Markets aren’t anticipating a lot from the Federal Reserve’s assembly this week, however excellent news could also be on the horizon for June.

Inventory indices noticed blended efficiency on Monday as merchants awaited a significant Federal Reserve announcement. The Dow Jones was buying and selling at 41,414, up 96.64 factors or 0.23%. In the meantime, the S&P 500 slipped 12.9 factors or 0.23% to five,673, and the Nasdaq was down 54.21 factors or 0.30% at 17,923.

In accordance with LPL Monetary chief economist Jeffrey Roach, the Fed might use this week’s assembly to arrange buyers for coming charge cuts. A mixture of labor information and inflation statistics, based on Roach, means that charge cuts could possibly be set for June, October, and December.

You may also like: Shares proceed to get better from ‘Liberation Day’ selloffs, S&P 500 on observe for main profitable streak

Inflation stays steady, however Fed charge cuts are seemingly

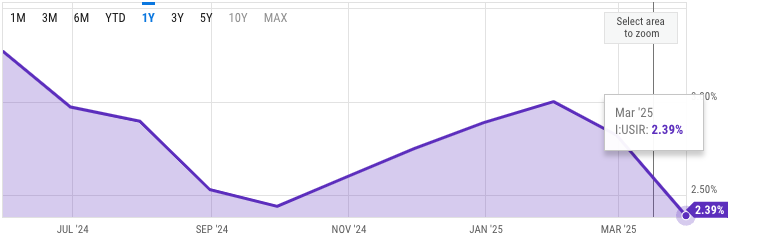

Whereas inflation continues to carry above the Fed’s goal of two%, at the moment at 2.39%, it has seen two consecutive months of declines. The principle purpose for inflation cooling is probably going the dropping demand as a consequence of inflation dangers. That is regardless of the fears that U.S. tariffs, particularly on China, would have ripple results on client costs.

Excellent news on the inflation entrance is that OPEC+ introduced it might increase its output by 411,000 from June 1. The information contributed to a pointy drop in oil costs, which quickly stabilized. Oil costs are a significant contributor to inflation, and their declines could have constructive results on client costs.

You may also like: Commerce conflict might drive Fed to lift charges, hurting crypto

In commerce coverage, markets had been rattled by Donald Trump’s new plans to impose 100% tariffs on foreign-made films. On Monday, Might 5, the President accused overseas international locations of providing incentives to drive studios away from the USA, and known as this a “Nationwide Safety risk.”

One of many greatest losers immediately was a multinational conglomerate, Berkshire Hathaway. Its inventory fell 4.33% on information that its founder, Warren Buffett, would retire as CEO, whereas nonetheless remaining the corporate’s president.

Learn extra: If the Fed prints more cash, what’s at stake for Bitcoin?