Story Protocol co-founder SY Lee defended the undertaking’s choice to push its first main IP token unlock to August 2026, in a latest interview with CoinDesk, saying the blockchain wants “extra time” to construct utilization and that near-zero on-chain income is “the unsuitable metric” for an intellectual-property and AI knowledge community.

The six-month delay retains crew and investor tokens locked as Story pivots from a basic IP registry towards licensing human-generated datasets for artificial-intelligence coaching.

He pointed to Worldcoin’s 2024 choice to increase investor and crew lockups from three to 5 years, a transfer that decreased near-term circulating provide and was framed as extending the event runway, with the token posting double-digit positive factors within the hours after the announcement. Story, Lee stated, is following the identical logic.

“If we had been all mercenary, we might have needed a shorter lockup,” he stated, describing the extension as a sign of long-term dedication somewhat than misery.

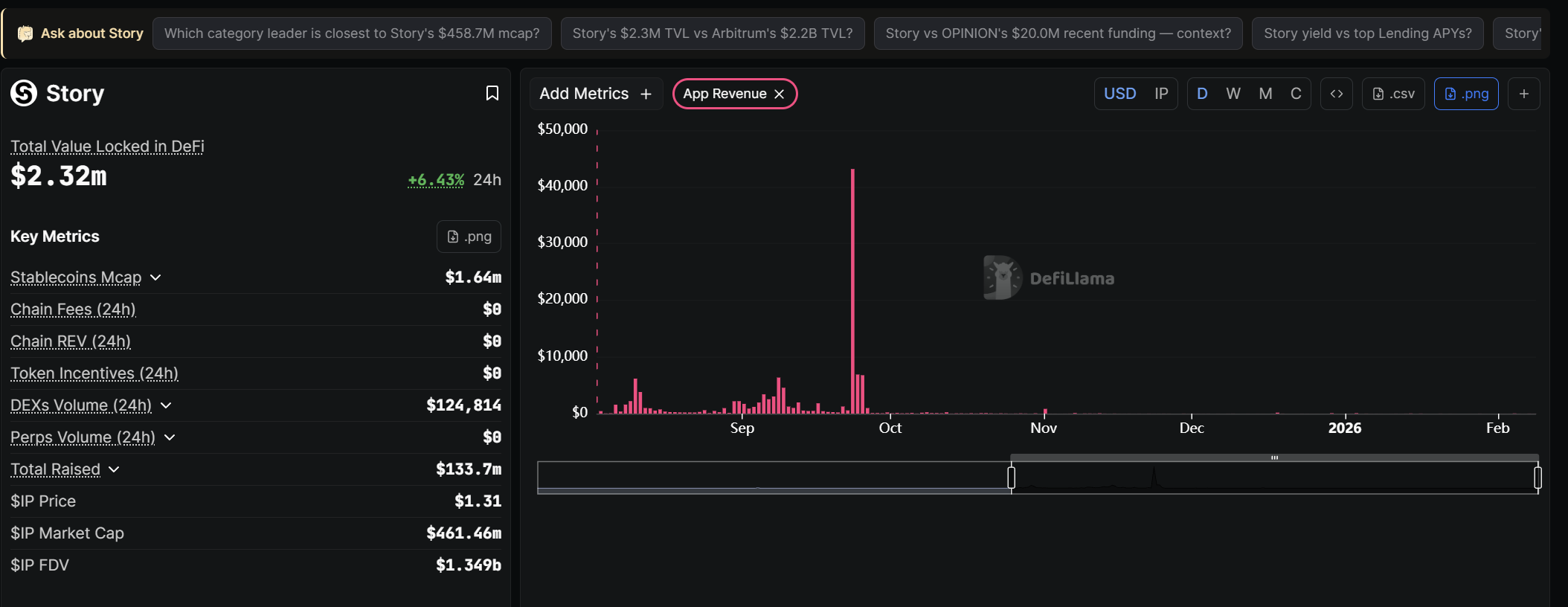

Story’s day by day income, which peaked at $43,000 in September 2025 and is at the moment $0 per DeFiLlama, has additionally been a priority for a lot of traders.

Lee contends that these numbers understate Story’s exercise as a result of a lot of the supposed monetization happens off-chain by means of licensing agreements somewhat than in transaction tolls.

In his view, gasoline income is a lagging indicator for a community designed to file rights, provenance, and utilization phrases earlier than it begins extracting significant worth from them.

“We deliberately put our chain gasoline charge fairly low. We’re extra of an IP chain,” he stated. “You might not see the kind of income stream that you just’re searching for like a DeFi chain.”

As a substitute, he stated Story’s near-term focus is on recording possession phrases and utilization rights for datasets and fashions used to coach artificial-intelligence techniques — one thing the undertaking introduced final yr — with funds and royalty splits embedded in sensible contracts.

That shift strikes the undertaking away from tokenizing media content material or collectibles and towards what Lee described as “unscrapable” human-contributed knowledge, reminiscent of multilingual voice samples and first-person video, belongings he argues are more durable for AI builders to acquire legally at scale by means of conventional net scraping.

The transition, nonetheless, delays the visibility of on-chain revenue as a result of a lot of the anticipated worth is tied to enterprise licensing offers somewhat than retail transaction charges. Lee in contrast the timeline to his earlier Web2-based startup expertise — which landed him a $440 million exit in 2021 — noting that it took years for significant income to materialize.

For token holders, the sensible implication is that provide enlargement is being slowed whereas the crew makes an attempt to display traction in AI knowledge partnerships and rights-cleared dataset assortment.

Whether or not that technique in the end converts right into a sustainable enterprise mannequin is an open query, however Lee maintained that extending vesting schedules is more healthy than speeding liquidity right into a weak market.

“The perfect founders, the very best groups, the very best firms normally do it for a decade plus, we’re in it for the long run and longer innings,” Lee stated.