Company bitcoin accumulation accelerated in January, however in line with bitcointreasuries.web, almost all of the momentum got here from a single heavyweight.

4.08 Million $BTC Held Throughout Entities, Says Bitcoin Treasuries Report

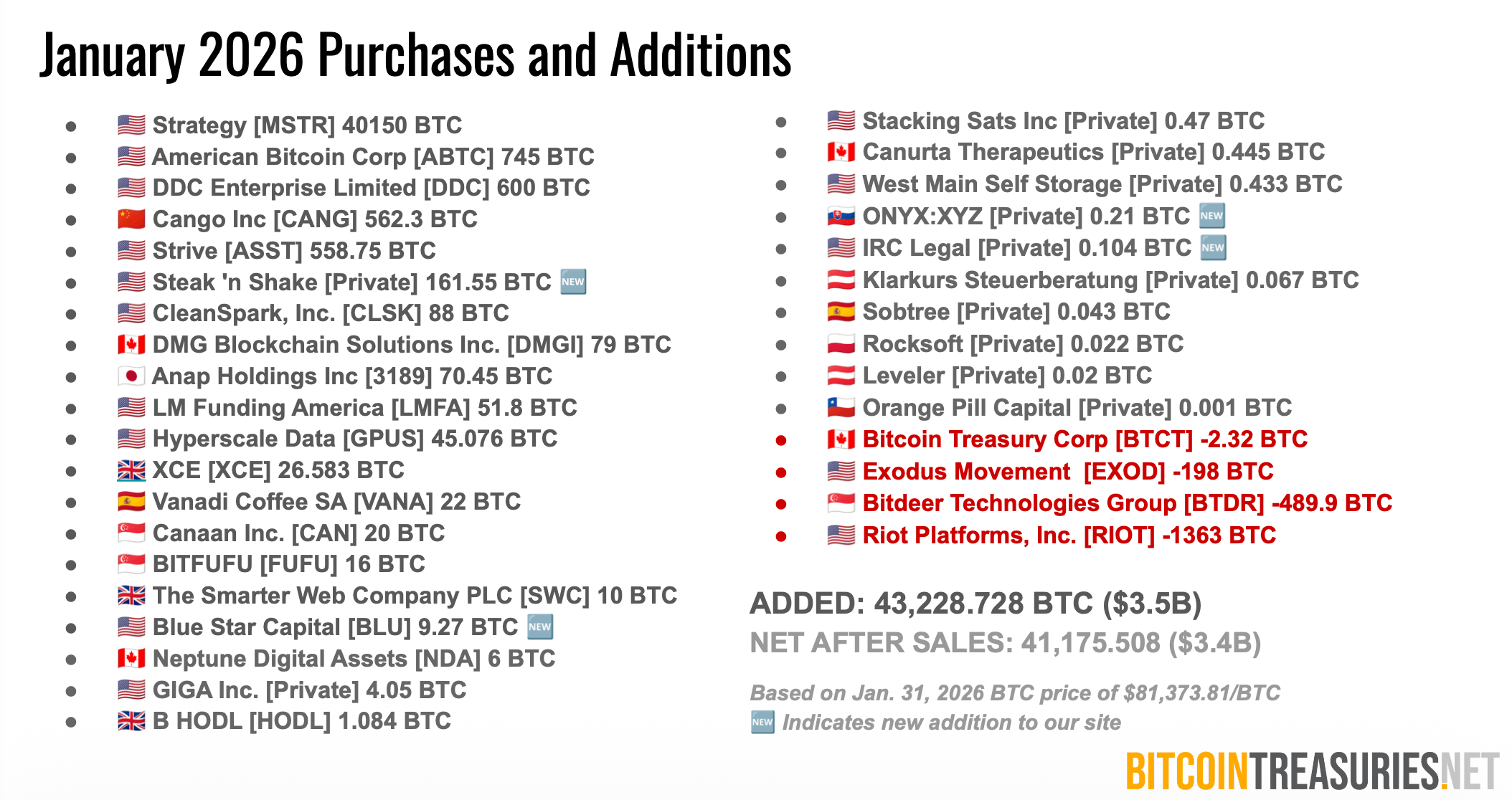

The January 2026 Company Adoption Report from bitcointreasuries.web reveals that private and non-private entities added 43,228 $BTC throughout the month, valued at roughly $3.5 billion based mostly on Jan. 31 pricing. After gross sales and reductions, web additions totaled 41,175 $BTC.

The report’s information highlights one clear driver: Technique bought 40,150 $BTC in January and ended the month holding 712,647 $BTC. That accounted for as much as 97.5% of public-company shopping for after gross sales, marking the third consecutive month by which the agency dominated additions.

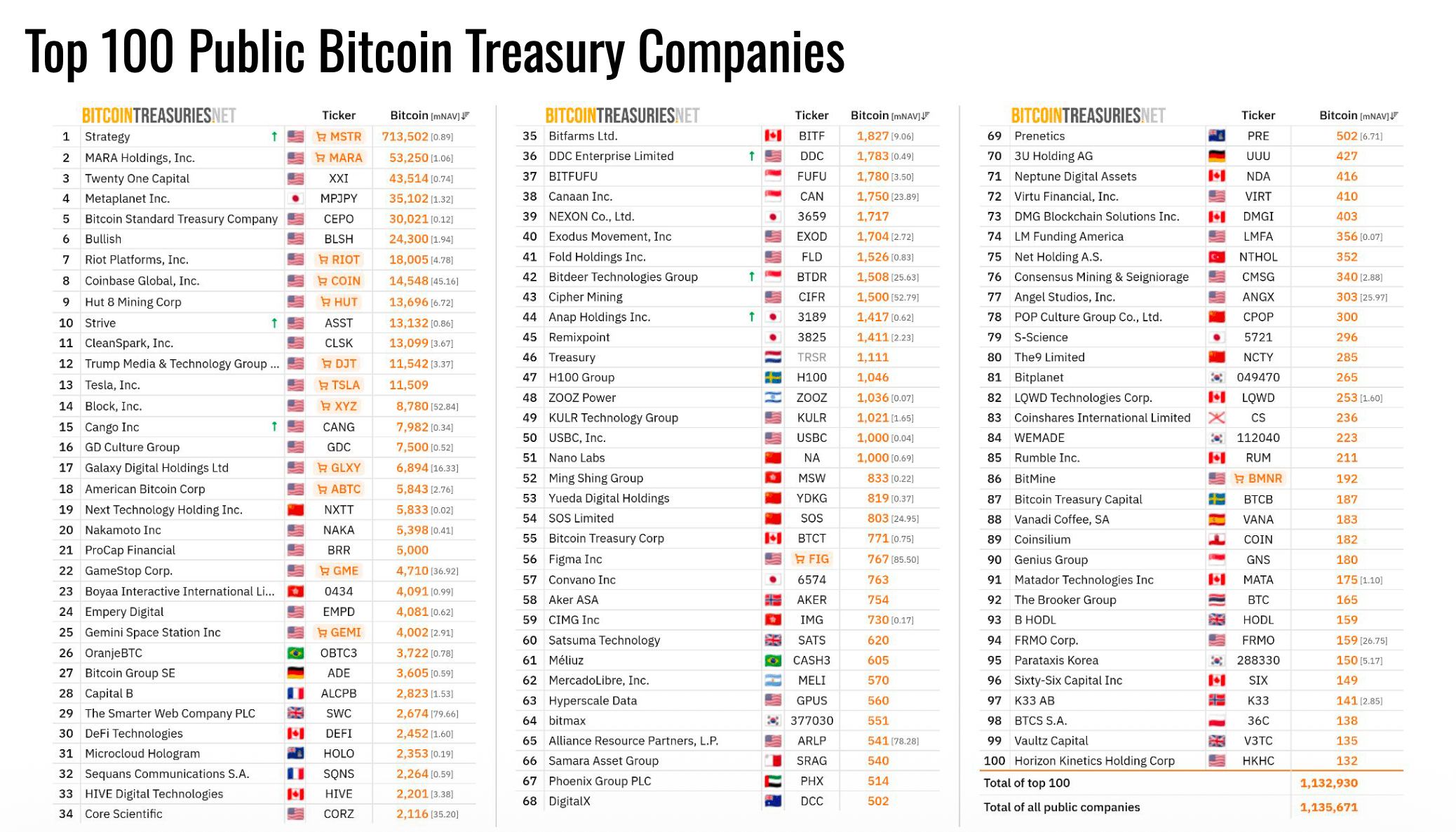

Whereas whole month-to-month shopping for approached ranges seen final summer time, bitcointreasuries.web researchers word that this rebound displays concentrated accumulation relatively than broad-based participation. Public treasuries now maintain roughly 1.13 million $BTC, whereas all tracked entities — together with ETFs and governments — maintain about 4.08 million $BTC.

The evaluation additionally factors to Technique’s long-range projections. Below its most aggressive mannequin, the corporate’s This autumn 2025 report outlines potential 2.5x development in bitcoin per share by 2032, concentrating on 492,000 BPS underneath a 14% assumed annual bitcoin yield.

Past spot purchases, bitcointreasuries.web’s new digital credit score dashboard tracks $26.8 billion in cumulative buying and selling quantity tied to preferred-share merchandise and associated devices. Technique’s choices account for almost all of that exercise, with yield dispersion and pricing variations shaping investor urge for food.

The analysis additional identifies a dedicated cohort of repeat patrons. Of 194 public corporations with bitcoin holdings, roughly one-third have added at the least 1 $BTC per day on common since launching treasury methods, and 20 companies common at the least 10 $BTC per day.

Adoption continues to broaden. Since October, 21 new treasuries have been added to the bitcointreasuries.web protection universe, contributing about 3% of non-Technique shopping for over the previous 4 months.

Nonetheless, focus is rising. The report cites information displaying elevated inequality in company bitcoin holdings over the previous two to 3 months, even when excluding the most important holder.

Mining companies stay influential, accounting for roughly 11% of public firm balances, although January featured notable miner gross sales that weighed on web additions.

In brief, the January report reveals a sector that’s increasing in headcount and product complexity — digital credit score included — however nonetheless overwhelmingly formed by one stability sheet that continues to set the tempo.

FAQ ❓

- How a lot bitcoin did corporations add in January 2026?Bitcointreasuries.web reviews 43,228 $BTC added, with 41,175 $BTC web after gross sales.

- How a lot bitcoin does Technique maintain?Technique ended January with 712,647 $BTC, in line with bitcointreasuries.web.

- What’s the measurement of the digital credit score market?Bitcointreasuries.web estimates cumulative digital credit score buying and selling quantity at $26.8 billion.

- Is company bitcoin possession turning into extra concentrated?Sure, bitcointreasuries.web information reveals rising holdings focus over current months.