Abstract

The asset is altering fingers round 1.39 USDT, clearly beneath its main every day transferring averages, which confirms a dominant bearish development on the upper timeframe. Momentum on the every day chart is weak, with an oversold RSI and a destructive MACD backdrop that factors to sellers nonetheless in management. Nonetheless, volatility measured by ATR stays average, suggesting managed slightly than chaotic promoting. On the identical time, the hourly and 15-minute charts look extra balanced, hinting at short-term consolidation as an alternative of additional fast collapse. Market-wide, bitcoin‘s dominance close to 57% and a Worry & Greed Index caught in Excessive Worry reveal risk-off habits that weighs on altcoins. Total, it is a market the place persistence and selective entries matter greater than chasing fast upside.

SUI crypto information: Market Context and Course

The worldwide crypto market capitalization stands round 3.04 trillion {dollars}, edging up by roughly 0.6% over the past 24 hours. Regardless of that delicate advance, bitcoin holds about 56.9% market dominance, which indicators a risk-averse market regime the place capital prefers the relative security of the benchmark slightly than smaller tokens. Furthermore, the Worry & Greed Index sits at 19, firmly in Excessive Worry, illustrating how reluctant merchants stay so as to add publicity throughout the board.

On this local weather, the asset’s weak spot versus its historic ranges is unsurprising. Whereas the broader market cap creeps greater, the token is caught in a every day bearish setup, which signifies underperformance relative to the mixture market. That stated, decentralized exchanges within the Sui ecosystem corresponding to Cetus CLMM and Bluefin Spot proceed to generate sizeable cumulative charges, an indication that underlying community exercise has not vanished whilst costs battle. Because of this, the elemental utilization backdrop might assist restrict structural harm as soon as sentiment ultimately normalizes.

Technical Outlook: studying the general setup

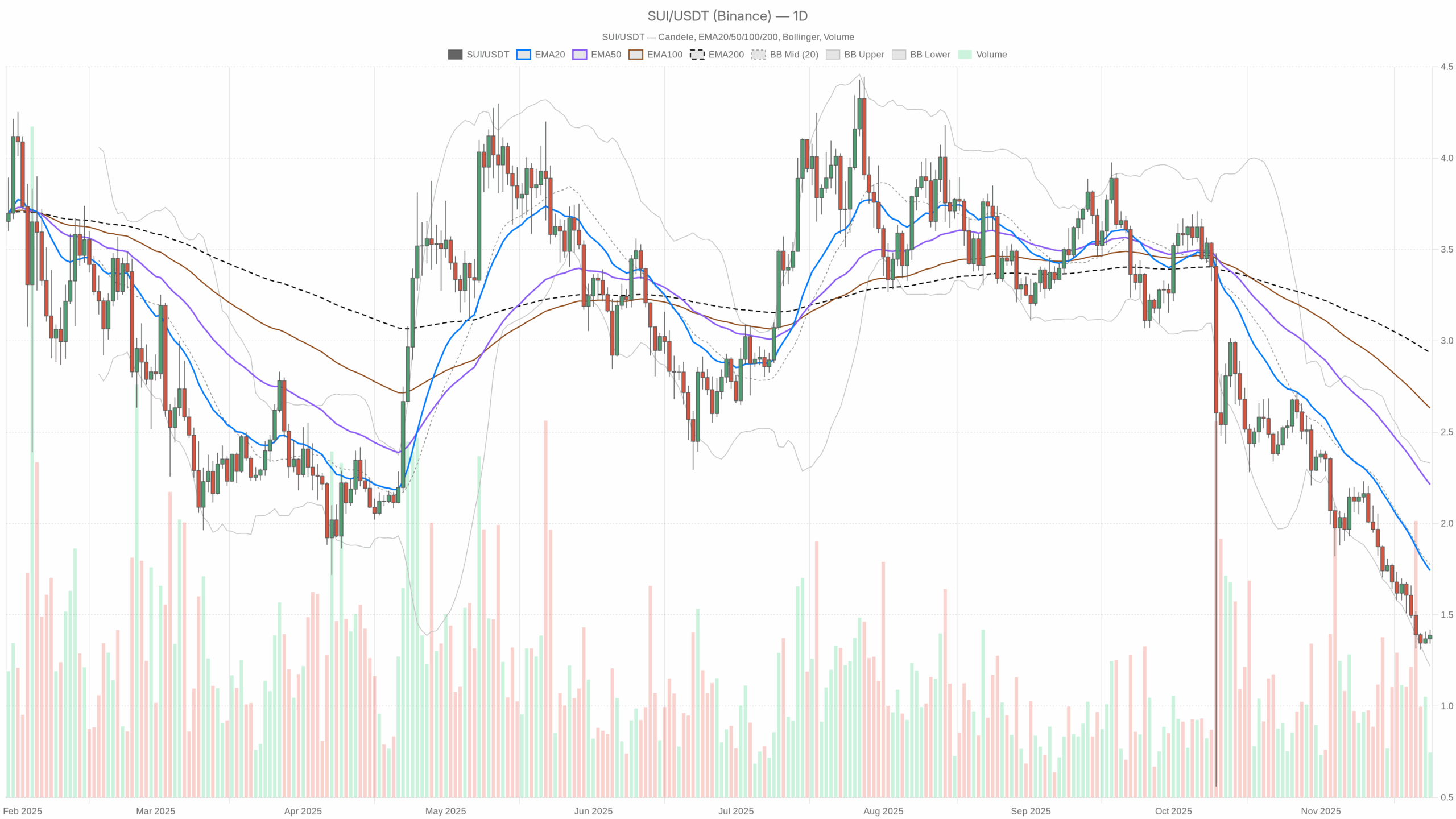

On the every day timeframe, worth at 1.39 is effectively beneath the 20-day exponential transferring common at 1.74, the 50-day at 2.21, and the 200-day close to 2.94. This broad hole between spot and the main EMAs illustrates persistent draw back strain and a mature downtrend slightly than a shallow pullback. Every of these transferring averages now possible acts as dynamic overhead resistance, implying that any bounce will meet provide on the best way up.

The every day RSI round 25.2 locations the token firmly in oversold territory. Traditionally, readings this low typically precede not less than a corrective rebound, as aggressive sellers start to expire of gas. Nonetheless, RSI can keep oversold in robust bear phases, so this setup signifies downtrend exhaustion dangers however not but a confirmed reversal. Merchants typically search for bullish divergences or a restoration again above the 30–35 zone to strengthen the case for a backside.

Each day MACD additionally leans destructive, with the road close to -0.27 and the sign at -0.26, whereas the histogram is barely barely beneath zero. This configuration exhibits that draw back momentum has already been robust, but it may be beginning to flatten. A narrowing histogram displays waning bearish momentum, suggesting that the tempo of decline is slowing even when the route has not but turned.

Bollinger Bands on the every day chart place the center band at 1.77, with the higher band at 2.33 and the decrease band near 1.22. Value presently hovers simply above the decrease band, signaling that latest candles have pressed into statistically stretched territory. Such positioning typically precedes both a sideways consolidation or a volatility snapback, that means a potential volatility growth may emerge if worth begins to mean-revert towards the center band.

The 14-day ATR sits close to 0.15, comparatively modest given absolutely the worth degree. This means that, regardless of the downtrend, every day swings will not be excessive and the market is experiencing managed volatility slightly than panic-driven capitulation. For place merchants, this atmosphere favors scaled entries and exits as an alternative of all-or-nothing bets.

Intraday Perspective and SUIUSDT token Momentum

In the meantime, the intraday construction paints a extra impartial image. On the hourly chart, worth round 1.39 trades virtually precisely according to the 20- and 50-period EMAs close to 1.38, whereas the 200-period EMA lags above at roughly 1.53. This configuration indicators that short-term worth motion has shifted into consolidation after a downtrend, with bulls and bears briefly balanced beneath a still-dominant longer-term resistance line.

The hourly RSI close to 53 factors to a impartial momentum regime: neither overbought nor oversold, and in keeping with a market catching its breath. The hourly MACD line and sign are roughly flat round zero, reinforcing the concept that fast directional conviction is proscribed. On the 15-minute chart, EMAs cluster tightly round 1.38–1.39 and RSI sits round 49, once more underlining a short-term equilibrium. Because of this, scalpers might discover range-trading setups extra engaging than trend-following methods till a clearer breakout unfolds.

Key Ranges and Market Reactions

Each day pivot ranges add helpful context. The principle pivot level is near 1.38, successfully the place worth is presently gravitating. Holding above this space retains the door open for a technical bounce, whereas a decisive shut beneath would verify persevering with weak spot. Slightly below lies a primary assist zone round 1.35, the place patrons might try to defend towards additional declines; a agency response there would assist a short-term basing try.

On the upside, the closest resistance band seems close to 1.42, the primary every day pivot resistance. A transfer by means of that area with rising quantity may mark step one in a broader corrective section towards the 20-day EMA close to 1.74. Nonetheless, the cluster of upper EMAs as much as the 200-day line close to 2.94 implies that any medium-term restoration will face layered resistance overhead, and swift V-shaped reversals are statistically much less possible.

Future Situations and Funding Outlook

Total, the first state of affairs stays bearish on the every day chart, with the asset entrenched beneath all key EMAs and sentiment weighed down by Excessive Worry and excessive bitcoin dominance. But a number of indicators, from oversold every day RSI to flattening MACD and impartial intraday momentum, level towards a section the place draw back momentum could also be dropping energy. This mix typically leads first to sideways consolidation, then to a corrective rally if macro circumstances cooperate.

Traders and merchants might due to this fact think about a two-step strategy: short-term individuals specializing in intraday ranges across the 1.35–1.42 hall, and longer-term individuals ready for stronger affirmation corresponding to RSI reclaiming the 30–40 zone or worth regaining the 20-day EMA. In such a fragile backdrop, strict threat administration, staggered orders, and real looking expectations about restoration velocity are essential whereas the market works by means of its present extremes.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.