Stellar ($XLM) has fallen under $0.20. This transfer has erased all the restoration it achieved final yr. Nevertheless, a number of optimistic indicators counsel that many traders are nonetheless staying throughout the ecosystem.

As well as, real-world belongings (RWA) and stablecoins might develop into key drivers of additional $XLM accumulation.

Optimistic Indicators for Stellar ($XLM) Regardless of the Sharp Worth Drop

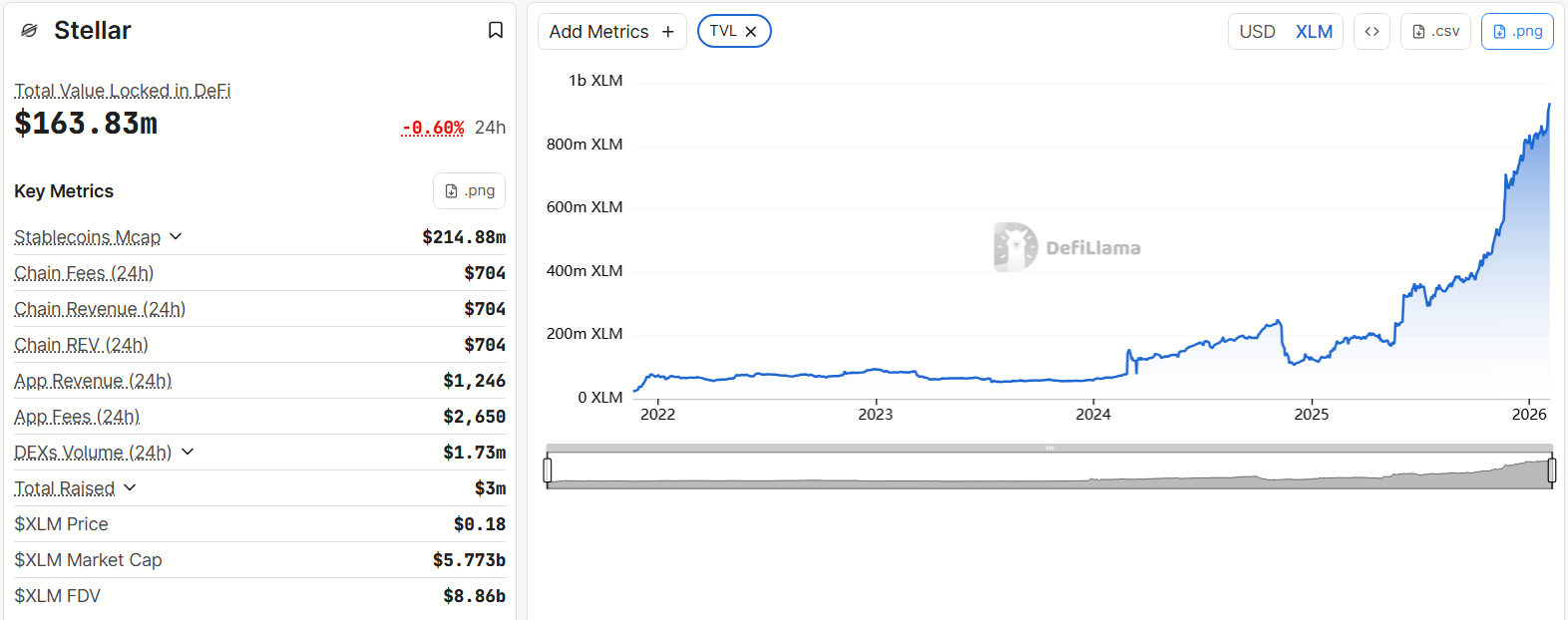

Information from DefiLlama exhibits that the quantity of $XLM locked in DeFi protocols on the Stellar community reached a brand new all-time excessive in early February 2026. It surpassed 900 million $XLM.

This milestone displays the expansion of Stellar’s DeFi ecosystem. It comes whilst $XLM continues to fall under the yr’s key assist stage at $0.20.

$XLM. Supply: DefiLlama”>

$XLM. Supply: DefiLlama”>

Complete Worth Locked on Stellar in $XLM. Supply: DefiLlama

Though Stellar’s TVL, measured in USD, at present sits round $163 million, the sharp rise in locked $XLM underscores sturdy confidence from the neighborhood and long-term traders within the community’s adoption potential.

The principle protocols driving this capital influx embody Mix, a liquidity protocol that enables anybody to create versatile lending markets on Stellar, and Aquarius Stellar, an AMM protocol and liquidity administration layer for the community. Collectively, these two protocols account for almost 70% of complete TVL.

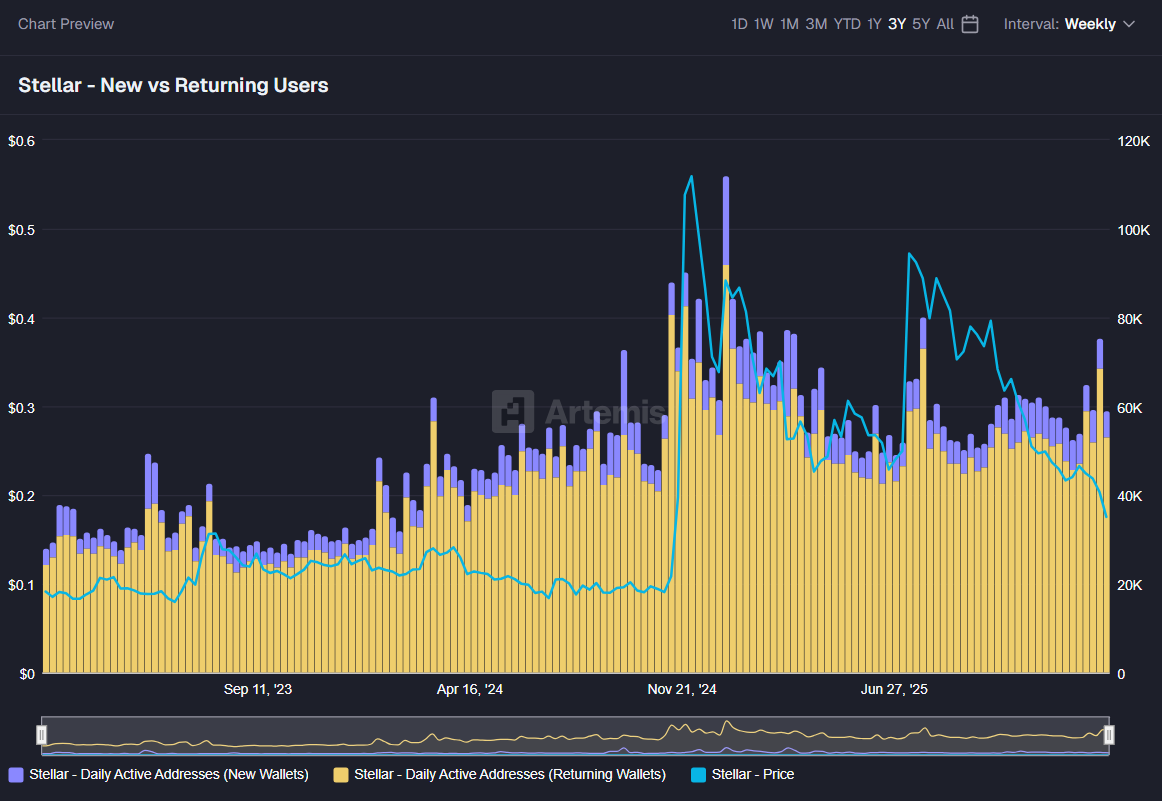

Artemis knowledge additionally reveals one other notable sign. Weekly energetic customers throughout the Stellar ecosystem have remained regular at round 60,000 over the previous few weeks. No vital decline has appeared regardless of the deep $XLM worth dump.

New and Returning Customers on Stellar. Supply: Artemis

The chart signifies that in late 2024, when $XLM fell under $0.10 earlier than rising to $0.60, person exercise remained steady and even trended upwards.

This means that Stellar customers will not be abandoning the community, whilst capital continues to exit the broader crypto market. Nevertheless, the present lack of latest customers might clarify why $XLM has not but recovered.

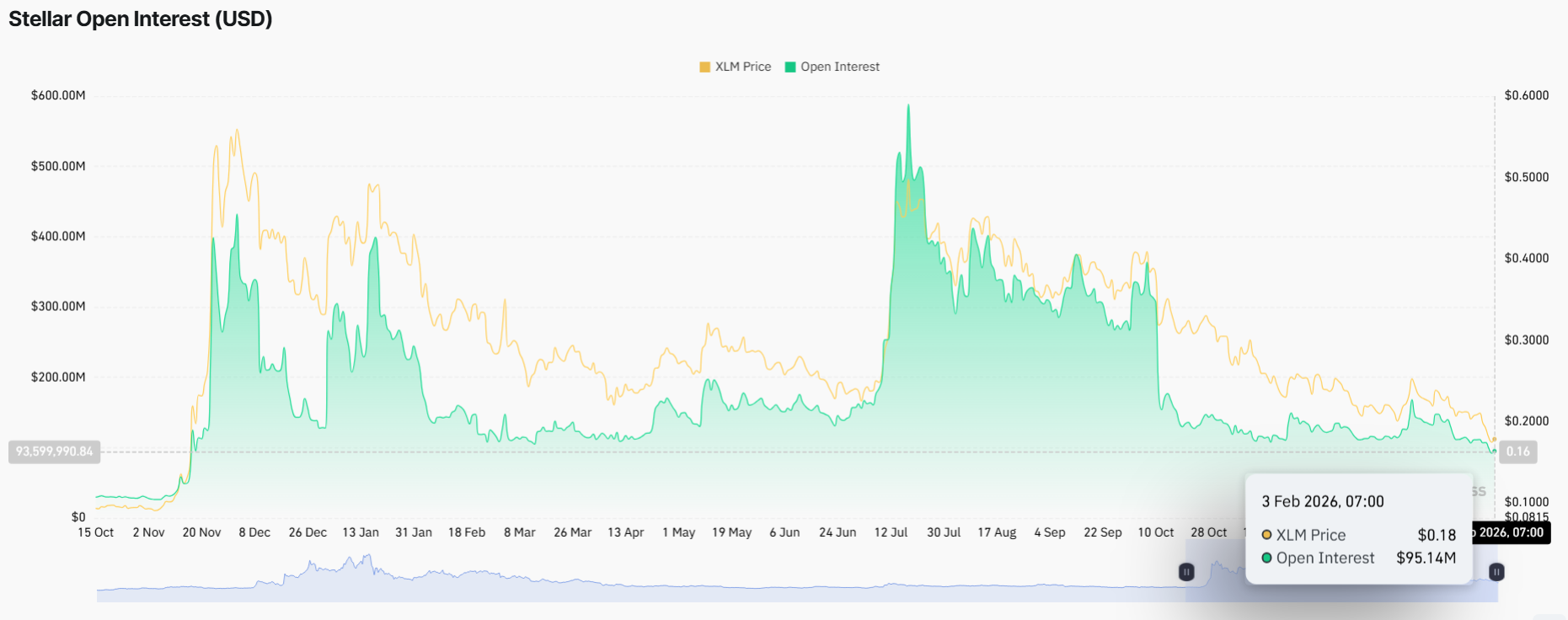

Derivatives metrics additionally point out that $XLM might be getting into a brand new consolidation zone. Open Curiosity quantity has dropped to its lowest stage since November 2024. This decline displays a pointy discount in leveraged publicity amongst merchants.

Stellar Open Curiosity. Supply: Coinglass

Because of this, sturdy volatility could also be fading. $XLM might now be transferring right into a sideways part, with much less leveraged shopping for and promoting strain. This atmosphere typically permits a brand new accumulation zone to kind.

Nevertheless, figuring out the precise market backside and timing a restoration stays difficult beneath present market circumstances.

Actual-World Property and Stablecoins Might Be Stellar’s Predominant Drivers in 2026

A report revealed final month acknowledged that the entire worth of tokenized real-world belongings on Stellar, excluding stablecoins, reached $1 billion at first of this yr.

Santiment, a crypto market analytics platform, additionally reported that Stellar ranks among the many prime 4 RWA tasks by GitHub growth exercise because the starting of the yr.

“$XLM isn’t a speculative add-on. It’s required for transactions, account operations, and community exercise. As RWA volumes develop, utilization of $XLM scales with it — not cyclically, however essentially,” stated Scopuly, a Stellar pockets supplier.

Stellar’s stablecoin market cap stays comparatively modest at round $200 million. Nevertheless, MoneyGram, one of many world’s main firms in worldwide remittance providers and P2P funds, not too long ago reaffirmed the soundness of its USD-backed stablecoin instrument. The agency continues testing it on Stellar.

USD-backed stablecoins can unlock entry to stability in even probably the most unstable economies.

That is why we piloted stablecoins within the MoneyGram® Cash Transfers App in Colombia with @StellarOrg, @Crossmint and @USDC.

— MoneyGram (@MoneyGram) February 3, 2026

Due to this fact, demand for RWAs and stablecoins might develop into the first drivers of $XLM accumulation, particularly because the token faces sturdy promoting strain close to present lows.

The submit Stellar ($XLM) Drops Under $0.20, However On-Chain Exercise Hits New Highs appeared first on BeInCrypto.