a few of the busiest good contracts.

ETH stays undervalued with risky buying and selling

The present standing of ETH is elevating expectations for a catch-up rally. Buying and selling beneath $2,500, ETH is seen as undervalued, regardless of the height on-chain exercise. Transactions have been climbing for Ethereum all through 2025, reaching a better baseline, with the occasional day of anomalous file exercise.

Regardless of this, the ETH market worth stays near its lows, nonetheless crashing after every breakout. In June, ETH did not reclaim the $3,000 degree. The token is down round 5% in June, although Q2 could finish with important web beneficial properties. ETH expanded by 31.8% in Q2, principally pushed by the height beneficial properties in Might.

The a number of bullish components for ETH are nonetheless not sufficient to spark a extra decisive rally. In June, there’s nonetheless an expectation for a breakout, the place ETH can rally as excessive as $10,000. Even with out a rally, Ethereum has proven it isn’t a useless chain. Lately, the community drew in over $334M in every day web inflows from bridges, as worth returned to the largest liquidity hub.