The Ethereum community continues to develop steadily, reaching new highs in validators and staked Ether this yr, however this won’t be the perfect consequence for the ecosystem going ahead.

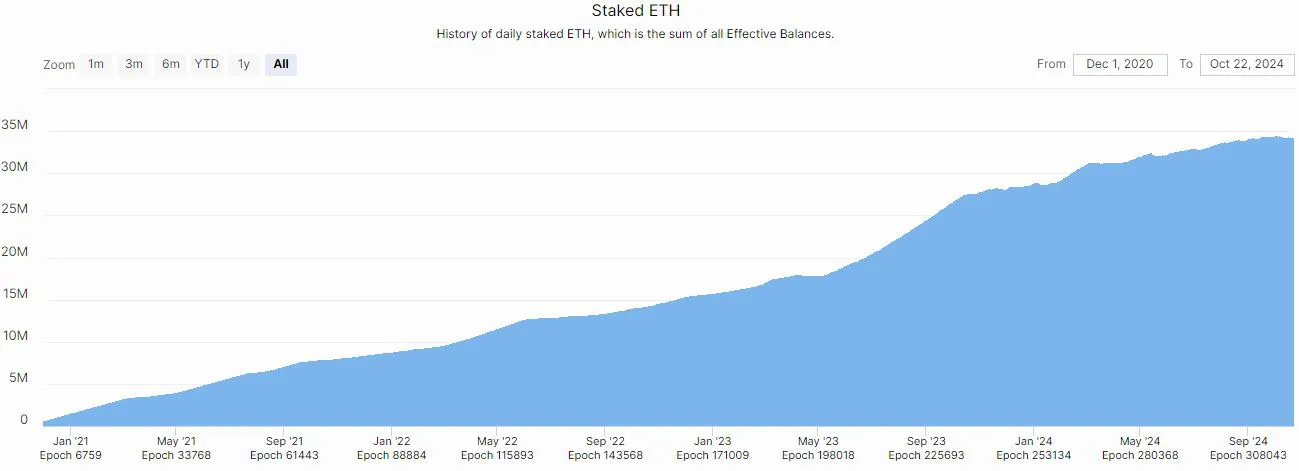

Based on the Beacon Chain, the quantity of staked Ether has been rising yearly, growing by over 6 million all through 2024 and hitting a peak of over 34 million on Oct. 2.

Lachlan Feeney, founder and CEO of Ethereum infrastructure agency Labrys, instructed Cryptopolitan the expansion is regular as a result of that’s what the system has been designed to incentivize.

The Ethereum Community has extra staked Ether and validators than ever, hitting new highs in 2024. Supply: Beacon Chain

The extra ETH staked, the decrease the yield for all stakers. Nonetheless, he says it’s essential to acknowledge that the Ethereum ecosystem just isn’t making an attempt to develop the quantity of staked Ether.

“It continues to develop as a result of for a lot of buyers who supposed to carry ETH anyway, they could as properly stake it, no matter how low the staking APY is, and earn extra yield,” he mentioned.

“Nonetheless, buyers who have been initially drawn to ETH resulting from excessive yield have principally stopped including to their stake by now. The Ethereum ecosystem just isn’t making an attempt to develop the quantity of staked ETH. Slowing staked ETH is an efficient factor.”

Quantity of staked Ether already handed the purpose of positivity

Roughly 28.43% of the 120.39 million circulating provide of Ether has been staked for the time being. In January, the proportion of Ether staked was 23.8%, which implies that a further 5.1% was staked within the final 10 months, in keeping with an Oct. 8 X submit from on-chain information supplier IntoTheBlock.

Feeney says the quantity of staked Ether has already probably handed the purpose of positivity for the community; extra received’t essentially add any advantages.

He thinks any extra staked Ether is including a non-significant quantity of safety to the community, that means that additional development just isn’t essentially fascinating.

“Nobody is aware of precisely what the best quantity of staked ETH is, however there’s a restrict. Personally, I imagine we’ve already handed that restrict,” Feeney mentioned.

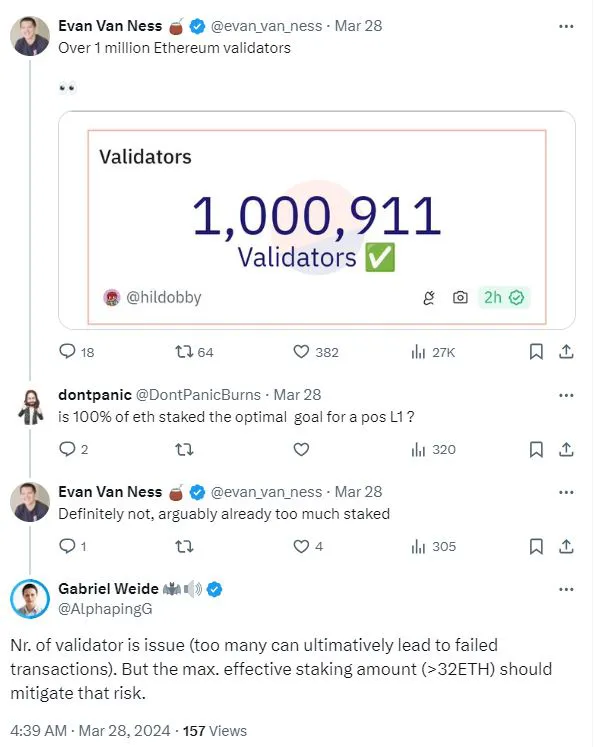

When the community clocked over a million validators and over 32 million Ether staked in March, considerations have been raised that this might create points for the Ethereum ecosystem.

Whereas the variety of validators may translate into larger safety for a blockchain, some group members questioned if too many validators and staked Ether may pose points for the community.

Supply: Evan Van Ness

Enterprise investor and Ethereum advocate Evan Van Ness mentioned there was already “an excessive amount of” staked. Gabriel Weide, who runs a staking pool, speculated that too many validators may finally result in “failed transactions.”

Extra isn’t at all times higher

“One may assume that certainly the extra ETH staked the higher, as staked ETH represents the safety of the community, nevertheless, if you happen to take that argument to an excessive the place 100% of all ETH in existence is staked, that is clearly not a fascinating consequence,” Feeney mentioned.

Whereas that state of affairs is unlikely, Feeney says any vital quantity of Ether, 90%, 80%, and even 70%, is a less-than-ideal consequence for the community. Except for the danger of failed transactions speculated by others, he thinks a bigger difficulty may come up.

“One apparent drawback is that with out ETH obtainable, you may’t pay for gasoline which have to be paid in ETH, customers might want to use stETH and cbETH and swETH in any software the place ETH is at the moment used,” he mentioned.

“This forces the consumer to select an LST, liquid staking token, which comes with pointless threat. Native ETH ought to at all times stay the first risk-free asset throughout the Ethereum ecosystem.”

Regardless of the rising curiosity in staking Ether, its value has declined since its all time excessive of over $4,000, which it hit on March 12, in keeping with CoinMarketCap.

As of Oct. 24, the worth is hovering round $ 2,500.